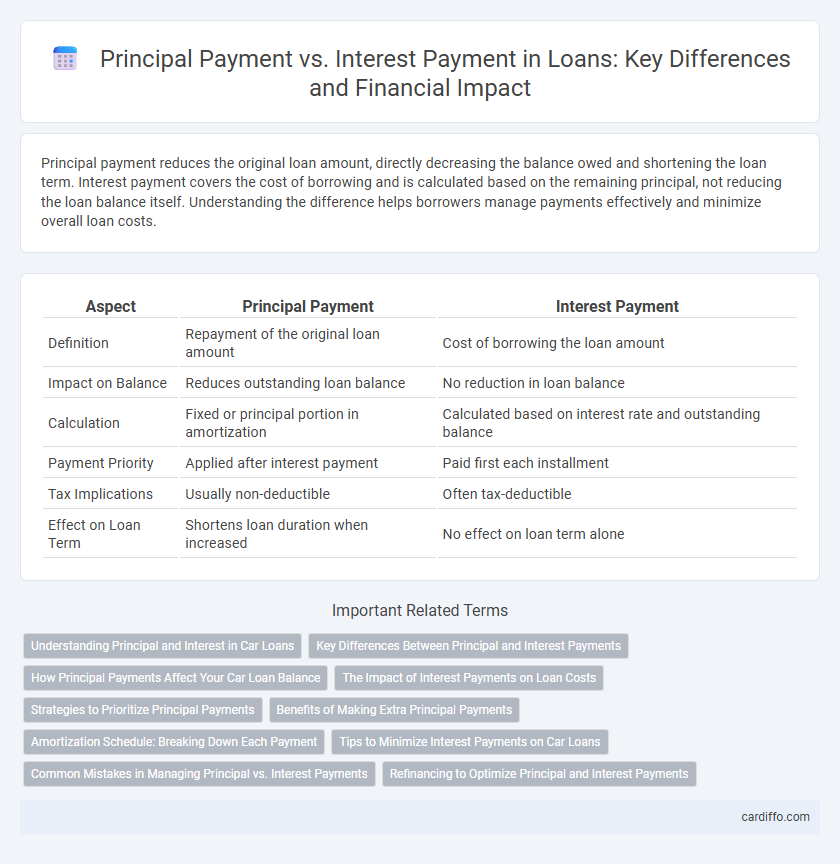

Principal payment reduces the original loan amount, directly decreasing the balance owed and shortening the loan term. Interest payment covers the cost of borrowing and is calculated based on the remaining principal, not reducing the loan balance itself. Understanding the difference helps borrowers manage payments effectively and minimize overall loan costs.

Table of Comparison

| Aspect | Principal Payment | Interest Payment |

|---|---|---|

| Definition | Repayment of the original loan amount | Cost of borrowing the loan amount |

| Impact on Balance | Reduces outstanding loan balance | No reduction in loan balance |

| Calculation | Fixed or principal portion in amortization | Calculated based on interest rate and outstanding balance |

| Payment Priority | Applied after interest payment | Paid first each installment |

| Tax Implications | Usually non-deductible | Often tax-deductible |

| Effect on Loan Term | Shortens loan duration when increased | No effect on loan term alone |

Understanding Principal and Interest in Car Loans

Understanding the distinction between principal and interest payments is crucial in managing car loans effectively. The principal payment reduces the original loan amount, directly decreasing the outstanding balance, while the interest payment covers the lender's cost for borrowing money, calculated based on the remaining principal. Regularly prioritizing higher principal payments can significantly shorten the loan term and reduce total interest paid over time.

Key Differences Between Principal and Interest Payments

Principal payment reduces the outstanding loan balance, directly lowering the amount owed and shortening the loan term. Interest payment covers the cost of borrowing, calculated as a percentage of the remaining principal, and does not decrease the loan amount. Key differences include that principal payments build equity in the asset, while interest payments represent the lender's earnings for providing the loan.

How Principal Payments Affect Your Car Loan Balance

Principal payments directly reduce the outstanding balance of your car loan, lowering the total amount owed and shortening the loan term. Each principal payment decreases the interest calculated on future payments, resulting in less interest paid over the life of the loan. Making extra principal payments accelerates loan payoff and improves overall financial savings.

The Impact of Interest Payments on Loan Costs

Interest payments significantly increase the total loan cost by accruing over the principal balance throughout the loan term. While principal payments reduce the outstanding loan amount, interest payments do not decrease the original debt and instead represent the lender's earnings. Understanding the proportion of interest versus principal in each installment is critical for managing loan expenses and optimizing repayment strategy.

Strategies to Prioritize Principal Payments

Prioritizing principal payments in a loan accelerates debt reduction and minimizes total interest paid over the loan term. Strategies include making extra payments directly toward the principal, rounding up monthly installments, or recasting the loan after lump-sum payments to lower interest obligations. Utilizing these methods effectively shortens loan duration and improves financial flexibility.

Benefits of Making Extra Principal Payments

Making extra principal payments on a loan reduces the outstanding balance faster, which lowers the total interest paid over the loan term. This strategy shortens the repayment period, helping borrowers become debt-free sooner while saving money on interest charges. By decreasing the principal, subsequent interest calculations are based on a smaller amount, enhancing overall financial savings.

Amortization Schedule: Breaking Down Each Payment

An amortization schedule details how each loan payment is divided between principal payment and interest payment over time, gradually reducing the loan balance. Early payments typically consist mostly of interest, with a smaller portion applied to the principal, while later payments increasingly reduce the principal. Understanding this breakdown helps borrowers track loan payoff progress and plan financial decisions more effectively.

Tips to Minimize Interest Payments on Car Loans

Making extra principal payments on your car loan reduces the loan balance faster, directly lowering the total interest paid over time. Opt for bi-weekly payments instead of monthly ones to increase the frequency of principal reduction and save on interest costs. Refinancing to a lower interest rate or shortening the loan term can also significantly decrease the amount of interest accrued on your car loan.

Common Mistakes in Managing Principal vs. Interest Payments

Confusing principal payments with interest payments often leads to slower loan reduction and increased total interest costs. Many borrowers mistakenly apply extra funds toward interest instead of principal, preventing effective balance reduction. Ignoring the impact of principal-prepayment penalties further complicates financial planning and loan amortization schedules.

Refinancing to Optimize Principal and Interest Payments

Refinancing a loan can strategically optimize principal and interest payments by securing a lower interest rate, which reduces overall interest costs and accelerates principal repayment. Adjusting the loan term during refinancing allows borrowers to balance monthly payments and total interest paid, improving cash flow management. Careful analysis of refinancing options helps maximize equity build-up while minimizing interest expenses over the loan lifecycle.

Principal Payment vs Interest Payment Infographic

cardiffo.com

cardiffo.com