Floor plan financing offers dealerships flexible funding specifically for inventory acquisition, enabling easier management of multiple vehicles without immediate full payment. Traditional auto loans are tailored for individual borrowers purchasing a single vehicle, often involving fixed terms and rates based on creditworthiness. Comparing both options highlights that floor plan financing supports business inventory flow, while traditional loans cater to personal vehicle ownership.

Table of Comparison

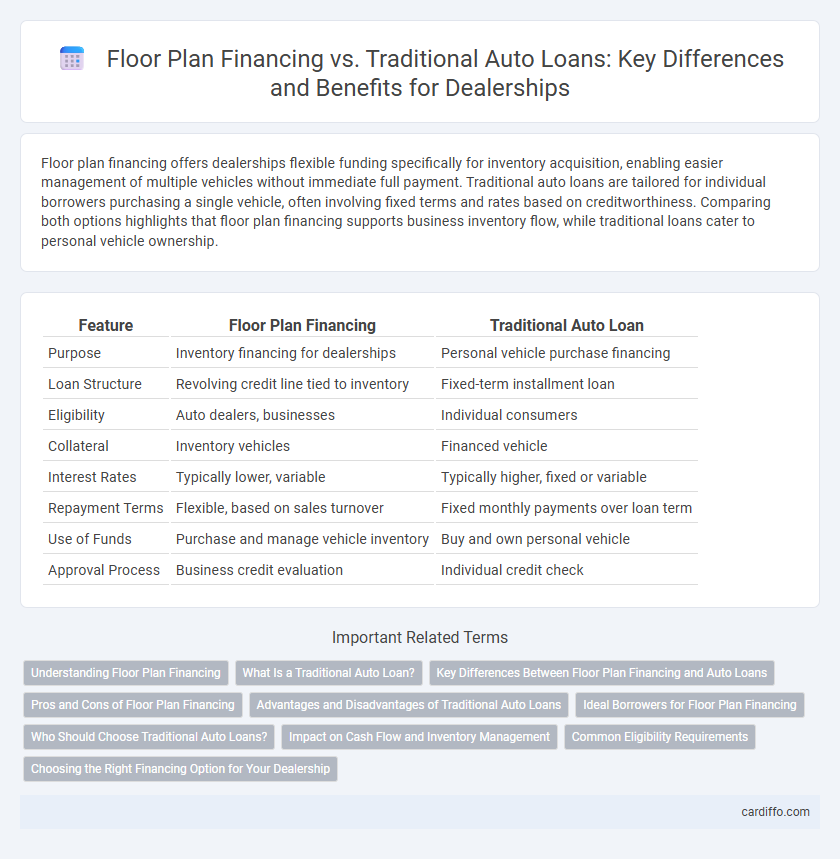

| Feature | Floor Plan Financing | Traditional Auto Loan |

|---|---|---|

| Purpose | Inventory financing for dealerships | Personal vehicle purchase financing |

| Loan Structure | Revolving credit line tied to inventory | Fixed-term installment loan |

| Eligibility | Auto dealers, businesses | Individual consumers |

| Collateral | Inventory vehicles | Financed vehicle |

| Interest Rates | Typically lower, variable | Typically higher, fixed or variable |

| Repayment Terms | Flexible, based on sales turnover | Fixed monthly payments over loan term |

| Use of Funds | Purchase and manage vehicle inventory | Buy and own personal vehicle |

| Approval Process | Business credit evaluation | Individual credit check |

Understanding Floor Plan Financing

Floor plan financing is a specialized loan designed for car dealerships to finance their inventory, allowing them to purchase multiple vehicles without paying upfront. Unlike traditional auto loans tailored to individual consumers, floor plan financing typically features revolving credit lines with interest charged only on borrowed amounts and flexible repayment terms tied to vehicle sales. Understanding the distinct structure and purposes of floor plan financing helps dealers manage cash flow effectively while maintaining a diverse inventory.

What Is a Traditional Auto Loan?

