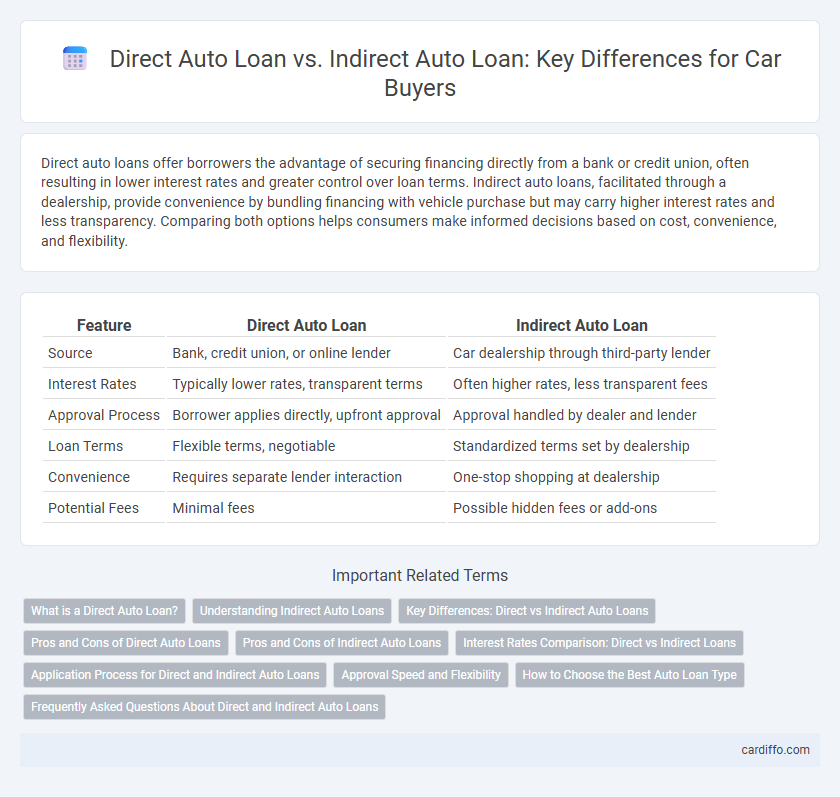

Direct auto loans offer borrowers the advantage of securing financing directly from a bank or credit union, often resulting in lower interest rates and greater control over loan terms. Indirect auto loans, facilitated through a dealership, provide convenience by bundling financing with vehicle purchase but may carry higher interest rates and less transparency. Comparing both options helps consumers make informed decisions based on cost, convenience, and flexibility.

Table of Comparison

| Feature | Direct Auto Loan | Indirect Auto Loan |

|---|---|---|

| Source | Bank, credit union, or online lender | Car dealership through third-party lender |

| Interest Rates | Typically lower rates, transparent terms | Often higher rates, less transparent fees |

| Approval Process | Borrower applies directly, upfront approval | Approval handled by dealer and lender |

| Loan Terms | Flexible terms, negotiable | Standardized terms set by dealership |

| Convenience | Requires separate lender interaction | One-stop shopping at dealership |

| Potential Fees | Minimal fees | Possible hidden fees or add-ons |

What is a Direct Auto Loan?

A direct auto loan is a type of financing obtained directly from a bank, credit union, or online lender, allowing borrowers to secure funds independently before visiting a dealership. This option often offers competitive interest rates and greater control over loan terms compared to dealer-arranged financing. Borrowers can negotiate vehicle prices more effectively when armed with pre-approved direct auto loan offers.

Understanding Indirect Auto Loans

Indirect auto loans are financing options arranged through car dealerships where the lender works behind the scenes to provide the loan. Interest rates for indirect auto loans may be higher due to dealer markups, but they offer convenience by combining car purchase and financing in one transaction. Borrowers should compare lender terms carefully to avoid inflated costs associated with dealership-arranged loans.

Key Differences: Direct vs Indirect Auto Loans

Direct auto loans involve borrowing funds straight from a lender such as a bank or credit union, often offering lower interest rates and more transparent terms. Indirect auto loans are financed through dealerships that work with multiple lenders, which may result in higher interest rates due to added dealer fees and markups. Key differences include loan approval process, interest rates, and negotiation flexibility, with direct loans providing more control over financing terms.

Pros and Cons of Direct Auto Loans

Direct auto loans offer competitive interest rates by dealing directly with financial institutions such as banks or credit unions, which often results in lower overall borrowing costs. Borrowers benefit from greater transparency and control over loan terms but must handle the entire financing process independently, which can be time-consuming and require more effort. The primary drawback is the lack of dealership support in loan approval and paperwork, which can make the purchasing process more complex compared to indirect auto loans arranged through dealerships.

Pros and Cons of Indirect Auto Loans

Indirect auto loans offered through dealerships provide the convenience of one-stop shopping and often faster approval processes. However, they may involve higher interest rates compared to direct loans from banks or credit unions, alongside less transparency in loan terms. Borrowers should carefully review the dealership's financing options to avoid potential markup costs and less favorable loan conditions.

Interest Rates Comparison: Direct vs Indirect Loans

Direct auto loans typically offer lower interest rates compared to indirect auto loans because borrowers work directly with financial institutions, reducing intermediary costs. Indirect auto loans, facilitated through dealerships, often come with higher rates due to dealer markups and additional fees. Comparing APRs, direct loans can save borrowers hundreds over the loan term, making them a more cost-effective financing option.

Application Process for Direct and Indirect Auto Loans

Direct auto loans involve applying directly through a bank, credit union, or online lender, allowing borrowers to secure financing before visiting a dealership. Indirect auto loans are processed through the dealership's partnership with multiple lenders, where the dealer submits the application on the buyer's behalf. The direct loan application process offers more control and transparency, while indirect loans typically provide a faster, more convenient approval experience at the point of sale.

Approval Speed and Flexibility

Direct auto loans typically offer faster approval speeds because borrowers apply directly through lenders, reducing processing time and paperwork. Indirect auto loans, arranged through dealerships with lender involvement, may take longer due to additional steps but provide greater flexibility in negotiating terms and loan options. Choosing between the two depends on whether quick approval or customizable loan conditions are the priority.

How to Choose the Best Auto Loan Type

Choosing the best auto loan type depends on interest rates, repayment terms, and lender options. Direct auto loans often offer lower interest rates and greater transparency by borrowing directly from banks or credit unions, while indirect auto loans provide convenience by financing through dealerships, sometimes with promotional offers. Evaluating credit scores, comparing APRs, and understanding loan flexibility are crucial steps to determine whether a direct or indirect auto loan aligns best with your financial goals.

Frequently Asked Questions About Direct and Indirect Auto Loans

Direct auto loans are obtained through banks, credit unions, or online lenders, offering borrowers control over loan terms and interest rates before visiting a dealership. Indirect auto loans are arranged by dealerships with third-party lenders, often providing convenience but sometimes higher interest rates due to dealer markups. Common questions include comparisons of interest rates, approval processes, and flexibility, with direct loans often favored for better rates and indirect loans preferred for streamlined purchasing.

Direct Auto Loan vs Indirect Auto Loan Infographic

cardiffo.com

cardiffo.com