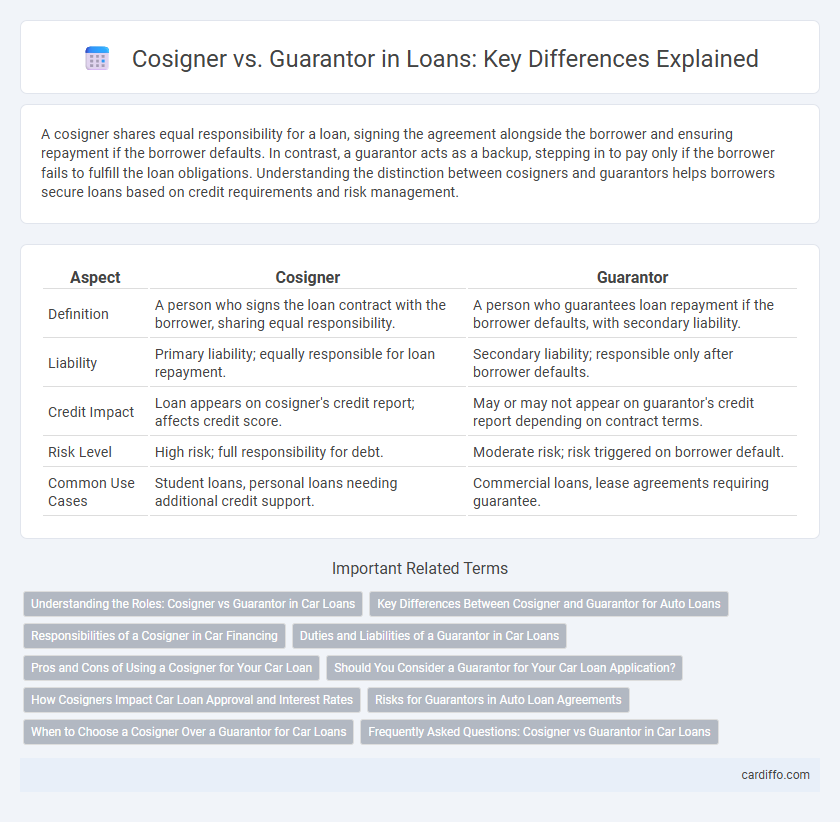

A cosigner shares equal responsibility for a loan, signing the agreement alongside the borrower and ensuring repayment if the borrower defaults. In contrast, a guarantor acts as a backup, stepping in to pay only if the borrower fails to fulfill the loan obligations. Understanding the distinction between cosigners and guarantors helps borrowers secure loans based on credit requirements and risk management.

Table of Comparison

| Aspect | Cosigner | Guarantor |

|---|---|---|

| Definition | A person who signs the loan contract with the borrower, sharing equal responsibility. | A person who guarantees loan repayment if the borrower defaults, with secondary liability. |

| Liability | Primary liability; equally responsible for loan repayment. | Secondary liability; responsible only after borrower defaults. |

| Credit Impact | Loan appears on cosigner's credit report; affects credit score. | May or may not appear on guarantor's credit report depending on contract terms. |

| Risk Level | High risk; full responsibility for debt. | Moderate risk; risk triggered on borrower default. |

| Common Use Cases | Student loans, personal loans needing additional credit support. | Commercial loans, lease agreements requiring guarantee. |

Understanding the Roles: Cosigner vs Guarantor in Car Loans

A cosigner on a car loan shares equal responsibility for the debt, impacting their credit and finances if the borrower defaults, while a guarantor only pays if the primary borrower fails to meet payments, typically after all collection efforts have been exhausted. Cosigners usually have direct access to loan details and repayment schedules, whereas guarantors act as a secondary safeguard, offering additional security to lenders without immediate liability. Understanding these roles helps borrowers and supporters manage risk and responsibilities effectively when financing a vehicle.

Key Differences Between Cosigner and Guarantor for Auto Loans

A cosigner and a guarantor both help secure auto loans by providing additional credit support, but a cosigner shares responsibility for loan repayment from the start, impacting their credit equally with the primary borrower. In contrast, a guarantor only becomes liable if the borrower defaults, serving as a last-resort payment source without immediate credit reporting obligations. Understanding this distinction is crucial for lenders and borrowers in assessing risk and credit liability in auto financing agreements.

Responsibilities of a Cosigner in Car Financing

A cosigner in car financing is equally responsible for repaying the loan if the primary borrower defaults, ensuring the lender has a secondary source of repayment. This responsibility includes credit obligations, such as timely payments and potential impacts on the cosigner's credit score. Unlike a guarantor who only pays after the lender exhausts all efforts against the borrower, a cosigner is immediately liable alongside the borrower from the loan's inception.

Duties and Liabilities of a Guarantor in Car Loans

A guarantor in car loans is legally responsible for repaying the loan if the primary borrower defaults, ensuring the lender has a secondary source of repayment. Their duties include reviewing loan terms carefully, maintaining communication with both borrower and lender, and providing financial information as required. The guarantor's liabilities can extend to covering the full outstanding loan amount, including interest, fees, and legal costs, which can severely impact their credit score and financial standing.

Pros and Cons of Using a Cosigner for Your Car Loan

Using a cosigner for your car loan can increase the likelihood of loan approval and secure a lower interest rate by reducing lender risk. However, the cosigner assumes full responsibility for the debt if the primary borrower defaults, potentially affecting their credit score and financial standing. This shared liability makes it essential to choose a financially stable and trustworthy cosigner to avoid complications.

Should You Consider a Guarantor for Your Car Loan Application?

Choosing a guarantor for your car loan application can improve your chances of approval, especially if you have a low credit score or insufficient income. A guarantor legally commits to repaying the loan if the primary borrower defaults, providing lenders with added security. Evaluating your financial stability and the potential impact on the guarantor's credit is crucial before deciding between a cosigner and a guarantor.

How Cosigners Impact Car Loan Approval and Interest Rates

Cosigners significantly improve car loan approval chances by providing lenders with added security through shared responsibility for repayment. Their involvement often leads to better interest rates, as the combined creditworthiness lowers the lender's risk. This dual commitment can result in more favorable loan terms and increased borrowing capacity for the primary borrower.

Risks for Guarantors in Auto Loan Agreements

Guarantors in auto loan agreements face significant financial risks, including full liability for the loan if the primary borrower defaults, which can lead to damage to their credit score and potential legal action. Unlike cosigners who are typically equally responsible from the outset, guarantors often assume risk only after the borrower fails to pay, making their involvement less transparent but equally critical. Understanding the extent of these risks is essential to avoid unexpected financial burdens, as guarantors may be required to cover missed payments, late fees, and repossession costs.

When to Choose a Cosigner Over a Guarantor for Car Loans

Choosing a cosigner for a car loan is beneficial when the primary borrower has limited credit history or low credit scores, as the cosigner's strong credit improves loan approval chances and secures better interest rates. A cosigner shares full responsibility for the loan repayment, making lenders more confident in approving higher loan amounts or favorable terms. Opt for a cosigner over a guarantor when the borrower needs immediate loan approval and better financing conditions because cosigners are legally obligated to repay the loan if the borrower defaults.

Frequently Asked Questions: Cosigner vs Guarantor in Car Loans

A cosigner in a car loan agrees to repay the debt if the primary borrower defaults, sharing equal responsibility on the loan agreement. A guarantor only pays after the lender exhausts all options to collect from the borrower, acting as a secondary backup. Common questions address the impact on credit scores, legal obligations, and differences in risk exposure between cosigners and guarantors.

Cosigner vs Guarantor Infographic

cardiffo.com

cardiffo.com