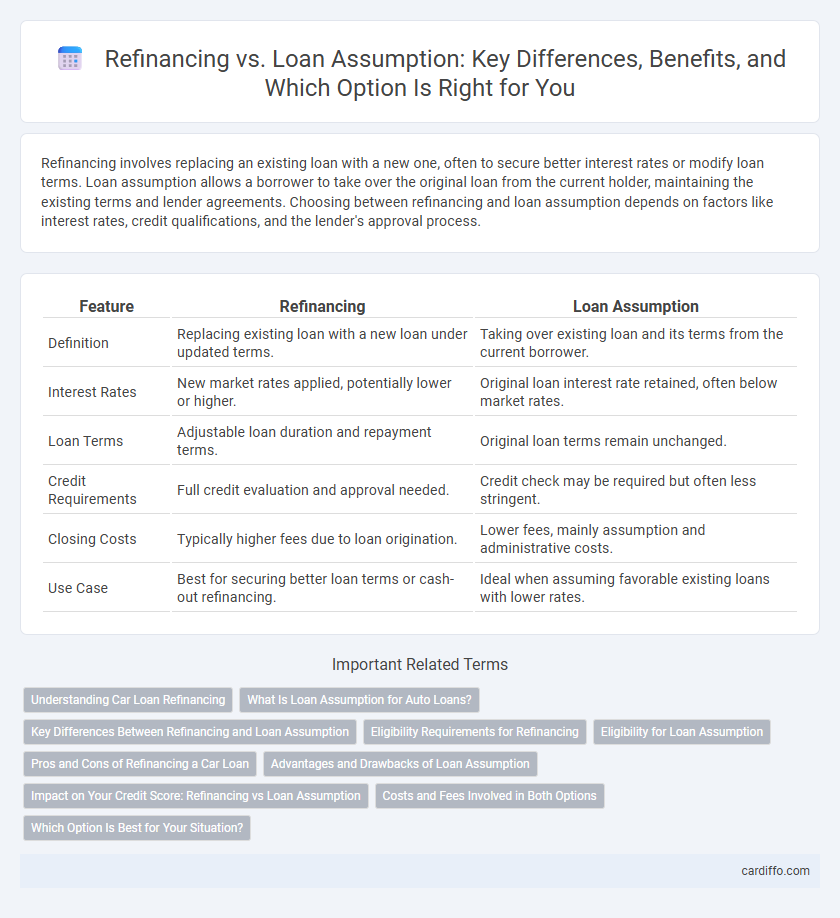

Refinancing involves replacing an existing loan with a new one, often to secure better interest rates or modify loan terms. Loan assumption allows a borrower to take over the original loan from the current holder, maintaining the existing terms and lender agreements. Choosing between refinancing and loan assumption depends on factors like interest rates, credit qualifications, and the lender's approval process.

Table of Comparison

| Feature | Refinancing | Loan Assumption |

|---|---|---|

| Definition | Replacing existing loan with a new loan under updated terms. | Taking over existing loan and its terms from the current borrower. |

| Interest Rates | New market rates applied, potentially lower or higher. | Original loan interest rate retained, often below market rates. |

| Loan Terms | Adjustable loan duration and repayment terms. | Original loan terms remain unchanged. |

| Credit Requirements | Full credit evaluation and approval needed. | Credit check may be required but often less stringent. |

| Closing Costs | Typically higher fees due to loan origination. | Lower fees, mainly assumption and administrative costs. |

| Use Case | Best for securing better loan terms or cash-out refinancing. | Ideal when assuming favorable existing loans with lower rates. |

Understanding Car Loan Refinancing

Car loan refinancing involves replacing an existing auto loan with a new one, often to secure a lower interest rate, reduce monthly payments, or change the loan term. Refinancing can improve financial flexibility by potentially lowering the overall cost of the loan and consolidating debt under better terms. Understanding the benefits and eligibility criteria for car loan refinancing helps borrowers make informed decisions to optimize their auto financing options.

What Is Loan Assumption for Auto Loans?

Loan assumption for auto loans allows a buyer to take over the seller's existing car loan, including the remaining balance, interest rate, and loan term. This process can simplify financing by avoiding a new loan application and potentially lower interest costs if the original loan has more favorable terms. Loan assumptions require lender approval and credit qualification, ensuring the new borrower meets the original loan criteria.

Key Differences Between Refinancing and Loan Assumption

Refinancing involves replacing an existing loan with a new loan, often to secure a lower interest rate or better terms, affecting the borrower's credit and loan duration. Loan assumption allows a buyer to take over the seller's current mortgage, preserving the original loan terms and interest rate without creating a new loan. Key differences include the credit evaluation process, closing costs, and the potential impact on loan duration and interest rates.

Eligibility Requirements for Refinancing

Eligibility requirements for refinancing typically include a strong credit score, a stable income, and sufficient home equity. Lenders often require a debt-to-income ratio below 43% and proof of timely mortgage payments. Meeting these criteria increases the likelihood of obtaining favorable refinancing terms.

Eligibility for Loan Assumption

Eligibility for loan assumption typically requires the buyer to meet specific credit score thresholds and income verification standards set by the lender, ensuring they can uphold the existing loan terms. Certain government-backed loans, such as FHA, VA, and USDA loans, often allow assumption with more flexible qualifications compared to conventional loans. Understanding these eligibility criteria helps borrowers determine whether assuming a loan or refinancing presents the best financial advantage.

Pros and Cons of Refinancing a Car Loan

Refinancing a car loan can lower monthly payments and reduce interest rates, potentially saving borrowers significant money over the loan term. However, it may extend the repayment period, increasing total interest paid, and can involve fees or require a strong credit score to qualify. Careful comparison of loan terms and costs is essential to determine if refinancing provides long-term financial benefits.

Advantages and Drawbacks of Loan Assumption

Loan assumption offers the advantage of potentially lower closing costs and faster approval since the buyer takes over the existing mortgage terms, which can be beneficial in a rising interest rate environment. However, drawbacks include the lender's approval requirements that may be stringent, and the buyer could inherit unfavorable loan conditions such as a higher interest rate or a large remaining balance. Additionally, loan assumption can limit the borrower's ability to negotiate more favorable terms compared to refinancing a new loan.

Impact on Your Credit Score: Refinancing vs Loan Assumption

Refinancing typically involves a hard credit inquiry, which can temporarily lower your credit score but may lead to better loan terms and long-term savings. Loan assumption generally does not require a credit check, minimizing immediate impact on your credit score while allowing you to take over existing loan terms. Understanding the credit implications of each option helps optimize financial decisions and maintain healthy credit standing.

Costs and Fees Involved in Both Options

Refinancing a loan typically involves closing costs ranging from 2% to 5% of the loan amount, including appraisal fees, origination fees, and title insurance, which can significantly increase upfront expenses. Loan assumption often incurs lower fees, usually limited to an assumption fee and minimal processing costs, making it a more cost-effective option in many cases. Comparing these expenses is crucial for borrowers to determine the most affordable choice based on their financial situation.

Which Option Is Best for Your Situation?

Refinancing involves replacing an existing loan with a new one, often offering better interest rates or terms, making it ideal for borrowers seeking lower monthly payments or access to additional funds. Loan assumption allows a buyer to take over the seller's existing mortgage under its current terms, which can be advantageous in a rising interest rate environment or when the original loan has favorable conditions. Evaluating your credit score, current interest rates, closing costs, and long-term financial goals will determine whether refinancing or loan assumption offers the best solution for your specific financial situation.

Refinancing vs Loan Assumption Infographic

cardiffo.com

cardiffo.com