Balloon payment loans require a large lump sum payment at the end of the term, resulting in lower monthly installments but a significant final balance. Standard installment loans have fixed monthly payments throughout the loan duration, ensuring consistent repayment amounts without a substantial final payment. Choosing between the two depends on cash flow preferences and the borrower's ability to handle a large payment at loan maturity.

Table of Comparison

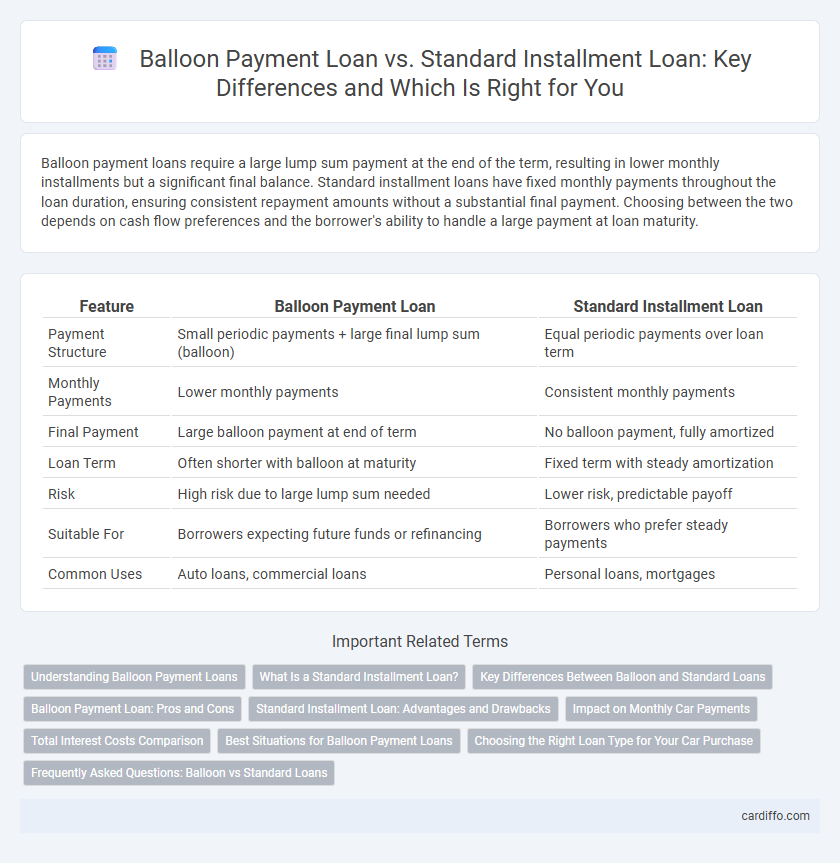

| Feature | Balloon Payment Loan | Standard Installment Loan |

|---|---|---|

| Payment Structure | Small periodic payments + large final lump sum (balloon) | Equal periodic payments over loan term |

| Monthly Payments | Lower monthly payments | Consistent monthly payments |

| Final Payment | Large balloon payment at end of term | No balloon payment, fully amortized |

| Loan Term | Often shorter with balloon at maturity | Fixed term with steady amortization |

| Risk | High risk due to large lump sum needed | Lower risk, predictable payoff |

| Suitable For | Borrowers expecting future funds or refinancing | Borrowers who prefer steady payments |

| Common Uses | Auto loans, commercial loans | Personal loans, mortgages |

Understanding Balloon Payment Loans

Balloon payment loans feature smaller regular payments with a large lump sum due at the end of the term, requiring careful planning to manage the final payment. These loans often have lower monthly payments compared to standard installment loans, which have equal payments spread evenly throughout the loan term. Borrowers must understand the risk of refinancing or saving enough to cover the balloon payment to avoid default.

What Is a Standard Installment Loan?

A standard installment loan is a type of loan repaid through fixed, regular payments over a predetermined term, typically consisting of both principal and interest. Unlike balloon payment loans, standard installment loans avoid large lump-sum payments at the end, providing predictable and manageable monthly expenses. Common examples include personal loans, auto loans, and mortgages, which help borrowers budget effectively while steadily reducing debt.

Key Differences Between Balloon and Standard Loans

Balloon payment loans require a large lump sum payment at the end of the term, while standard installment loans involve equal payments spread throughout the loan duration. Balloon loans typically have lower monthly payments but higher risk due to the significant final payment, whereas standard installment loans offer consistent payment amounts that simplify budgeting. The key difference lies in payment structure and cash flow management, affecting borrower eligibility and financial planning strategies.

Balloon Payment Loan: Pros and Cons

A balloon payment loan requires smaller monthly installments with a large lump sum due at the end of the term, offering lower initial payments compared to standard installment loans. This structure benefits borrowers seeking short-term cash flow relief but poses a risk if they cannot afford the final balloon payment or refinance effectively. Balloon loans typically have higher interest rates and potential refinancing challenges, making them less suitable for those without guaranteed future income or equity growth.

Standard Installment Loan: Advantages and Drawbacks

Standard installment loans offer predictable monthly payments, facilitating effective budgeting and financial planning. These loans typically carry lower interest rates than balloon payment loans, reducing the overall cost of borrowing. However, fixed payment schedules may limit flexibility, potentially causing challenges if the borrower encounters financial difficulties during the repayment period.

Impact on Monthly Car Payments

Balloon payment loans feature lower monthly car payments compared to standard installment loans because the principal repayment is deferred to a large lump-sum payment at the end of the term. Standard installment loans spread the principal and interest evenly across monthly payments, resulting in consistently higher monthly costs. Choosing a balloon payment loan can improve short-term cash flow but may require careful financial planning to manage the substantial final payment.

Total Interest Costs Comparison

Balloon payment loans typically have lower monthly payments initially but incur higher total interest costs due to the large lump-sum payment at the end, increasing overall financial burden. Standard installment loans spread payments evenly over the loan term, resulting in consistent monthly costs and generally lower total interest expenses. Borrowers seeking predictable payments and lower total interest often prefer standard installment loans, while those willing to manage a sizable final payment might choose balloon loans despite higher total interest.

Best Situations for Balloon Payment Loans

Balloon payment loans are ideal for borrowers expecting a significant cash influx before the loan term ends, such as anticipated bonuses or property sales. These loans provide lower monthly payments compared to standard installment loans, making them suitable for short-term financing or bridging gaps in cash flow. They benefit businesses or individuals seeking to preserve capital during the loan period while planning for a large lump-sum repayment.

Choosing the Right Loan Type for Your Car Purchase

Choosing between a balloon payment loan and a standard installment loan depends on your financial goals and cash flow flexibility. Balloon payment loans offer lower monthly payments with a large final payment, ideal for short-term ownership or if you plan to refinance, while standard installment loans have fixed monthly payments that fully amortize the loan, providing predictable budgeting and long-term financial stability. Evaluating factors such as loan term, interest rates, and your ability to manage lump-sum payments can help determine the best loan type for your car purchase.

Frequently Asked Questions: Balloon vs Standard Loans

Balloon payment loans require a large lump sum payment at the end of the loan term, while standard installment loans have fixed monthly payments spread evenly over the loan period. Borrowers often ask if balloon loans have lower monthly payments compared to standard loans; the answer is yes, but they carry higher risk due to the large final payment. Common questions also address whether balloon loans are suitable for short-term financing needs and how refinancing options can mitigate the balloon payment burden.

Balloon payment loan vs Standard installment loan Infographic

cardiffo.com

cardiffo.com