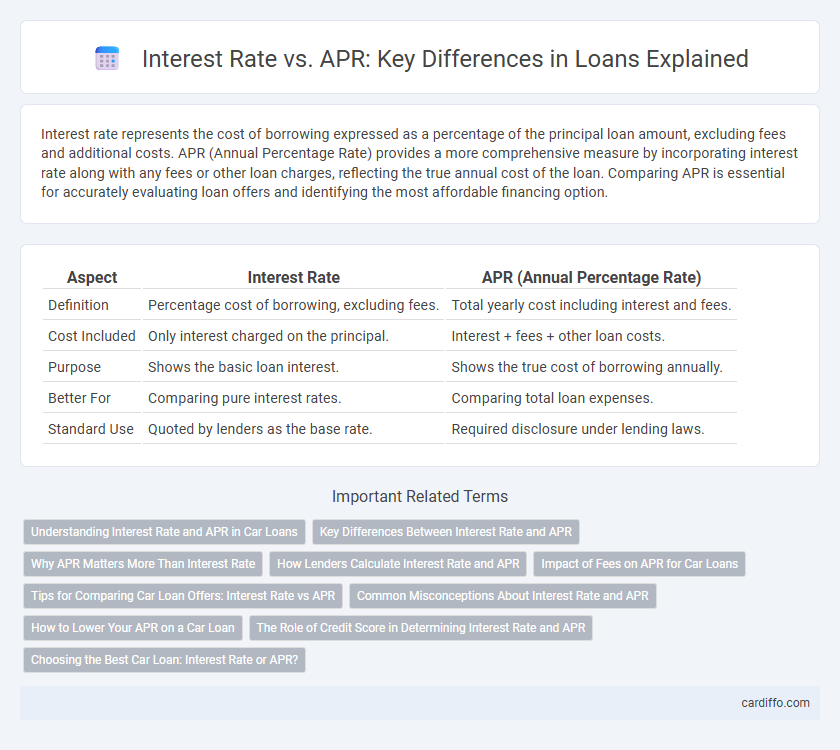

Interest rate represents the cost of borrowing expressed as a percentage of the principal loan amount, excluding fees and additional costs. APR (Annual Percentage Rate) provides a more comprehensive measure by incorporating interest rate along with any fees or other loan charges, reflecting the true annual cost of the loan. Comparing APR is essential for accurately evaluating loan offers and identifying the most affordable financing option.

Table of Comparison

| Aspect | Interest Rate | APR (Annual Percentage Rate) |

|---|---|---|

| Definition | Percentage cost of borrowing, excluding fees. | Total yearly cost including interest and fees. |

| Cost Included | Only interest charged on the principal. | Interest + fees + other loan costs. |

| Purpose | Shows the basic loan interest. | Shows the true cost of borrowing annually. |

| Better For | Comparing pure interest rates. | Comparing total loan expenses. |

| Standard Use | Quoted by lenders as the base rate. | Required disclosure under lending laws. |

Understanding Interest Rate and APR in Car Loans

Interest rate in car loans represents the cost charged by the lender for borrowing the principal amount, expressed as a percentage annually. APR (Annual Percentage Rate) includes the interest rate plus additional fees and charges, providing a more comprehensive view of the total loan cost. Comparing APR instead of just the interest rate helps borrowers accurately evaluate car loan offers and avoid hidden costs.

Key Differences Between Interest Rate and APR

Interest rate represents the cost of borrowing expressed as a percentage of the principal loan amount, excluding fees. APR, or Annual Percentage Rate, includes both the interest rate and additional loan-related fees, providing a more comprehensive measure of the total borrowing cost. Comparing APR instead of just the interest rate offers a clearer picture of the loan's true expense over time.

Why APR Matters More Than Interest Rate

APR matters more than the interest rate because it reflects the true cost of borrowing by including fees, points, and other charges beyond the nominal interest rate. This comprehensive measure allows borrowers to accurately compare loan offers and understand the total repayment amount over the life of the loan. Lenders use APR to provide transparency, ensuring borrowers can make informed financial decisions without hidden costs.

How Lenders Calculate Interest Rate and APR

Lenders calculate the interest rate based on the principal amount and the term of the loan, reflecting the cost charged for borrowing money. APR (Annual Percentage Rate) includes the interest rate plus additional fees and costs spread over one year, providing a more comprehensive measure of the loan's true cost. Understanding the difference helps borrowers compare loan offers more accurately by considering both the interest expense and associated fees.

Impact of Fees on APR for Car Loans

Interest rates on car loans represent the cost of borrowing money, excluding fees, while the APR (Annual Percentage Rate) includes both interest and additional fees, providing a more comprehensive measure of loan cost. Fees such as loan origination charges, documentation fees, and dealer processing fees increase the APR, often significantly inflating the total cost beyond the nominal interest rate. Comparing APRs rather than just interest rates allows borrowers to understand the true financial impact of fees and make more informed decisions when selecting car loans.

Tips for Comparing Car Loan Offers: Interest Rate vs APR

When comparing car loan offers, understand that the interest rate represents the cost of borrowing the principal amount, while the APR includes interest plus additional fees like loan origination or insurance, reflecting the true cost. Prioritize offers with lower APRs to get a more accurate comparison of total loan expenses over the term. Examine loan terms carefully, including loan duration and hidden fees, to avoid surprises and ensure the best financial decision.

Common Misconceptions About Interest Rate and APR

Many borrowers confuse the interest rate with the APR, assuming they represent the same cost of a loan. The interest rate reflects the basic cost of borrowing expressed as a percentage annually, excluding fees, while the APR (Annual Percentage Rate) includes the interest rate plus other loan-related fees, giving a more comprehensive measure of the loan's total cost. Misunderstanding this distinction can lead to underestimating the true expense of a loan and choosing less favorable terms.

How to Lower Your APR on a Car Loan

Lowering your APR on a car loan involves improving your credit score, negotiating loan terms, and choosing shorter loan durations. Refinancing your car loan when interest rates drop or your credit improves can also reduce your APR. Lenders factor in creditworthiness, loan length, and down payment size, so increasing your down payment can further decrease your APR.

The Role of Credit Score in Determining Interest Rate and APR

Credit score plays a crucial role in determining both the interest rate and APR for a loan, as lenders use it to assess the borrower's creditworthiness and risk level. A higher credit score typically results in lower interest rates and APRs, reflecting lower risk and more favorable loan terms. Lenders may increase rates for borrowers with lower credit scores to compensate for the higher likelihood of default.

Choosing the Best Car Loan: Interest Rate or APR?

When choosing the best car loan, understanding the difference between interest rate and APR is crucial for accurate cost comparison. The interest rate reflects the cost of borrowing the principal loan amount annually, while the APR includes interest plus additional fees such as loan origination and processing charges, providing a more comprehensive view of the loan's true cost. Opting for a loan with a lower APR ensures transparency and helps avoid hidden expenses that can increase the total repayment amount over the loan term.

Interest Rate vs APR Infographic

cardiffo.com

cardiffo.com