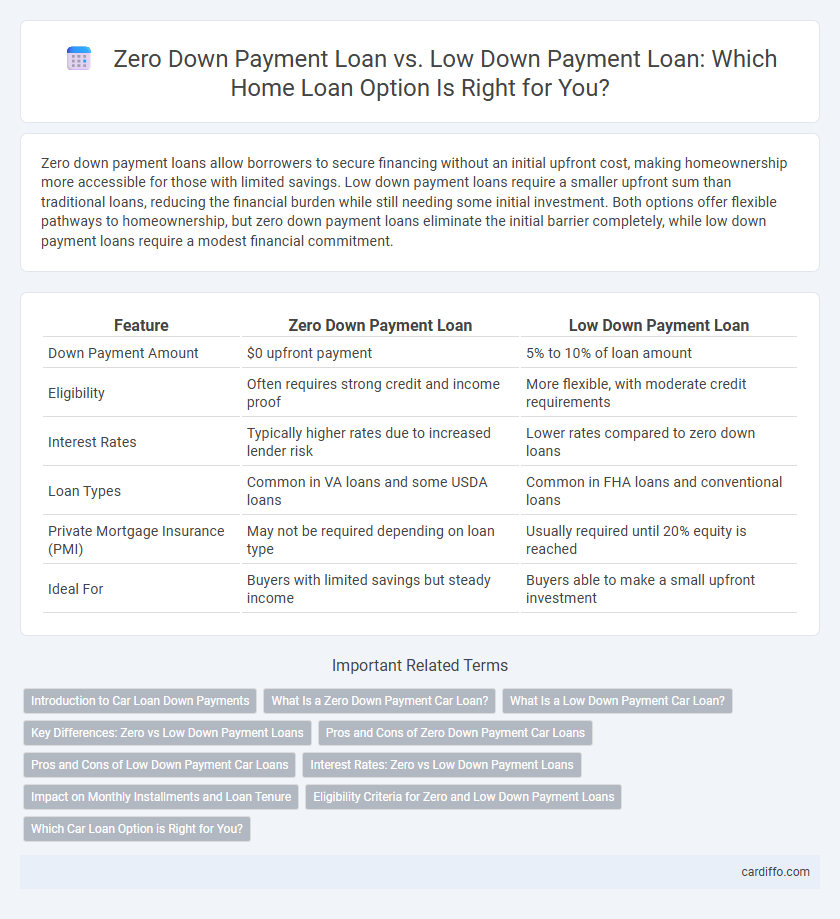

Zero down payment loans allow borrowers to secure financing without an initial upfront cost, making homeownership more accessible for those with limited savings. Low down payment loans require a smaller upfront sum than traditional loans, reducing the financial burden while still needing some initial investment. Both options offer flexible pathways to homeownership, but zero down payment loans eliminate the initial barrier completely, while low down payment loans require a modest financial commitment.

Table of Comparison

| Feature | Zero Down Payment Loan | Low Down Payment Loan |

|---|---|---|

| Down Payment Amount | $0 upfront payment | 5% to 10% of loan amount |

| Eligibility | Often requires strong credit and income proof | More flexible, with moderate credit requirements |

| Interest Rates | Typically higher rates due to increased lender risk | Lower rates compared to zero down loans |

| Loan Types | Common in VA loans and some USDA loans | Common in FHA loans and conventional loans |

| Private Mortgage Insurance (PMI) | May not be required depending on loan type | Usually required until 20% equity is reached |

| Ideal For | Buyers with limited savings but steady income | Buyers able to make a small upfront investment |

Introduction to Car Loan Down Payments

Car loan down payments significantly influence the total financing cost and monthly installments, with zero down payment loans requiring no upfront cash, increasing the loan principal and interest over time. Low down payment loans, often ranging from 5% to 20%, reduce the loan amount while maintaining manageable initial expenses, potentially lowering interest rates and monthly payments. Understanding the trade-off between immediate affordability and long-term financial impact is crucial for selecting the appropriate car loan down payment option.

