Buy Here Pay Here loans offer in-house financing directly from the dealership, often accessible to individuals with poor credit but typically feature higher interest rates and shorter repayment terms. Credit Union loans usually provide lower interest rates and more flexible repayment options, requiring members to meet credit standards and membership criteria. Choosing between the two depends on credit history, financial needs, and the importance of affordable rates versus ease of approval.

Table of Comparison

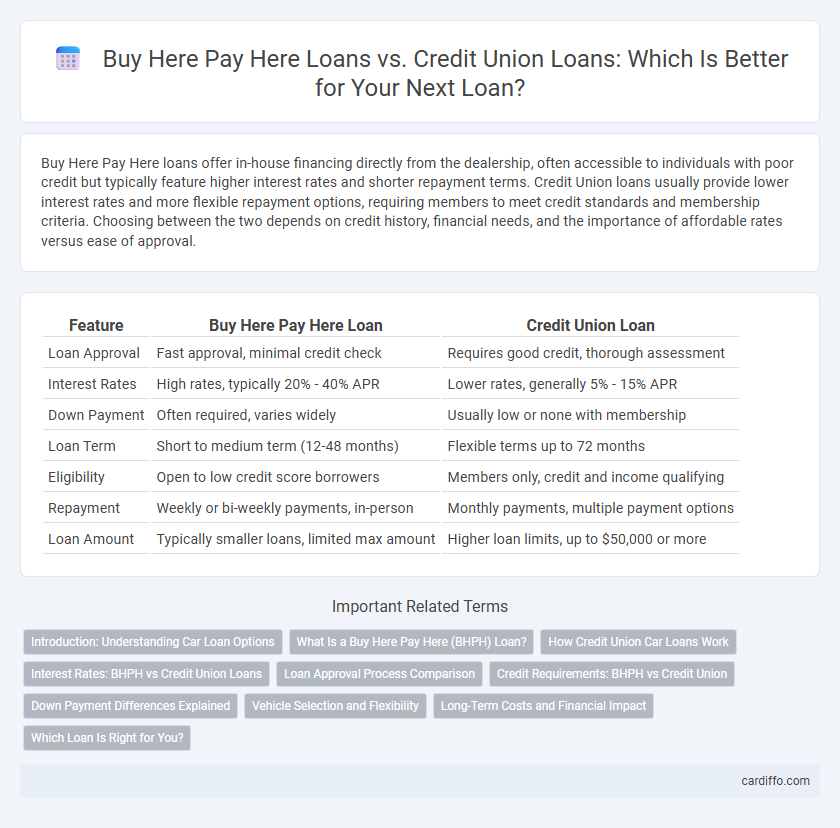

| Feature | Buy Here Pay Here Loan | Credit Union Loan |

|---|---|---|

| Loan Approval | Fast approval, minimal credit check | Requires good credit, thorough assessment |

| Interest Rates | High rates, typically 20% - 40% APR | Lower rates, generally 5% - 15% APR |

| Down Payment | Often required, varies widely | Usually low or none with membership |

| Loan Term | Short to medium term (12-48 months) | Flexible terms up to 72 months |

| Eligibility | Open to low credit score borrowers | Members only, credit and income qualifying |

| Repayment | Weekly or bi-weekly payments, in-person | Monthly payments, multiple payment options |

| Loan Amount | Typically smaller loans, limited max amount | Higher loan limits, up to $50,000 or more |

Introduction: Understanding Car Loan Options

Buy Here Pay Here loans offer in-house financing directly through dealerships, often catering to buyers with poor credit and requiring minimal credit checks. Credit Union loans provide competitive interest rates and flexible terms, typically benefiting members with stronger credit profiles. Evaluating creditworthiness and loan terms is essential when choosing between these car loan options.

What Is a Buy Here Pay Here (BHPH) Loan?

A Buy Here Pay Here (BHPH) loan is an in-house financing option provided directly by car dealerships, targeting buyers with poor or no credit history. These loans typically require a down payment and have higher interest rates compared to traditional loans, reflecting the increased risk for the seller. BHPH loans offer immediate vehicle access but often lack the competitive rates and borrower protections found in Credit Union loans.

How Credit Union Car Loans Work

Credit union car loans typically offer lower interest rates and more flexible terms compared to Buy Here Pay Here loans due to their nonprofit structure and member-focused approach. Borrowers must become members of the credit union, allowing access to personalized loan options based on creditworthiness and financial history. These loans often require proof of income and have more stringent credit standards, promoting better financial management and lower overall loan costs.

Interest Rates: BHPH vs Credit Union Loans

Buy Here Pay Here (BHPH) loans typically feature higher interest rates compared to credit union loans due to increased risk and limited credit checks. Credit unions offer lower interest rates, often ranging from 5% to 12%, because they operate as nonprofit organizations and provide more favorable terms for members with good credit. The significant difference in interest rates impacts the overall cost of borrowing, making credit union loans a more cost-effective option for qualified borrowers.

Loan Approval Process Comparison

Buy Here Pay Here loans offer faster approval with minimal credit checks, making them accessible for individuals with poor credit or no credit history. Credit Union loans require a more thorough evaluation, including credit score assessment, income verification, and membership eligibility, leading to a longer but more comprehensive approval process. The streamlined Buy Here Pay Here approval favors immediate financing needs, while Credit Union loans provide lower interest rates and better terms through stricter vetting.

Credit Requirements: BHPH vs Credit Union

Buy Here Pay Here (BHPH) loans typically have lenient credit requirements, making them accessible to borrowers with poor or no credit history, as dealerships manage both financing and vehicle sales. Credit Union loans demand better credit scores and financial stability, benefiting members with low interest rates and favorable terms. Borrowers with established credit profiles often secure more affordable and flexible repayment options through Credit Union loans compared to BHPH financing.

Down Payment Differences Explained

Buy Here Pay Here loans often require higher down payments, sometimes ranging from 10% to 20%, due to increased risk and lack of credit checks. Credit Union loans typically offer lower down payment options, often as low as 5%, reflecting their member-focused lending practices and competitive interest rates. Understanding these down payment differences is crucial for borrowers deciding between flexible Buy Here Pay Here financing and more structured Credit Union loan agreements.

Vehicle Selection and Flexibility

Buy Here Pay Here loans typically offer limited vehicle selection as buyers must purchase directly from the dealership's inventory, often focusing on older or high-mileage cars. Credit Union loans provide greater flexibility, allowing borrowers to choose from a wider range of vehicles, including new and used cars from various sellers. The broader vehicle selection and competitive interest rates at credit unions make them a preferable option for customized financing needs.

Long-Term Costs and Financial Impact

Buy Here Pay Here loans typically carry higher interest rates and fees, leading to significantly greater long-term costs compared to Credit Union loans. Credit Union loans offer lower interest rates and flexible repayment terms, reducing financial strain and improving credit scores over time. Choosing a Credit Union loan can result in substantial savings and better financial health due to more favorable loan conditions and transparency.

Which Loan Is Right for You?

Buy Here Pay Here loans offer immediate financing with easier approval for those with poor credit but often come with higher interest rates and limited vehicle choices. Credit Union loans provide lower interest rates, flexible terms, and better customer service, ideal for borrowers with fair to excellent credit. Evaluating your credit score, budget, and long-term financial goals will help determine which loan best suits your needs.

Buy Here Pay Here Loan vs Credit Union Loan Infographic

cardiffo.com

cardiffo.com