A residual value loan, also known as a balloon loan, typically features lower monthly payments by deferring a significant portion of the vehicle's cost to the end of the term, whereas a standard auto loan spreads the total cost evenly across all payments. This structure makes residual value loans attractive for those who prefer lower monthly expenses but plan to either sell or refinance the car at the loan's conclusion. Standard auto loans offer consistent payments and full ownership once the loan is paid off, appealing to buyers seeking predictable costs and long-term ownership.

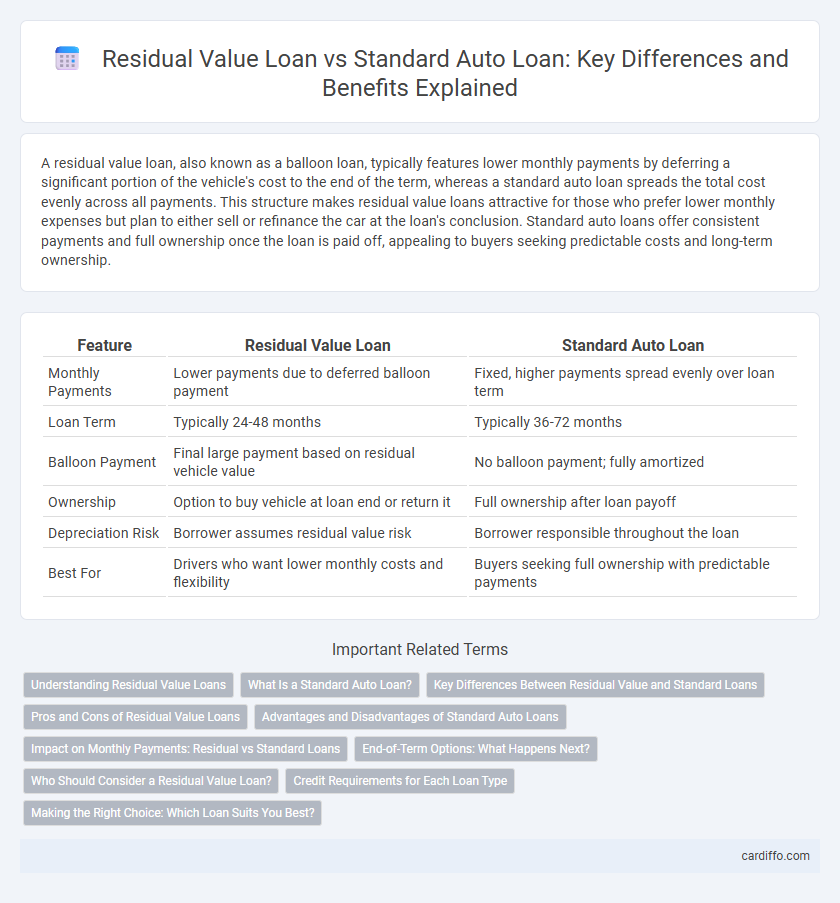

Table of Comparison

| Feature | Residual Value Loan | Standard Auto Loan |

|---|---|---|

| Monthly Payments | Lower payments due to deferred balloon payment | Fixed, higher payments spread evenly over loan term |

| Loan Term | Typically 24-48 months | Typically 36-72 months |

| Balloon Payment | Final large payment based on residual vehicle value | No balloon payment; fully amortized |

| Ownership | Option to buy vehicle at loan end or return it | Full ownership after loan payoff |

| Depreciation Risk | Borrower assumes residual value risk | Borrower responsible throughout the loan |

| Best For | Drivers who want lower monthly costs and flexibility | Buyers seeking full ownership with predictable payments |

Understanding Residual Value Loans

Residual value loans differ from standard auto loans by focusing on the vehicle's predicted depreciation, allowing lower monthly payments based on the car's expected residual value at lease-end or loan maturity. Borrowers pay for the estimated loss in value rather than the full car price, making this structure ideal for those who plan to trade or return the vehicle after term. Understanding residual value loans is crucial for assessing total cost of ownership and potential financial benefits compared to traditional auto financing options.

What Is a Standard Auto Loan?

