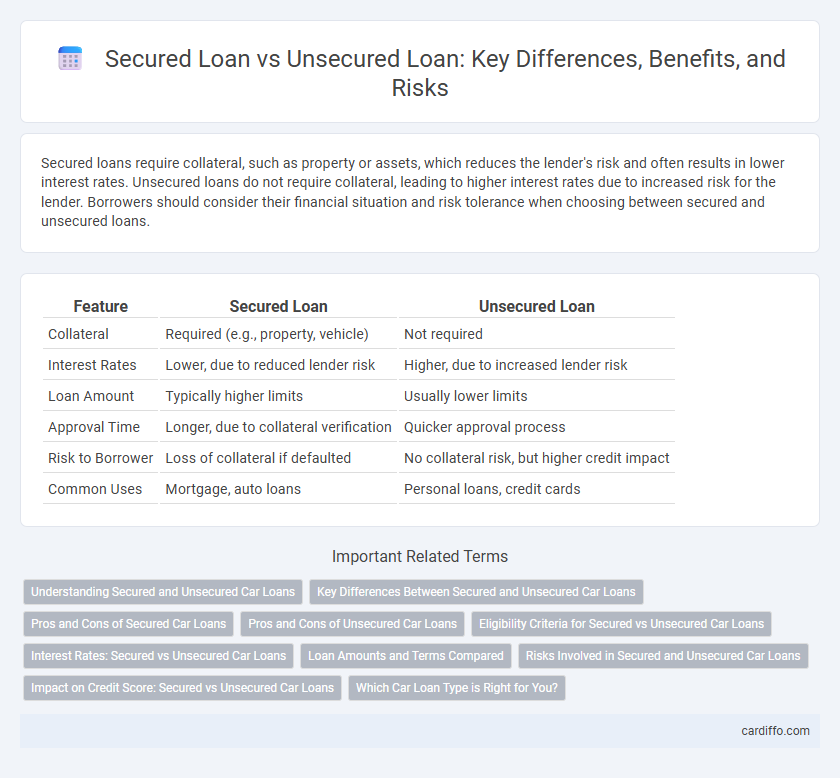

Secured loans require collateral, such as property or assets, which reduces the lender's risk and often results in lower interest rates. Unsecured loans do not require collateral, leading to higher interest rates due to increased risk for the lender. Borrowers should consider their financial situation and risk tolerance when choosing between secured and unsecured loans.

Table of Comparison

| Feature | Secured Loan | Unsecured Loan |

|---|---|---|

| Collateral | Required (e.g., property, vehicle) | Not required |

| Interest Rates | Lower, due to reduced lender risk | Higher, due to increased lender risk |

| Loan Amount | Typically higher limits | Usually lower limits |

| Approval Time | Longer, due to collateral verification | Quicker approval process |

| Risk to Borrower | Loss of collateral if defaulted | No collateral risk, but higher credit impact |

| Common Uses | Mortgage, auto loans | Personal loans, credit cards |

Understanding Secured and Unsecured Car Loans

Secured car loans require borrowers to use the vehicle as collateral, reducing lender risk and often resulting in lower interest rates and higher borrowing limits. Unsecured car loans do not involve collateral, leading to higher interest rates due to increased lender risk and stricter approval criteria. Understanding these differences helps borrowers choose the best financing option based on credit history, loan terms, and risk tolerance.

Key Differences Between Secured and Unsecured Car Loans

Secured car loans require collateral, typically the vehicle itself, which lowers lender risk and often results in lower interest rates and better loan terms. Unsecured car loans do not require collateral, leading to higher interest rates and stricter credit requirements due to increased lender risk. The key difference lies in the security interest held by the lender: secured loans protect the lender with asset-backed collateral, while unsecured loans rely solely on the borrower's creditworthiness.

Pros and Cons of Secured Car Loans

Secured car loans offer lower interest rates and higher borrowing limits due to the vehicle serving as collateral, reducing lender risk. Borrowers face the risk of repossession if they fail to make timely payments, and these loans often require a good credit score for approval. While secured car loans provide affordable financing, the potential loss of the car remains a significant drawback.

Pros and Cons of Unsecured Car Loans

Unsecured car loans do not require collateral, reducing the risk of asset loss if repayments are missed, but typically come with higher interest rates compared to secured loans. Borrowers benefit from faster approval processes and less paperwork, making unsecured loans more convenient for those without sufficient collateral. However, stricter credit score requirements and lower borrowing limits can limit access and total loan amounts for many applicants.

Eligibility Criteria for Secured vs Unsecured Car Loans

Eligibility criteria for secured car loans typically require the borrower to provide the vehicle as collateral, demonstrate a stable income source, and have a reasonable credit score, ensuring lenders have security against default. Unsecured car loans focus more heavily on the borrower's creditworthiness, income stability, and debt-to-income ratio, since no collateral is offered to the lender. Lenders often require higher credit scores and stricter financial verification for unsecured loans due to the increased risk.

Interest Rates: Secured vs Unsecured Car Loans

Secured car loans typically offer lower interest rates because the vehicle acts as collateral, reducing the lender's risk and resulting in more favorable borrowing terms. Unsecured car loans generally have higher interest rates as they rely solely on the borrower's creditworthiness without any asset backing, increasing the lender's risk exposure. Comparing average interest rates, secured loans can be 2-5% lower than unsecured loans, significantly impacting overall loan cost and monthly payments.

Loan Amounts and Terms Compared

Secured loans typically offer higher loan amounts and longer repayment terms due to the collateral that reduces lender risk. Unsecured loans often come with lower loan limits and shorter terms because they rely solely on the borrower's creditworthiness. Interest rates on secured loans are usually lower, reflecting the reduced risk compared to unsecured loans.

Risks Involved in Secured and Unsecured Car Loans

Secured car loans involve risks such as potential repossession of the vehicle if the borrower defaults, which directly impacts credit scores and financial stability. Unsecured car loans pose higher interest rates and stricter qualification criteria due to the absence of collateral, increasing the risk of debt accumulation and credit damage if payments are missed. Borrowers should carefully evaluate these risks against their financial situations and loan terms to avoid severe consequences.

Impact on Credit Score: Secured vs Unsecured Car Loans

Secured car loans, backed by the vehicle as collateral, typically have a lower impact on credit scores due to lower default risk and often more favorable repayment terms. Unsecured car loans, lacking collateral, present higher risk to lenders, leading to stricter credit requirements and potentially greater credit score fluctuations if payments are missed. Timely payments on either loan type improve credit scores, but missed payments on unsecured loans can result in more significant negative impacts due to the higher risk profile.

Which Car Loan Type is Right for You?

Choosing the right car loan depends on your financial situation and risk tolerance. Secured car loans, backed by the vehicle as collateral, often offer lower interest rates and longer repayment terms, making them ideal for buyers seeking affordability and flexibility. Unsecured car loans require no collateral but typically come with higher interest rates and stricter qualification criteria, suitable for borrowers with strong credit who prefer not to risk their assets.

Secured Loan vs Unsecured Loan Infographic

cardiffo.com

cardiffo.com