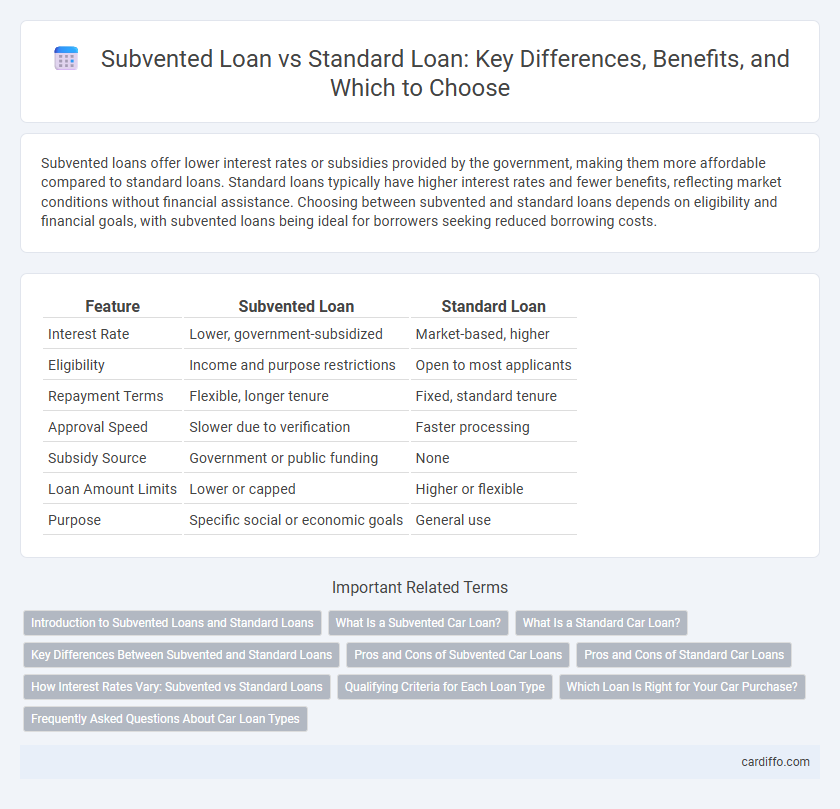

Subvented loans offer lower interest rates or subsidies provided by the government, making them more affordable compared to standard loans. Standard loans typically have higher interest rates and fewer benefits, reflecting market conditions without financial assistance. Choosing between subvented and standard loans depends on eligibility and financial goals, with subvented loans being ideal for borrowers seeking reduced borrowing costs.

Table of Comparison

| Feature | Subvented Loan | Standard Loan |

|---|---|---|

| Interest Rate | Lower, government-subsidized | Market-based, higher |

| Eligibility | Income and purpose restrictions | Open to most applicants |

| Repayment Terms | Flexible, longer tenure | Fixed, standard tenure |

| Approval Speed | Slower due to verification | Faster processing |

| Subsidy Source | Government or public funding | None |

| Loan Amount Limits | Lower or capped | Higher or flexible |

| Purpose | Specific social or economic goals | General use |

Introduction to Subvented Loans and Standard Loans

Subvented loans are government-sponsored financial products offering below-market interest rates or subsidies to eligible borrowers, designed to promote specific economic or social objectives. Standard loans, provided by traditional lenders such as banks or credit unions, carry market-based interest rates without government subsidies, reflecting borrower credit risk and market conditions. Understanding the distinction between subvented loans and standard loans is critical for borrowers seeking cost-effective financing options aligned with their financial situation and goals.

What Is a Subvented Car Loan?

A subvented car loan is a type of financing where the lender offers reduced interest rates or subsidized terms, often supported by the car manufacturer or dealership, making monthly payments more affordable. Unlike standard loans with market-based interest rates, subvented loans provide cost savings by lowering the borrower's overall financing expenses. These loans are typically available on select new vehicle models, aiming to boost sales while benefiting buyers with more favorable loan conditions.

What Is a Standard Car Loan?

A standard car loan is a traditional financing option where borrowers receive a fixed amount to purchase a vehicle and repay it through regular monthly payments with interest over a set term. Unlike subvented loans that offer manufacturer-subsidized interest rates or incentives, standard loans typically have higher interest rates determined by creditworthiness and market conditions. Borrowers are responsible for all interest costs without additional subsidies, making standard car loans straightforward but potentially more expensive than subvented alternatives.

Key Differences Between Subvented and Standard Loans

Subvented loans offer lower interest rates subsidized by the government or institutions, significantly reducing borrowing costs compared to standard loans that have market-based interest rates. Repayment terms for subvented loans are often more flexible, including extended grace periods and income-contingent repayment options, while standard loans typically require fixed payments on a strict schedule. Eligibility criteria for subvented loans usually involve meeting specific income or financial need requirements, whereas standard loans are accessible to a broader range of borrowers based on creditworthiness.

Pros and Cons of Subvented Car Loans

Subvented car loans offer lower interest rates as manufacturers or dealers subsidize part of the financing cost, resulting in significant savings on monthly payments and overall loan expenses. However, these loans typically come with strict eligibility criteria, limited negotiation flexibility, and may require purchasing specific models or configurations. Unlike standard loans, subvented loans might restrict refinancing options and often include shorter loan terms, which can impact long-term financial planning.

Pros and Cons of Standard Car Loans

Standard car loans offer flexible terms and competitive interest rates, providing borrowers with the ability to choose loan duration and payment schedules suited to their financial situation. However, they often require higher credit scores and larger down payments compared to subvented loans, making them less accessible for buyers with limited credit history or tight budgets. Borrowers benefit from the absence of manufacturer restrictions but may face higher overall borrowing costs without the incentives commonly included in subvented loan agreements.

How Interest Rates Vary: Subvented vs Standard Loans

Subvented loans typically offer lower interest rates due to government subsidies that reduce the lender's risk and cost of funds. Standard loans usually have higher and variable interest rates, reflecting market conditions and borrower credit risk without external financial support. This divergence in interest rates significantly impacts the overall repayment amount and affordability for borrowers.

Qualifying Criteria for Each Loan Type

Subvented loans require borrowers to meet specific eligibility criteria such as income limits, employment type, or residency status, often targeting low- to moderate-income applicants. Standard loans have broader qualifying criteria, focusing primarily on credit score, debt-to-income ratio, and repayment capacity without income restrictions. Lenders use these qualifying factors to assess risk and determine loan approval, terms, and interest rates for each loan type.

Which Loan Is Right for Your Car Purchase?

Subvented loans often offer lower interest rates and special incentives provided by manufacturers or dealerships, making them ideal for buyers seeking reduced financing costs on new cars. Standard loans from banks or credit unions typically have higher interest rates but offer more flexible terms and are available for a broader range of vehicles, including used cars. Evaluating factors like loan term, interest rates, eligibility criteria, and your credit score helps determine whether a subvented or standard loan best suits your car purchase needs.

Frequently Asked Questions About Car Loan Types

Subvented loans are car loans where the manufacturer or dealer subsidizes the interest rate, often offering lower monthly payments compared to standard loans. Standard loans typically come with fixed or variable interest rates determined by financial institutions without external subsidies, resulting in higher overall borrowing costs. Borrowers frequently ask about eligibility, interest rate differences, and the impact of loan terms on total repayment when comparing subvented and standard car loans.

Subvented loan vs standard loan Infographic

cardiffo.com

cardiffo.com