When considering a car loan payoff, it is essential to compare the trade-in value with the loan payoff amount to determine your financial position. The trade-in value represents what a dealer offers for your vehicle, while the loan payoff amount is the remaining balance you owe on the loan, including any fees. If the trade-in value exceeds the loan payoff amount, you can use the difference as equity toward your next purchase; if it's less, you may need to cover the shortfall out-of-pocket.

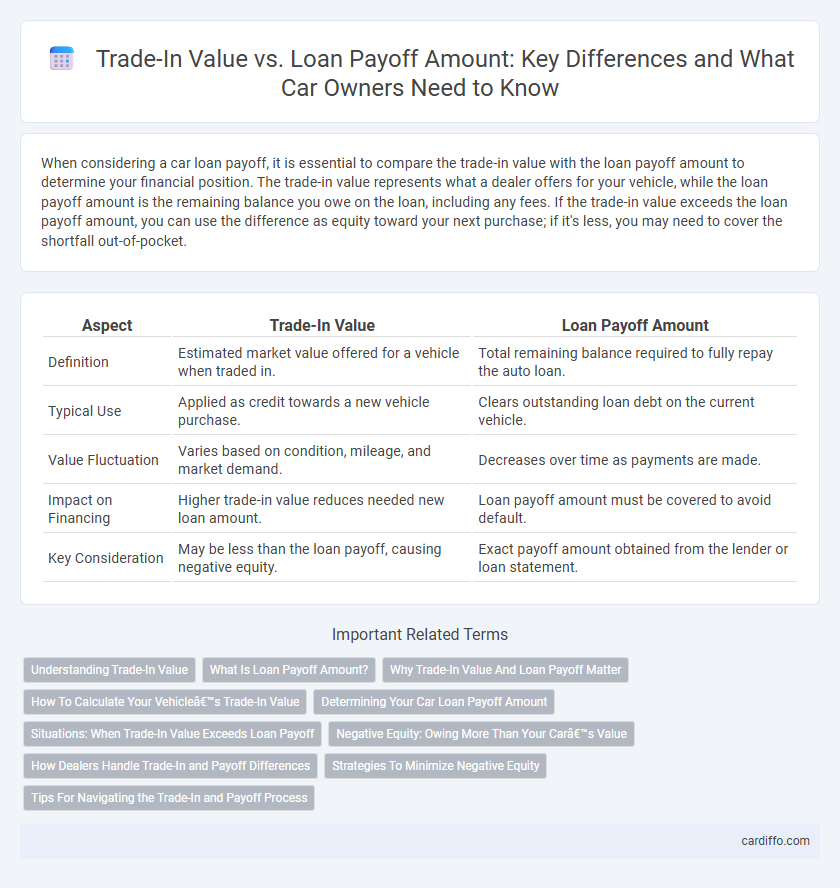

Table of Comparison

| Aspect | Trade-In Value | Loan Payoff Amount |

|---|---|---|

| Definition | Estimated market value offered for a vehicle when traded in. | Total remaining balance required to fully repay the auto loan. |

| Typical Use | Applied as credit towards a new vehicle purchase. | Clears outstanding loan debt on the current vehicle. |

| Value Fluctuation | Varies based on condition, mileage, and market demand. | Decreases over time as payments are made. |

| Impact on Financing | Higher trade-in value reduces needed new loan amount. | Loan payoff amount must be covered to avoid default. |

| Key Consideration | May be less than the loan payoff, causing negative equity. | Exact payoff amount obtained from the lender or loan statement. |

Understanding Trade-In Value

Trade-in value represents the amount a dealership offers for your current vehicle when you exchange it for another, reflecting its market condition and demand. This value can differ significantly from the loan payoff amount, which is the exact remaining balance required to clear your auto loan. Understanding trade-in value helps in negotiating better deals and assessing whether your vehicle's worth covers the outstanding loan balance.

