Residual value loans feature a lower monthly payment structure as they are based on the depreciation of the asset, with a lump sum due at the end of the term representing the vehicle's estimated worth. No residual value loans require equal monthly installments that cover the entire cost of the asset, resulting in higher monthly payments but full ownership once the loan is paid off. Choosing between these options depends on the borrower's financial goals and plans for asset ownership at the end of the loan term.

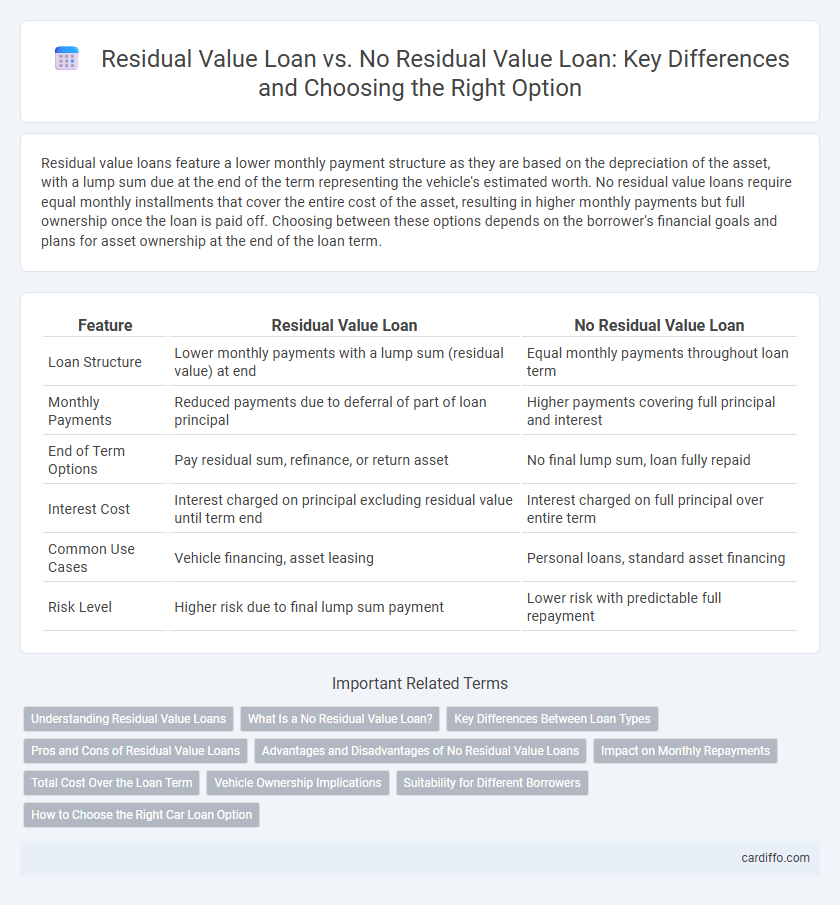

Table of Comparison

| Feature | Residual Value Loan | No Residual Value Loan |

|---|---|---|

| Loan Structure | Lower monthly payments with a lump sum (residual value) at end | Equal monthly payments throughout loan term |

| Monthly Payments | Reduced payments due to deferral of part of loan principal | Higher payments covering full principal and interest |

| End of Term Options | Pay residual sum, refinance, or return asset | No final lump sum, loan fully repaid |

| Interest Cost | Interest charged on principal excluding residual value until term end | Interest charged on full principal over entire term |

| Common Use Cases | Vehicle financing, asset leasing | Personal loans, standard asset financing |

| Risk Level | Higher risk due to final lump sum payment | Lower risk with predictable full repayment |

Understanding Residual Value Loans

Residual value loans are structured so the borrower pays lower monthly installments by deferring a lump sum payment, known as the residual value, to the end of the loan term. This financing option is common in auto loans and leases, allowing borrowers to reduce their periodic payments based on the vehicle's estimated depreciation. Unlike no residual value loans, where the loan balance is fully amortized through equal payments over the term, residual value loans require careful consideration of the asset's future worth and potential market fluctuations.

