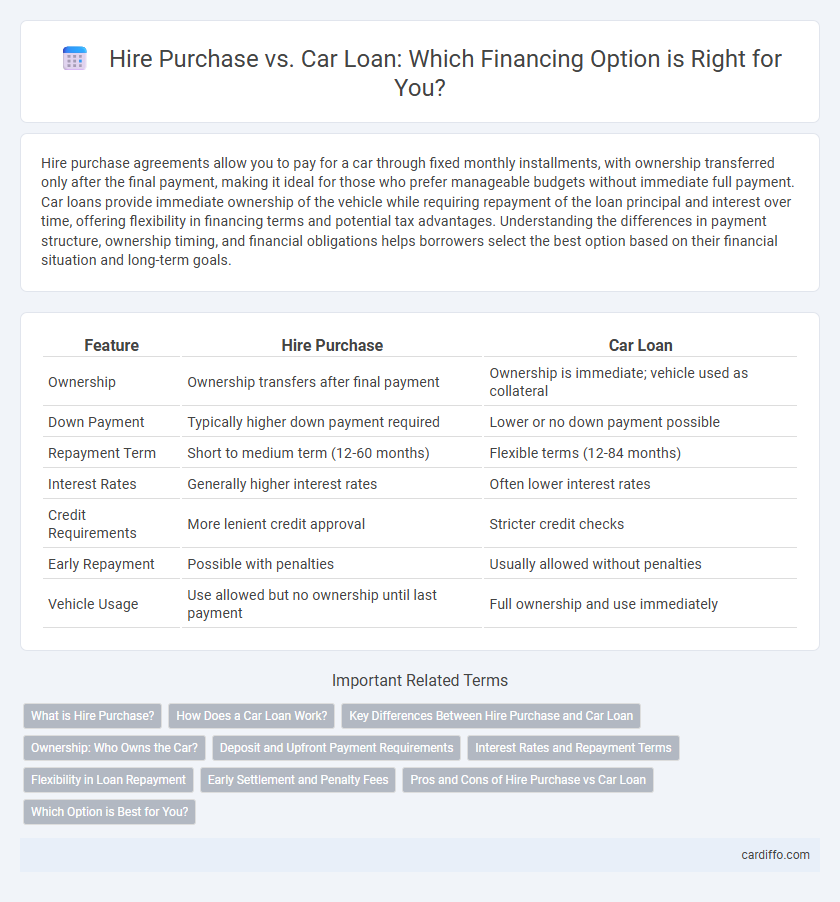

Hire purchase agreements allow you to pay for a car through fixed monthly installments, with ownership transferred only after the final payment, making it ideal for those who prefer manageable budgets without immediate full payment. Car loans provide immediate ownership of the vehicle while requiring repayment of the loan principal and interest over time, offering flexibility in financing terms and potential tax advantages. Understanding the differences in payment structure, ownership timing, and financial obligations helps borrowers select the best option based on their financial situation and long-term goals.

Table of Comparison

| Feature | Hire Purchase | Car Loan |

|---|---|---|

| Ownership | Ownership transfers after final payment | Ownership is immediate; vehicle used as collateral |

| Down Payment | Typically higher down payment required | Lower or no down payment possible |

| Repayment Term | Short to medium term (12-60 months) | Flexible terms (12-84 months) |

| Interest Rates | Generally higher interest rates | Often lower interest rates |

| Credit Requirements | More lenient credit approval | Stricter credit checks |

| Early Repayment | Possible with penalties | Usually allowed without penalties |

| Vehicle Usage | Use allowed but no ownership until last payment | Full ownership and use immediately |

What is Hire Purchase?

Hire Purchase is a financing method allowing individuals to acquire vehicles by paying an initial deposit followed by fixed monthly installments over an agreed period. Ownership of the car transfers to the buyer only after all payments have been completed, distinguishing it from traditional car loans where the buyer may own the vehicle from the outset. This arrangement often includes interest rates and terms tailored to the borrower's credit profile, making it a flexible option for car acquisition without upfront full payment.

