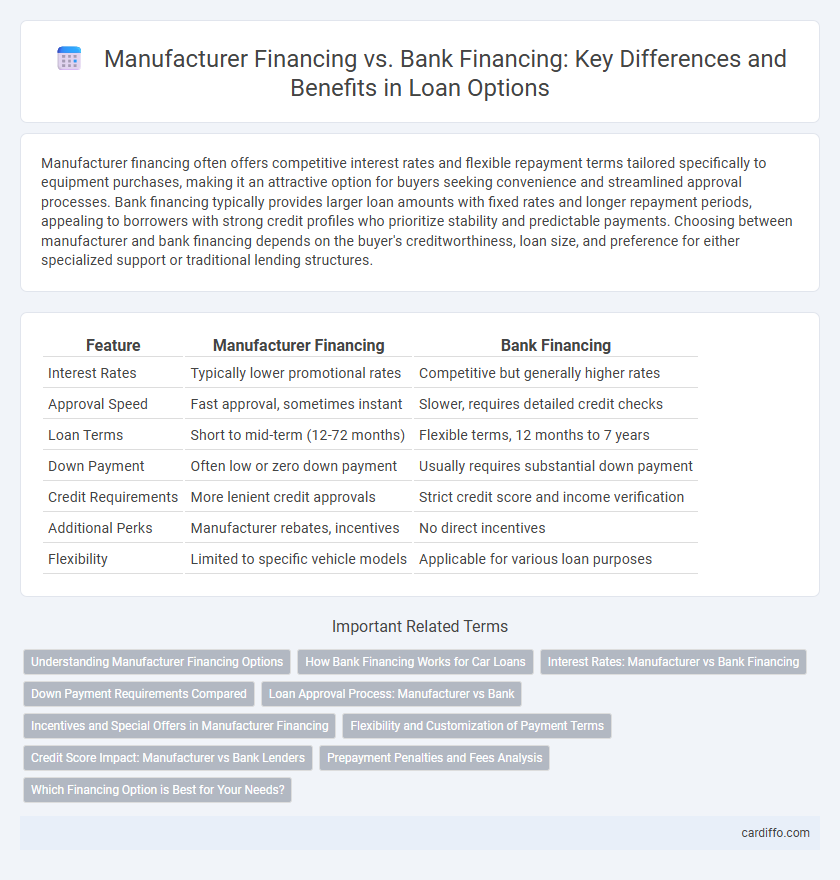

Manufacturer financing often offers competitive interest rates and flexible repayment terms tailored specifically to equipment purchases, making it an attractive option for buyers seeking convenience and streamlined approval processes. Bank financing typically provides larger loan amounts with fixed rates and longer repayment periods, appealing to borrowers with strong credit profiles who prioritize stability and predictable payments. Choosing between manufacturer and bank financing depends on the buyer's creditworthiness, loan size, and preference for either specialized support or traditional lending structures.

Table of Comparison

| Feature | Manufacturer Financing | Bank Financing |

|---|---|---|

| Interest Rates | Typically lower promotional rates | Competitive but generally higher rates |

| Approval Speed | Fast approval, sometimes instant | Slower, requires detailed credit checks |

| Loan Terms | Short to mid-term (12-72 months) | Flexible terms, 12 months to 7 years |

| Down Payment | Often low or zero down payment | Usually requires substantial down payment |

| Credit Requirements | More lenient credit approvals | Strict credit score and income verification |

| Additional Perks | Manufacturer rebates, incentives | No direct incentives |

| Flexibility | Limited to specific vehicle models | Applicable for various loan purposes |

Understanding Manufacturer Financing Options

Manufacturer financing offers tailored loan options directly from the product maker, often featuring lower interest rates and flexible repayment plans compared to traditional bank loans. These financing programs frequently include promotional deals such as deferred payments or cash rebates, enhancing affordability for buyers. Understanding manufacturer financing involves evaluating eligibility requirements, loan terms, and the total cost of credit to determine the most cost-effective solution.