What Is a Zero Down Payment Car Loan?

A zero down payment car loan allows borrowers to finance the entire purchase price of the vehicle without an initial upfront payment, making it easier for buyers with limited savings to acquire a car. These loans often come with higher interest rates and may require strong credit scores or additional fees to offset the lender's risk. Compared to low down payment loans, which require a small upfront amount, zero down payment loans maximize immediate affordability but could increase overall loan costs.

What Is a Low Down Payment Car Loan?

A low down payment car loan requires the borrower to pay a small portion of the vehicle's purchase price upfront, typically ranging from 3% to 10%, easing the initial financial burden. This type of loan makes car ownership more accessible for buyers with limited savings while still lowering the total loan amount compared to zero down payment options. Lenders may charge higher interest rates or impose stricter credit requirements to offset the increased risk associated with lower upfront payments.

Key Differences: Zero vs Low Down Payment Loans

Zero down payment loans require no initial cash outlay, making them ideal for borrowers lacking immediate funds but often carry higher interest rates or stricter credit requirements. Low down payment loans mandate a small upfront payment, generally ranging from 3% to 10%, offering a balance between initial affordability and potentially lower long-term costs. Choosing between zero and low down payment loans depends on borrower credit profiles, loan terms, and overall financial strategy.

Pros and Cons of Zero Down Payment Car Loans

Zero down payment car loans offer the advantage of immediate vehicle acquisition without upfront costs, making them accessible for buyers with limited savings; however, they often come with higher interest rates and can increase total loan costs over time. These loans may lead to negative equity, where the loan balance exceeds the car's value, posing financial risks if the vehicle depreciates quickly or is totaled early in the loan term. While convenient, zero down payment loans require careful consideration of long-term affordability and lender terms compared to low down payment options that, although requiring initial cash, typically reduce interest expenses and equity risks.

Pros and Cons of Low Down Payment Car Loans

Low down payment car loans offer the advantage of requiring less upfront cash, making vehicle ownership more accessible for buyers with limited savings. However, these loans often come with higher interest rates and larger monthly payments compared to loans with higher down payments, increasing the overall cost of the vehicle. Borrowers should carefully assess their budget and long-term financial goals before opting for low down payment car loans to avoid potential financial strain.

Interest Rates: Zero vs Low Down Payment Loans

Zero down payment loans often carry higher interest rates compared to low down payment loans due to increased lender risk. Low down payment loans typically offer more competitive interest rates as borrowers contribute a portion upfront, reducing the loan-to-value ratio. Borrowers should carefully evaluate interest rate differences to determine the most cost-effective financing option.

Impact on Monthly Installments and Loan Tenure

Zero down payment loans typically result in higher monthly installments and longer loan tenures due to the entire principal amount being financed from the start. Low down payment loans reduce the financed principal, leading to lower monthly installments and potentially shorter loan tenures. Borrowers must balance upfront affordability with long-term financial commitments when choosing between these options.

Eligibility Criteria for Zero and Low Down Payment Loans

Zero down payment loans typically require strong credit scores and stable income sources to minimize lender risk, often targeting first-time homebuyers or veterans with specific qualifications. Low down payment loans generally have more flexible eligibility criteria, allowing borrowers with moderate credit scores and steady, but not exceptional, income to qualify, often facilitated by government-backed programs like FHA or conventional loans with private mortgage insurance. Both loan types require thorough income verification, debt-to-income ratio assessments, and sometimes employment history checks to determine borrower reliability.

Which Car Loan Option is Right for You?

Zero down payment loans allow borrowers to finance the entire vehicle cost without upfront cash, ideal for those with limited savings but often come with higher interest rates or stricter credit requirements. Low down payment loans require a smaller upfront payment, typically 5-20% of the car's price, balancing affordability with lower overall loan costs and interest rates. Choosing the right car loan option depends on your financial stability, credit score, and long-term budget for monthly payments and interest expenses.

Zero Down Payment Loan vs Low Down Payment Loan Infographic

cardiffo.com

cardiffo.com