A standard auto loan is a traditional financing option where the borrower repays the full vehicle price plus interest over a fixed term, typically ranging from 36 to 72 months. Monthly payments are generally higher compared to a residual value loan because the entire loan amount is amortized throughout the loan period. This type of loan offers full ownership of the vehicle once all payments have been completed, with no residual balance owed.

Key Differences Between Residual Value and Standard Loans

Residual value loans require borrowers to pay lower monthly installments by deferring a significant portion of the vehicle's cost to the end of the loan term, known as the balloon or residual payment, while standard auto loans spread the entire vehicle cost evenly over the loan period. Residual value loans often involve risks related to the vehicle's depreciation and market value at lease-end, unlike standard loans where ownership and full payment responsibility transfer to the borrower from the onset. Choosing between these loan types depends largely on the borrower's financial situation, expected vehicle usage, and plans for ownership or trade-in at the conclusion of the loan term.

Pros and Cons of Residual Value Loans

Residual value loans offer lower monthly payments by financing only the car's depreciation, but come with a balloon payment at the end of the term that may pose financial risk if the vehicle's actual value is less than expected. Standard auto loans require consistent monthly payments that cover the entire vehicle cost, providing full ownership without large end-of-term payments. Residual value loans benefit those who prefer lower upfront costs and plan to return or refinance the vehicle but may result in higher total expenses or unexpected charges if the repurchase price is underestimated.

Advantages and Disadvantages of Standard Auto Loans

Standard auto loans offer full vehicle ownership upon completion of payments, allowing unlimited mileage and customization without penalties. Higher monthly payments and faster depreciation costs impact overall affordability compared to residual value loans. Borrowers benefit from straightforward terms and equity buildup, but face greater financial risk if the car's value declines rapidly.

Impact on Monthly Payments: Residual vs Standard Loans

Residual value loans typically offer lower monthly payments by deferring a portion of the vehicle's cost to the end of the term, based on the estimated residual value. Standard auto loans spread the total cost of the vehicle over the loan term, resulting in higher monthly payments compared to residual value loans. The choice between these loan types affects cash flow, with residual loans providing short-term affordability and standard loans building equity more quickly.

End-of-Term Options: What Happens Next?

At the end of a Residual Value Loan, borrowers typically have the option to pay the predetermined residual value to own the vehicle outright, return the car without further obligations, or refinance the remaining balance. In contrast, a Standard Auto Loan concludes once all monthly payments have been made, after which the vehicle is fully owned by the borrower without any residual payment. Understanding these end-of-term options helps borrowers decide which loan type aligns with their financial goals and vehicle ownership preferences.

Who Should Consider a Residual Value Loan?

A residual value loan is ideal for borrowers who prefer lower monthly payments and plan to return or trade in their vehicle at the end of the loan term, often suited for individuals driving predictable annual mileage. Standard auto loans benefit those who want full ownership immediately and drive extensively, as monthly payments are higher but no end-of-term vehicle value concerns exist. Choosing a residual value loan can be advantageous for cost-conscious drivers who prioritize short-term affordability over long-term vehicle equity.

Credit Requirements for Each Loan Type

Residual value loans typically require higher credit scores due to the risk associated with the vehicle's depreciation at the end of the term, often exceeding 700 FICO scores. Standard auto loans have more flexible credit requirements, commonly approved for scores as low as 620, reflecting their straightforward repayment structure and full ownership transfer. Lenders consider income stability and debt-to-income ratio for both loans, but residual value loans demand stricter evaluation given the loan's contingent value on the car's future worth.

Making the Right Choice: Which Loan Suits You Best?

Residual value loans offer lower monthly payments by financing only the vehicle's depreciation over the term, making them ideal for drivers who prefer lower upfront costs and plan to trade or refinance at lease end. Standard auto loans spread the full vehicle price over the loan term, resulting in higher monthly payments but full ownership at payoff, suitable for those who want long-term asset control. Assess expected mileage, budget flexibility, and ownership goals to determine whether a residual value loan or a standard auto loan aligns best with your financial needs.

Residual Value Loan vs Standard Auto Loan Infographic

cardiffo.com

cardiffo.com