How Does a Car Loan Work?

A car loan is a type of secured loan where the vehicle itself serves as collateral, allowing borrowers to finance the purchase of a car through monthly payments over a fixed term. Interest rates on car loans typically vary based on credit score, loan duration, and lender policies, impacting the total repayment amount. Unlike hire purchase agreements, ownership of the car is transferred to the borrower immediately, although the lender may hold the title until the loan is fully paid off.

Key Differences Between Hire Purchase and Car Loan

Hire purchase agreements involve paying for a car in installments while the vehicle ownership remains with the seller until the final payment is made, whereas car loans provide immediate ownership with monthly repayments to the lender. Interest rates on hire purchase tend to be higher than traditional car loans, affecting the overall cost of purchase. Unlike car loans, hire purchase contracts often include restrictions on mileage and require maintaining insurance throughout the term.

Ownership: Who Owns the Car?

In a hire purchase agreement, ownership of the car remains with the finance company until all payments are completed, allowing the buyer to use the vehicle but not own it outright during the term. In contrast, a car loan provides immediate ownership to the borrower, with the vehicle serving as collateral until the loan is fully repaid. This distinction affects legal rights, responsibilities, and the ability to modify or sell the car during the financing period.

Deposit and Upfront Payment Requirements

Hire purchase agreements typically require a higher upfront deposit, often ranging from 10% to 20% of the vehicle's purchase price, to secure the loan and reduce monthly repayments. Car loans usually demand a lower initial payment or deposit, sometimes as low as 5%, but may come with higher interest rates over the loan term. Understanding these deposit requirements helps borrowers evaluate cash flow impact and total cost when choosing between hire purchase and car loans.

Interest Rates and Repayment Terms

Hire purchase agreements typically feature higher interest rates compared to car loans due to secured asset financing and risk factors. Repayment terms for hire purchase contracts are often shorter and involve fixed monthly payments, whereas car loans offer more flexible repayment schedules that can extend over several years. Car loans generally provide lower overall costs through competitive interest rates and adjustable terms tailored to borrower credit profiles.

Flexibility in Loan Repayment

Hire purchase agreements typically offer less flexibility in loan repayment, with fixed monthly installments over a set period, binding the borrower to a strict payment schedule. Car loans often allow more adaptable repayment options, including the possibility of early repayment or refinancing without significant penalties. This flexibility in car loans can help borrowers better manage cash flow fluctuations and potentially reduce overall interest costs.

Early Settlement and Penalty Fees

Early settlement of hire purchase agreements often incurs higher penalty fees compared to car loans, as hire purchase contracts typically include a fixed interest component that lenders aim to recover. Car loans generally allow greater flexibility for early repayment with lower or no penalty fees, enabling borrowers to save on interest costs. Understanding these differences is crucial for selecting the most cost-effective financing option based on the potential for early settlement.

Pros and Cons of Hire Purchase vs Car Loan

Hire Purchase allows you to own the vehicle after completing all payments, often with lower monthly installments but typically higher total interest costs compared to a Car Loan. Car Loans usually offer lower interest rates and greater flexibility in ownership from the start, though they require a larger initial deposit and may have stricter credit requirements. Hire Purchase is advantageous for buyers with limited upfront capital, while Car Loans suit those seeking quicker ownership and potentially lower overall financing costs.

Which Option is Best for You?

Hire purchase agreements allow you to pay for a vehicle in installments and gain ownership only after the final payment, making it ideal for those who prefer spreading costs but don't mind delayed ownership. Car loans typically offer fixed interest rates and immediate ownership, providing flexibility for buyers who want full control of their vehicle from the outset. Evaluating your financial situation, credit score, and long-term ownership goals will help determine whether hire purchase or a car loan best suits your needs.

Hire Purchase vs Car Loan Infographic

cardiffo.com

cardiffo.com