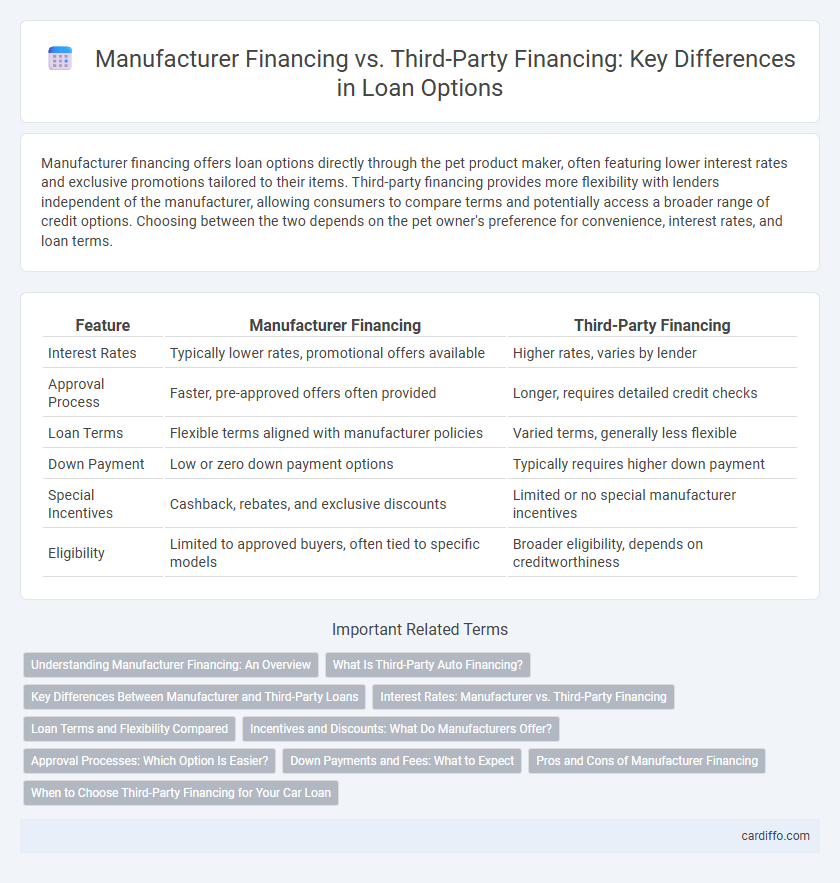

Manufacturer financing offers loan options directly through the pet product maker, often featuring lower interest rates and exclusive promotions tailored to their items. Third-party financing provides more flexibility with lenders independent of the manufacturer, allowing consumers to compare terms and potentially access a broader range of credit options. Choosing between the two depends on the pet owner's preference for convenience, interest rates, and loan terms.

Table of Comparison

| Feature | Manufacturer Financing | Third-Party Financing |

|---|---|---|

| Interest Rates | Typically lower rates, promotional offers available | Higher rates, varies by lender |

| Approval Process | Faster, pre-approved offers often provided | Longer, requires detailed credit checks |

| Loan Terms | Flexible terms aligned with manufacturer policies | Varied terms, generally less flexible |

| Down Payment | Low or zero down payment options | Typically requires higher down payment |

| Special Incentives | Cashback, rebates, and exclusive discounts | Limited or no special manufacturer incentives |

| Eligibility | Limited to approved buyers, often tied to specific models | Broader eligibility, depends on creditworthiness |

Understanding Manufacturer Financing: An Overview

Manufacturer financing offers loans directly from the product maker, often featuring competitive interest rates and tailored repayment plans aligned with the manufacturer's sales goals. This type of financing typically includes added incentives like rebates, deferred payments, or service agreements that are not usually available through third-party lenders. Understanding these benefits helps borrowers evaluate cost-effectiveness and convenience compared to conventional external financing options.

What Is Third-Party Auto Financing?

Third-party auto financing involves obtaining a vehicle loan through an independent lender rather than directly from the car manufacturer. These lenders can include banks, credit unions, or online financial institutions offering competitive interest rates and flexible loan terms. This type of financing often provides buyers with more options and potential cost savings compared to manufacturer financing programs.

Key Differences Between Manufacturer and Third-Party Loans

Manufacturer financing offers loans directly from the vehicle maker, often featuring promotional rates and incentives tailored to their products. Third-party financing typically involves banks or credit unions providing broader loan options with varying interest rates and terms. Key differences include eligibility criteria, loan flexibility, and potential dealer-specific perks that can impact overall loan cost and borrowing experience.

Interest Rates: Manufacturer vs. Third-Party Financing

Manufacturer financing often offers lower interest rates as a promotional incentive directly from the producer to attract buyers. Third-party financing may present higher rates due to added credit risk and administrative costs from financial institutions. Comparing APRs between manufacturer offers and third-party loans is crucial to determine the most cost-effective borrowing option.

Loan Terms and Flexibility Compared

Manufacturer financing typically offers loan terms tailored to specific products, often featuring lower interest rates and promotional deals directly from the manufacturer. Third-party financing provides a broader range of loan options with varying interest rates and repayment flexibility, enabling borrowers to select terms that best fit their financial situation. Flexibility in third-party loans often includes extended repayment periods and customizable payment plans, whereas manufacturer financing may have stricter terms tied to the purchase of the product.

Incentives and Discounts: What Do Manufacturers Offer?

Manufacturers often provide incentives such as cashback offers, low or zero-percent interest rates, and extended payment terms to attract buyers through their financing programs. These manufacturer financing deals typically include promotional discounts tied to specific models or seasonal campaigns, making them more cost-effective than standard third-party loans. Third-party financing rarely matches these exclusive manufacturer incentives, as they depend more on credit assessments and less on sales promotions.

Approval Processes: Which Option Is Easier?

Manufacturer financing typically offers a streamlined approval process with fewer credit requirements due to the manufacturer's vested interest in promoting sales. Third-party financing often involves more rigorous credit checks and documentation as it is handled by independent lenders aiming to mitigate risk. Approval ease largely depends on the borrower's credit profile and the specific terms offered by either the manufacturer or the third-party financial institution.

Down Payments and Fees: What to Expect

Manufacturer financing often requires lower down payments and offers promotional deals with minimal or no fees to attract buyers, enhancing affordability. Third-party financing typically demands higher down payments and includes additional fees such as loan origination and processing charges. Comparing down payment requirements and fee structures helps borrowers choose the most cost-effective loan option for their vehicle purchase.

Pros and Cons of Manufacturer Financing

Manufacturer financing often provides lower interest rates and exclusive promotional offers, making it an attractive option for buyers seeking affordability and convenience. However, it may come with limited lender options and stringent eligibility criteria tied to the manufacturer's brand, potentially restricting borrower flexibility. The risk of dependency on the manufacturer's financial health and less competitive loan terms compared to third-party lenders are notable drawbacks.

When to Choose Third-Party Financing for Your Car Loan

Choose third-party financing for your car loan when seeking more competitive interest rates or flexible repayment terms that may not be available through manufacturer financing. Independent lenders often offer pre-approval options, allowing buyers to negotiate prices more effectively with dealerships. This financing method is ideal for borrowers with strong credit scores aiming to maximize savings and customize loan conditions.

Manufacturer Financing vs Third-Party Financing Infographic

cardiffo.com

cardiffo.com