A traditional auto loan is a financing option where individuals borrow a lump sum to purchase a personal vehicle, repaying it in fixed monthly installments over a predetermined term with interest. This type of loan typically requires a credit check, a down payment, and offers interest rates based on the borrower's creditworthiness and loan duration. Unlike floor plan financing, which is designed for dealerships to fund inventory, traditional auto loans are structured for individual consumer purchases.

Key Differences Between Floor Plan Financing and Auto Loans

Floor plan financing primarily supports inventory acquisition for auto dealers, allowing them to purchase multiple vehicles with revolving credit, while traditional auto loans are consumer-focused, meant for individual car buyers to finance a single vehicle purchase. Floor plan loans often have higher credit limits, lower interest rates, and require repayment upon vehicle sale, contrasting with auto loans that have fixed terms and monthly payments. The risk profile, purpose, and repayment structure distinctly separate floor plan financing from conventional auto loans.

Pros and Cons of Floor Plan Financing

Floor plan financing offers dealerships the advantage of maintaining a large inventory without tying up significant capital, enabling quicker turnover and improved cash flow. However, it typically involves higher interest rates and can lead to complex repayment schedules, increasing financial risk if vehicle sales slow. Traditional auto loans provide straightforward terms and fixed payments but require immediate capital outlay, limiting inventory expansion potential.

Advantages and Disadvantages of Traditional Auto Loans

Traditional auto loans offer straightforward financing with fixed interest rates and fixed repayment terms, making budgeting predictable for consumers. However, these loans often require a substantial down payment and typically involve higher monthly payments compared to floor plan financing, limiting cash flow flexibility. Additionally, traditional auto loans may have stricter credit requirements and less favorable terms for dealers seeking inventory financing.

Ideal Borrowers for Floor Plan Financing

Floor plan financing is ideal for car dealerships and businesses that maintain inventory and require ongoing vehicle purchases, as it allows for flexible revolving credit secured by the inventory itself. Traditional auto loans better suit individual buyers seeking fixed terms and repayment schedules for single vehicle purchases. Dealers benefit from floor plan financing by managing cash flow efficiently and increasing inventory turnover without large upfront capital.

Who Should Choose Traditional Auto Loans?

Traditional auto loans are ideal for individual consumers purchasing a single vehicle for personal use, as they offer fixed rates and predictable monthly payments. Buyers with good credit scores benefit from competitive interest rates and straightforward approval processes tailored to personal credit profiles. This financing option suits those who prefer ownership of the vehicle rather than inventory management or business-related purposes.

Impact on Cash Flow and Inventory Management

Floor plan financing specifically targets vehicle dealers, allowing them to stock inventory without immediate cash outlay, which improves cash flow by deferring payments until the sale of the vehicle. Traditional auto loans require upfront repayment schedules that can strain cash flow but offer straightforward financing for individual buyers. Effective inventory management benefits from floor plan financing by enabling larger stock volumes and more flexible turnover, whereas traditional loans limit inventory expansion due to direct financial burdens.

Common Eligibility Requirements

Common eligibility requirements for floor plan financing include a valid business license, established dealership operations, and satisfactory credit history, emphasizing the applicant's ability to manage inventory. Traditional auto loans typically require proof of income, personal creditworthiness, and vehicle details to assess individual repayment capacity. Both financing options necessitate clear ownership documentation and compliance with lender-specific underwriting criteria to secure approval.

Choosing the Right Financing Option for Your Dealership

Floor plan financing offers dealerships a revolving line of credit specifically designed for inventory acquisition, enabling efficient cash flow management and large volume purchases. Traditional auto loans, conversely, provide fixed-term financing with predictable monthly payments, ideal for dealers needing straightforward, long-term credit for vehicle procurement. Selecting the right financing option hinges on the dealership's inventory turnover rate, capital flexibility, and repayment preferences to optimize operational efficiency and financial health.

Floor Plan Financing vs Traditional Auto Loan Infographic

cardiffo.com

cardiffo.com