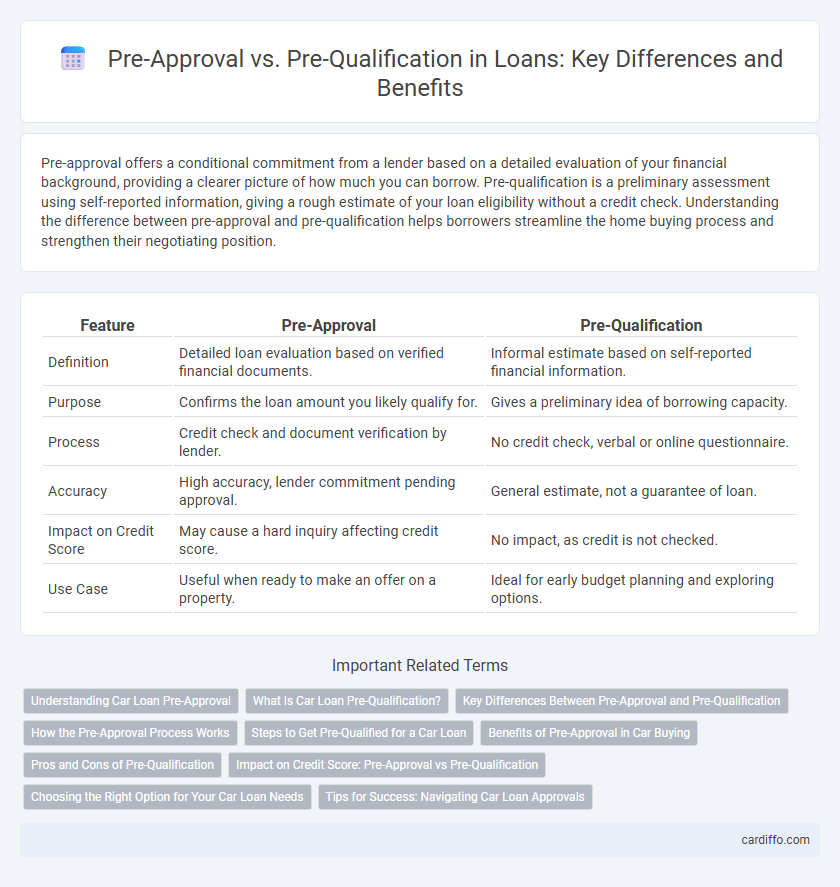

Pre-approval offers a conditional commitment from a lender based on a detailed evaluation of your financial background, providing a clearer picture of how much you can borrow. Pre-qualification is a preliminary assessment using self-reported information, giving a rough estimate of your loan eligibility without a credit check. Understanding the difference between pre-approval and pre-qualification helps borrowers streamline the home buying process and strengthen their negotiating position.

Table of Comparison

| Feature | Pre-Approval | Pre-Qualification |

|---|---|---|

| Definition | Detailed loan evaluation based on verified financial documents. | Informal estimate based on self-reported financial information. |

| Purpose | Confirms the loan amount you likely qualify for. | Gives a preliminary idea of borrowing capacity. |

| Process | Credit check and document verification by lender. | No credit check, verbal or online questionnaire. |

| Accuracy | High accuracy, lender commitment pending approval. | General estimate, not a guarantee of loan. |

| Impact on Credit Score | May cause a hard inquiry affecting credit score. | No impact, as credit is not checked. |

| Use Case | Useful when ready to make an offer on a property. | Ideal for early budget planning and exploring options. |

Understanding Car Loan Pre-Approval

Car loan pre-approval involves a lender conducting a thorough credit check and verifying financial information to provide a conditional commitment for a specific loan amount. This process offers buyers a clearer budget estimate and strengthens their negotiating position with dealerships. Unlike pre-qualification, pre-approval carries more weight since it reflects a more rigorous evaluation of the borrower's creditworthiness.

What Is Car Loan Pre-Qualification?

Car loan pre-qualification is an initial assessment by lenders that estimates the loan amount a borrower may qualify for based on basic financial information without a detailed credit check. It provides potential buyers with a preliminary idea of their borrowing capacity, helping them shop for vehicles within their budget. This process is quicker and less formal than pre-approval, making it a useful first step in the car financing journey.

Key Differences Between Pre-Approval and Pre-Qualification

Pre-Approval involves a thorough credit check and verification of financial documents, providing a conditional commitment from lenders, while Pre-Qualification is an initial assessment based on self-reported information without a credit check. Pre-Approval offers a more accurate estimation of the loan amount you qualify for and strengthens your position with sellers during home buying. Pre-Qualification serves as a preliminary step to gauge eligibility but does not guarantee loan approval or locked interest rates.

How the Pre-Approval Process Works

The pre-approval process involves a thorough review of a borrower's financial documents, such as credit score, income statements, and debt-to-income ratio, by a lender to determine the maximum loan amount they qualify for. This process typically requires submitting a formal application, enabling the lender to provide a conditional commitment based on verified information, which strengthens the borrower's position in the home buying market. Pre-approval differs from pre-qualification by offering a more accurate assessment and demonstrating serious intent to sellers and real estate agents.

Steps to Get Pre-Qualified for a Car Loan

To get pre-qualified for a car loan, gather essential financial documents such as proof of income, credit history, and identification. Submit these details to a lender, who will perform a preliminary credit check and assess your financial standing without impacting your credit score. Receiving pre-qualification provides an estimated loan amount and interest rate, helping you understand your buying power before formally applying.

Benefits of Pre-Approval in Car Buying

Pre-approval in car buying offers significant benefits by providing buyers with a clear understanding of their budget and loan terms, which enhances negotiating power at dealerships. Unlike pre-qualification, pre-approval involves a thorough credit check, resulting in a more accurate estimate of loan eligibility and interest rates. This process accelerates the purchase by streamlining financing, reducing uncertainty, and increasing confidence in selecting the right vehicle.

Pros and Cons of Pre-Qualification

Pre-qualification offers a quick and informal assessment of a borrower's creditworthiness, helping to gauge potential loan amounts and interest rates without impacting credit scores. The main advantage is its speed and ease, often requiring minimal documentation, which benefits those just starting their loan search. However, its downside lies in the lack of guarantee or accuracy since the evaluation is based mainly on self-reported information rather than verified financial data.

Impact on Credit Score: Pre-Approval vs Pre-Qualification

Pre-Approval involves a hard credit inquiry that can temporarily lower your credit score, while Pre-Qualification uses a soft inquiry and does not affect your credit rating. Lenders rely more heavily on Pre-Approval as it reflects a verified financial assessment, impacting credit risk evaluation. Understanding this distinction helps borrowers manage their credit health during the loan application process.

Choosing the Right Option for Your Car Loan Needs

Pre-approval for a car loan offers a conditional commitment from lenders based on a thorough credit check, providing clearer insight into your borrowing capacity and interest rates. Pre-qualification, on the other hand, is a simpler, preliminary assessment that gives an estimated loan amount without affecting your credit score. Opting for pre-approval helps secure better financing terms and strengthens your bargaining power at dealerships, making it the preferred choice for serious car buyers.

Tips for Success: Navigating Car Loan Approvals

Understanding the difference between pre-approval and pre-qualification is essential for navigating car loan approvals effectively. Pre-approval involves a thorough credit check and provides a conditional commitment from a lender, enhancing your bargaining power at the dealership. To increase success, maintain a strong credit score, gather necessary financial documents, and compare offers from multiple lenders before committing to a loan.

Pre-Approval vs Pre-Qualification Infographic

cardiffo.com

cardiffo.com