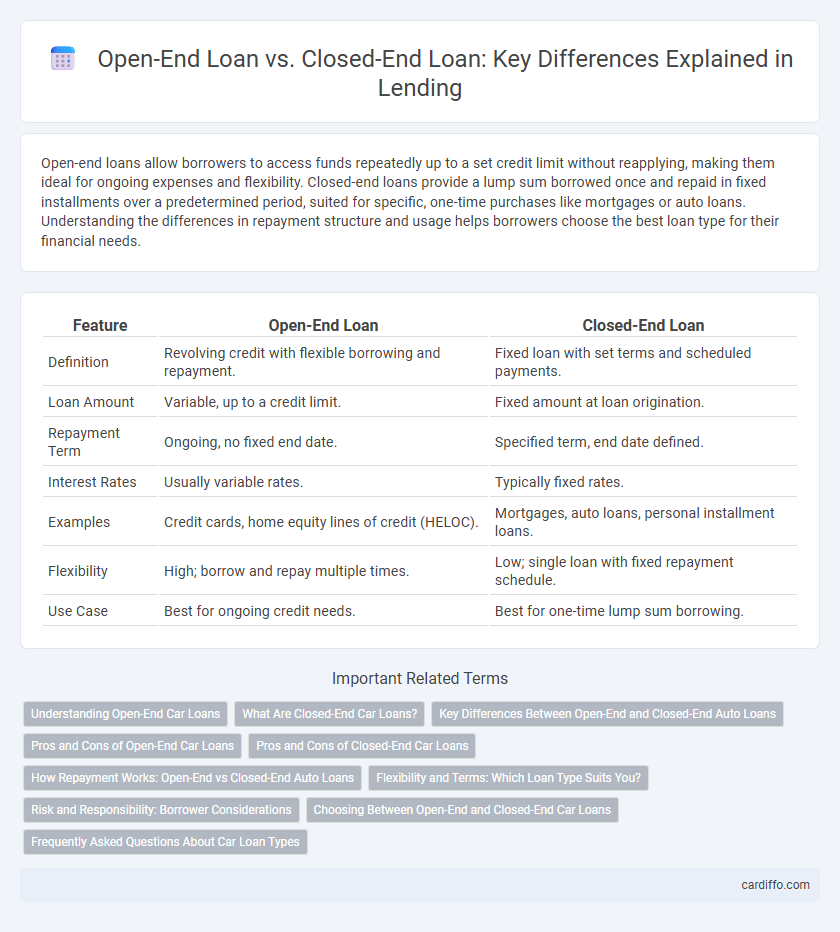

Open-end loans allow borrowers to access funds repeatedly up to a set credit limit without reapplying, making them ideal for ongoing expenses and flexibility. Closed-end loans provide a lump sum borrowed once and repaid in fixed installments over a predetermined period, suited for specific, one-time purchases like mortgages or auto loans. Understanding the differences in repayment structure and usage helps borrowers choose the best loan type for their financial needs.

Table of Comparison

| Feature | Open-End Loan | Closed-End Loan |

|---|---|---|

| Definition | Revolving credit with flexible borrowing and repayment. | Fixed loan with set terms and scheduled payments. |

| Loan Amount | Variable, up to a credit limit. | Fixed amount at loan origination. |

| Repayment Term | Ongoing, no fixed end date. | Specified term, end date defined. |

| Interest Rates | Usually variable rates. | Typically fixed rates. |

| Examples | Credit cards, home equity lines of credit (HELOC). | Mortgages, auto loans, personal installment loans. |

| Flexibility | High; borrow and repay multiple times. | Low; single loan with fixed repayment schedule. |

| Use Case | Best for ongoing credit needs. | Best for one-time lump sum borrowing. |

Understanding Open-End Car Loans

Open-end car loans allow borrowers to repeatedly borrow up to a pre-approved credit limit, offering flexibility to finance vehicle expenses over time. These loans differ from closed-end loans, which require full repayment of the borrowed amount by a fixed term without the option to re-borrow. Open-end loans typically involve variable interest rates and minimum monthly payments based on the outstanding balance, making them ideal for ongoing vehicle-related costs.