What Is Loan Payoff Amount?

The loan payoff amount is the total sum required to fully repay a loan, including the principal balance, accrued interest, and any applicable fees or penalties. It differs from the trade-in value, which represents the estimated market worth of a vehicle when selling or trading it in. Understanding the loan payoff amount is essential to determine the financial gap or equity when trading in a vehicle with an outstanding loan.

Why Trade-In Value And Loan Payoff Matter

Trade-in value represents the amount a dealer offers for your vehicle, while the loan payoff amount is the remaining balance you owe on the auto loan. Understanding the difference is crucial because if the trade-in value is less than the loan payoff amount, you may face negative equity, requiring additional funds to settle the loan. Accurate knowledge of both figures helps negotiate better trade-in deals and avoid financial shortfalls during vehicle replacement.

How To Calculate Your Vehicle’s Trade-In Value

To calculate your vehicle's trade-in value, research the current market price using resources like Kelley Blue Book, Edmunds, or NADA Guides to determine the average retail value based on your car's make, model, year, mileage, and condition. Compare listings for similar vehicles in your area to refine the estimate and consider factors such as recent maintenance, accident history, and aftermarket upgrades that can influence value. Subtract any outstanding loan payoff amount from the trade-in estimate to understand your net equity and how it will affect your new loan or purchase.

Determining Your Car Loan Payoff Amount

Determining your car loan payoff amount involves obtaining the current balance from your lender, which may include outstanding principal, interest, and any prepayment fees. The trade-in value represents the price your dealer offers for your vehicle, which can be higher or lower than the payoff amount depending on market demand and vehicle condition. Comparing the trade-in value to the loan payoff amount helps you understand whether you owe additional money or can apply leftover funds toward a new car purchase.

Situations: When Trade-In Value Exceeds Loan Payoff

When the trade-in value exceeds the loan payoff amount, the borrower gains positive equity, allowing them to use the surplus as a down payment on a new vehicle or receive it as cash. This equity situation often occurs when the vehicle's market value remains strong or the loan has been partially repaid ahead of schedule. Understanding this scenario helps borrowers make informed financial decisions and leverage their asset effectively during trade-in transactions.

Negative Equity: Owing More Than Your Car’s Value

Negative equity occurs when the loan payoff amount exceeds the trade-in value of your vehicle, meaning you owe more than the car is worth. This situation often results in higher monthly payments or the need to roll the remaining balance into a new loan. Understanding the difference between trade-in value and loan payoff is crucial for avoiding financial pitfalls during vehicle upgrades.

How Dealers Handle Trade-In and Payoff Differences

Dealers assess the trade-in value of a vehicle based on market demand and condition, often offering less than the loan payoff amount owed on the car. When the payoff amount exceeds the trade-in value, dealers may require the seller to cover the negative equity or roll it into a new loan, affecting financing terms. Understanding how dealers handle trade-in and payoff differences is crucial for negotiating favorable loan payoff arrangements during trade-in transactions.

Strategies To Minimize Negative Equity

Understanding the trade-in value and loan payoff amount is crucial for minimizing negative equity in a vehicle loan. Strategies include obtaining a trade-in appraisal from multiple dealerships to find the highest offer, refinancing the loan to lower interest rates and monthly payments, and making extra payments to reduce the principal balance faster. Timing the trade-in when the vehicle's market value is close to or exceeds the remaining loan balance helps avoid owing more than the car is worth.

Tips For Navigating the Trade-In and Payoff Process

When navigating the trade-in and loan payoff process, accurately comparing the trade-in value with the loan payoff amount is essential to avoid negative equity situations. Request a detailed payoff quote from your lender and obtain multiple trade-in appraisals from reputable dealerships to ensure you get the best possible deal. Understanding the difference between these figures allows you to negotiate effectively and plan for any remaining balance.

Trade-In Value vs Loan Payoff Amount Infographic

cardiffo.com

cardiffo.com