How Bank Financing Works for Car Loans

Bank financing for car loans involves borrowing a set amount from a financial institution, which is repaid over a fixed term with interest based on the borrower's credit score and financial history. The bank typically requires a down payment and may offer competitive interest rates, but approval depends on creditworthiness and income verification. Monthly payments are fixed, and the bank holds a lien on the vehicle until the loan is fully repaid, ensuring legal ownership rights.

Interest Rates: Manufacturer vs Bank Financing

Manufacturer financing often offers lower initial interest rates compared to bank financing, making it attractive for buyers seeking immediate affordability. Banks typically provide more competitive interest rates for well-qualified borrowers with strong credit histories, leading to lower long-term borrowing costs. Interest rates from manufacturers may include promotional rates but can increase significantly after the introductory period, whereas banks usually offer more stable rates throughout the loan term.

Down Payment Requirements Compared

Manufacturer financing typically offers lower down payment requirements than bank financing, often ranging from 0% to 10%, making it accessible for buyers with limited upfront capital. Bank loans usually require a higher down payment, commonly between 10% and 20%, reflecting stricter lending criteria and risk assessment. These differences significantly impact the initial cash outflow and eligibility for loan approval in vehicle or equipment purchases.

Loan Approval Process: Manufacturer vs Bank

Manufacturer financing typically offers a faster loan approval process due to streamlined procedures and direct involvement with the buyer, often requiring less documentation. Bank financing involves more rigorous credit checks, extensive documentation, and longer approval times to assess risk thoroughly. Borrowers seeking quicker approvals may prefer manufacturer financing, while those prioritizing competitive rates might opt for bank loans despite the lengthier process.

Incentives and Special Offers in Manufacturer Financing

Manufacturer financing often includes exclusive incentives such as cashback offers, low or zero percent interest rates, and extended warranty coverage that are not typically available through traditional bank loans. These special offers can significantly reduce the overall cost of purchasing a vehicle or equipment, providing immediate financial benefits to the buyer. Banks usually focus on standard interest rates and fixed repayment terms, lacking the promotional advantages found in manufacturer financing deals.

Flexibility and Customization of Payment Terms

Manufacturer financing offers greater flexibility and customization in payment terms, often allowing tailored schedules based on production cycles and sales forecasts. Bank financing typically involves fixed repayment structures with less room for negotiation, requiring strict adherence to predetermined installment amounts and dates. This difference makes manufacturer financing more adaptable for businesses needing variable cash flow management.

Credit Score Impact: Manufacturer vs Bank Lenders

Manufacturer financing often offers more flexible credit score requirements compared to bank lenders, making it accessible for borrowers with lower credit ratings. Bank financing typically demands higher credit scores, reflecting stricter risk assessments and resulting in potentially better interest rates for qualified applicants. Understanding these credit score impacts is crucial for borrowers to select the financing option that aligns with their credit profile and financial goals.

Prepayment Penalties and Fees Analysis

Manufacturer financing often includes prepayment penalties to secure interest revenue, typically ranging from 2% to 5% of the remaining balance, while bank financing usually offers more flexible prepayment options with minimal or no fees. Banks tend to have stricter fee structures on origination but incentivize early repayment to reduce default risk, contrasting with manufacturer loans that prioritize fixed-term profit. Evaluating total cost of ownership involves scrutinizing these prepayment terms, as penalties in manufacturer financing may significantly increase overall loan expenses compared to bank financing.

Which Financing Option is Best for Your Needs?

Manufacturer financing often offers lower interest rates and tailored repayment plans directly connected to the product purchase, making it ideal for buyers seeking convenience and potential cost savings. Bank financing typically provides higher loan amounts and flexible terms suited for borrowers with strong credit profiles needing comprehensive financing solutions. Evaluating factors like interest rates, loan terms, credit requirements, and total cost of ownership will help determine the best financing option for your specific financial needs.

Manufacturer Financing vs Bank Financing Infographic

cardiffo.com

cardiffo.com