What Are Closed-End Car Loans?

Closed-end car loans are fixed-term financing agreements where borrowers repay a set principal amount plus interest in regular installments until the loan is fully paid off. These loans typically have consistent monthly payments and a predetermined payoff date, making budgeting predictable for car buyers. Unlike open-end loans, closed-end loans do not allow additional borrowing beyond the original loan amount without refinancing.

Key Differences Between Open-End and Closed-End Auto Loans

Open-end loans for auto financing allow borrowers to repeatedly borrow up to a credit limit and make variable payments, offering flexibility in managing funds. Closed-end auto loans provide a fixed loan amount with a set repayment schedule and equal monthly payments, ensuring predictable budgeting. Interest rates on closed-end loans are typically lower due to their structured nature, while open-end loans may have higher rates reflecting the revolving credit risk.

Pros and Cons of Open-End Car Loans

Open-end car loans offer flexibility by allowing borrowers to make multiple draws up to a preset credit limit, which helps manage cash flow and unexpected expenses. However, the variable interest rates and potential for escalating debt can increase the overall cost compared to closed-end loans, where fixed payments and loan terms provide clearer repayment schedules. Open-end loans also require disciplined financial management to avoid prolonged debt accumulation and higher interest payments.

Pros and Cons of Closed-End Car Loans

Closed-end car loans provide borrowers with a fixed repayment schedule and predictable monthly payments, reducing financial uncertainty. The loan is fully amortized, meaning once the term ends, the car is paid off and owned outright, which helps in building equity. However, closed-end loans may require higher credit scores for approval and often involve stricter terms and penalties for early repayment, limiting flexibility.

How Repayment Works: Open-End vs Closed-End Auto Loans

Open-end auto loans allow borrowers to repeatedly borrow up to a credit limit and make flexible payments that can vary based on the outstanding balance, resembling a credit card structure. Closed-end auto loans require fixed monthly payments of principal and interest over a set term until the loan is fully repaid, with no option to re-borrow once payments are made. Understanding the repayment differences helps borrowers choose between flexible spending and predictable payment schedules.

Flexibility and Terms: Which Loan Type Suits You?

Open-end loans offer flexible borrowing limits and repayment schedules, making them ideal for ongoing expenses or fluctuating cash flow needs. Closed-end loans provide fixed terms and repayment amounts, suitable for specific purchases with a clear payoff timeline. Evaluating your financial situation and spending habits helps determine whether the adaptability of an open-end loan or the structure of a closed-end loan aligns better with your borrowing goals.

Risk and Responsibility: Borrower Considerations

Open-end loans carry the risk of fluctuating interest rates and potential for escalating debt due to ongoing access to credit, requiring borrowers to manage spending carefully to avoid excessive financial burden. Closed-end loans involve fixed repayment schedules and interest rates, providing predictability but obligating borrowers to repay the full amount regardless of financial changes. Borrowers must assess their ability to maintain consistent payments and control loan usage to effectively manage risk and responsibility in either loan type.

Choosing Between Open-End and Closed-End Car Loans

Open-end car loans offer flexible borrowing limits and repayment options, allowing borrowers to adjust the amount financed over time, whereas closed-end loans provide a fixed loan amount with set monthly payments and a definitive payoff period. Choosing between open-end and closed-end car loans depends on factors like borrowing needs, budget stability, and credit score, with open-end loans suiting those who anticipate fluctuating expenses and closed-end loans benefiting borrowers seeking predictable payments. Interest rates on closed-end loans are generally lower due to fixed terms and collateral, while open-end loans may carry higher rates reflecting their flexibility and risk.

Frequently Asked Questions About Car Loan Types

Open-end loans, also known as revolving loans, allow borrowers to borrow repeatedly up to a set credit limit, making them flexible for ongoing expenses but often with variable interest rates. Closed-end loans provide a fixed amount of money with a set repayment schedule, commonly used in auto financing for predictable monthly payments and fixed interest rates. Understanding these differences helps car buyers choose financing that best suits their budget and repayment preferences.

Open-End Loan vs Closed-End Loan Infographic

cardiffo.com

cardiffo.com