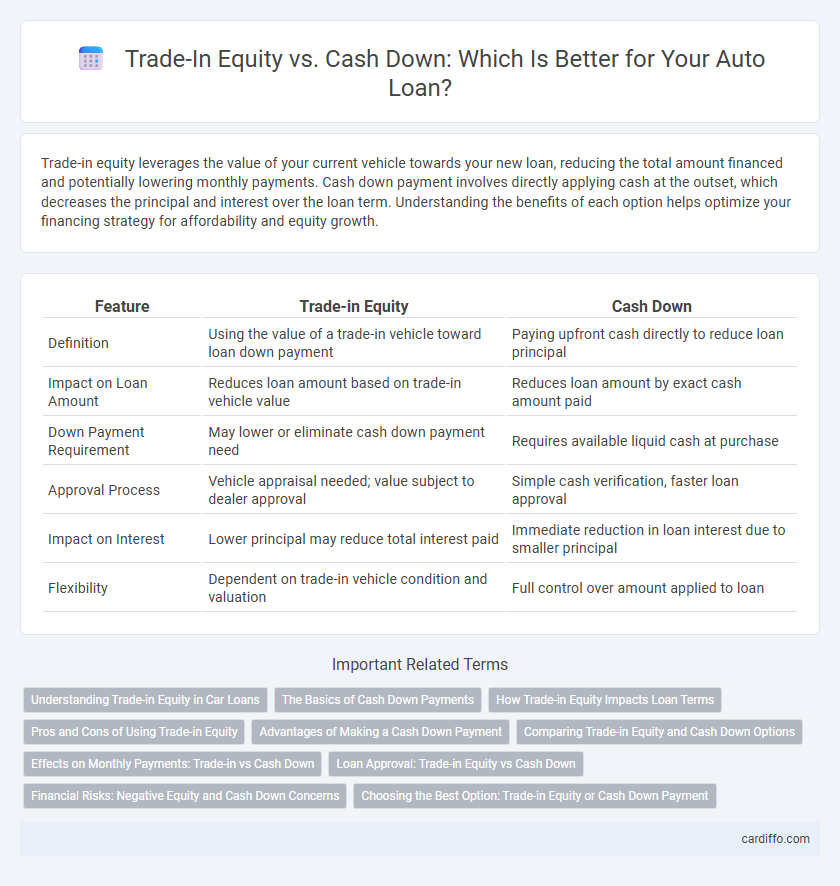

Trade-in equity leverages the value of your current vehicle towards your new loan, reducing the total amount financed and potentially lowering monthly payments. Cash down payment involves directly applying cash at the outset, which decreases the principal and interest over the loan term. Understanding the benefits of each option helps optimize your financing strategy for affordability and equity growth.

Table of Comparison

| Feature | Trade-in Equity | Cash Down |

|---|---|---|

| Definition | Using the value of a trade-in vehicle toward loan down payment | Paying upfront cash directly to reduce loan principal |

| Impact on Loan Amount | Reduces loan amount based on trade-in vehicle value | Reduces loan amount by exact cash amount paid |

| Down Payment Requirement | May lower or eliminate cash down payment need | Requires available liquid cash at purchase |

| Approval Process | Vehicle appraisal needed; value subject to dealer approval | Simple cash verification, faster loan approval |

| Impact on Interest | Lower principal may reduce total interest paid | Immediate reduction in loan interest due to smaller principal |

| Flexibility | Dependent on trade-in vehicle condition and valuation | Full control over amount applied to loan |

Understanding Trade-in Equity in Car Loans

Trade-in equity refers to the difference between a vehicle's trade-in value and the remaining balance on its loan, which can be applied as a down payment toward a new car loan. Utilizing trade-in equity reduces the overall loan amount and monthly payments, enhancing affordability without requiring upfront cash. Understanding trade-in equity helps borrowers maximize their financing options while minimizing out-of-pocket expenses during vehicle replacement.

The Basics of Cash Down Payments

Cash down payments represent the upfront amount a buyer pays directly toward the purchase price of a loan, reducing the principal balance and interest costs over time. This payment is typically expressed as a percentage of the total loan value, commonly ranging between 5% and 20%, and it establishes immediate equity in the asset. Compared to trade-in equity, cash down payments provide a clearer financial commitment without relying on the fluctuating value of traded assets.

How Trade-in Equity Impacts Loan Terms

Trade-in equity reduces the principal loan amount by applying the vehicle's appraised value toward the down payment, resulting in lower monthly payments and potentially a shorter loan term. This equity can improve loan-to-value ratios and may qualify borrowers for better interest rates due to decreased lender risk. Unlike cash down payments, trade-in equity involves the trade of an asset, affecting the overall loan balance and financing conditions directly.

Pros and Cons of Using Trade-in Equity

Using trade-in equity as a down payment can reduce the amount needed to finance, lowering monthly loan payments and interest costs. However, relying on trade-in equity risks fluctuating vehicle values, potentially leaving borrowers with less equity than anticipated. Cash down payments provide more predictable financing but require immediate liquid funds, which may not be accessible for all buyers.

Advantages of Making a Cash Down Payment

Making a cash down payment on a loan reduces the principal balance, leading to lower monthly payments and less interest paid over the loan term. It improves loan approval chances by demonstrating financial stability and reduces the risk of negative equity. A substantial cash down payment can also result in better interest rates, saving money throughout the loan repayment period.

Comparing Trade-in Equity and Cash Down Options

Trade-in equity leverages the value of your current vehicle as a down payment, reducing the loan principal and potentially lowering monthly payments. Cash down payments offer immediate reduction of the loan amount without the need to sell or appraise a trade-in, providing more flexibility and control over the transaction. Both options impact loan-to-value ratios and interest costs differently, making the choice dependent on individual financial situations and vehicle equity.

Effects on Monthly Payments: Trade-in vs Cash Down

Trade-in equity reduces the loan principal by applying the vehicle's value directly, lowering monthly payments without requiring extra cash upfront. Cash down payments immediately decrease the financed amount, often resulting in similar monthly savings but impact liquidity differently. Choosing between trade-in equity and cash down hinges on available assets and preferences for preserving cash flow versus reducing debt.

Loan Approval: Trade-in Equity vs Cash Down

Using trade-in equity for loan approval leverages the value of an existing asset to reduce the financed amount, often improving loan-to-value ratios and increasing approval likelihood. Cash down payments demonstrate immediate borrower liquidity, enhancing creditworthiness and lowering lender risk for faster loan approval. Lenders weigh trade-in equity and cash down differently, but both can significantly influence loan approval outcomes based on borrower financial profiles and asset valuations.

Financial Risks: Negative Equity and Cash Down Concerns

Trade-in equity reduces the risk of negative equity by applying existing vehicle value toward the new loan, minimizing the loan-to-value ratio and potential underwater loan scenarios. Cash down payments, while lowering monthly installments and loan principal, involve liquidity risks and reduce immediate financial reserves, potentially impacting emergency funds. Balancing trade-in equity with cash down optimizes financial stability, minimizing exposure to depreciation-related losses and cash flow constraints.

Choosing the Best Option: Trade-in Equity or Cash Down Payment

Selecting between trade-in equity and a cash down payment hinges on maximizing financial benefits and loan terms. Trade-in equity reduces the principal amount, potentially lowering monthly payments and interest over the loan term, while cash down payments can improve loan-to-value ratios and secure better interest rates. Evaluating individual credit profiles, vehicle depreciation, and overall budget constraints is crucial for choosing the most advantageous option in auto financing.

Trade-in Equity vs Cash Down Infographic

cardiffo.com

cardiffo.com