What Is a No Residual Value Loan?

A No Residual Value Loan is a type of financing where the borrower makes consistent monthly payments that fully cover the loan principal and interest without any remaining balance at the end of the term. Unlike Residual Value Loans, which leave a final balloon payment reflecting the asset's estimated market value, No Residual Value Loans eliminate the risk of a lump-sum payoff. This structure ensures the loan is completely paid off by the maturity date, providing clear financial planning and ownership transfer.

Key Differences Between Loan Types

Residual value loans require borrowers to pay only the difference between the loan amount and the vehicle's estimated residual value at the end of the term, often resulting in lower monthly payments. No residual value loans demand full repayment of the principal and interest over the loan term, leading to higher monthly installments but clear ownership once paid off. Key differences include payment structures, end-of-term obligations, and potential risks related to the asset's residual depreciation or appreciation.

Pros and Cons of Residual Value Loans

Residual value loans offer lower monthly payments and reduced initial costs by factoring in the estimated asset value at the end of the term, benefiting borrowers seeking cash flow management. However, borrowers face the risk of a higher final payment if the asset's residual value is overestimated, leading to potential financial strain or the need for refinancing. This loan type also limits equity accumulation during the term, contrasting with no residual value loans where payments fully amortize the principal.

Advantages and Disadvantages of No Residual Value Loans

No Residual Value Loans require full repayment of the principal without a balloon payment, offering the advantage of predictable monthly payments and complete ownership at loan maturity. This type of loan eliminates the risk of depreciation impacting a final lump sum, reducing financial uncertainty for borrowers. However, monthly payments are typically higher compared to loans with residual values, which may affect cash flow management for some borrowers.

Impact on Monthly Repayments

Residual value loans typically result in lower monthly repayments because the borrower only finances the depreciation amount, with the residual value due as a balloon payment at the end of the term. In contrast, no residual value loans require higher monthly repayments as the entire loan amount is amortized evenly over the loan period without a final lump sum. The choice between these loan types directly affects cash flow management and total interest paid during the loan tenure.

Total Cost Over the Loan Term

Residual value loans typically have lower monthly payments because the borrower is only financing the loan amount minus the estimated residual value at the end of the term, reducing the total cost over the loan period if the asset's value holds. In contrast, no residual value loans require the entire asset cost to be amortized over the term, resulting in higher monthly payments and potentially a higher total cost. Borrowers should evaluate the residual value assumptions and potential depreciation to accurately compare the total financial impact of each loan type.

Vehicle Ownership Implications

Residual value loans allow borrowers to pay a lower monthly amount by deferring a portion of the vehicle's cost as a balloon payment due at the end of the loan term, impacting ownership by requiring a lump-sum decision to buy, return, or refinance the vehicle. No residual value loans spread the full cost of the vehicle across monthly payments, enabling outright ownership upon completion without additional payments. Understanding these options influences financial planning and vehicle possession timelines, as residual value loans offer flexibility but may lead to higher end-of-term costs or complex ownership decisions.

Suitability for Different Borrowers

Residual value loans suit borrowers looking for lower monthly payments and planning to sell or trade the asset at the end of the term, often appealing to businesses and individuals expecting significant depreciation. No residual value loans work better for borrowers aiming to fully own the asset by the end of the term, ideal for those who prefer straightforward ownership without future payment uncertainties. Choosing between these loans depends on financial goals, asset usage, and risk tolerance.

How to Choose the Right Car Loan Option

Choosing the right car loan option involves evaluating the benefits of residual value loans versus no residual value loans based on your financial goals and vehicle usage. Residual value loans often result in lower monthly payments by financing only the depreciation, ideal for those who plan to return or trade the car after the loan term. No residual value loans require full repayment of the vehicle cost, offering ownership without future payments but higher monthly obligations.

Residual Value Loan vs No Residual Value Loan Infographic

cardiffo.com

cardiffo.com