Lease buyout loans offer a streamlined option for drivers looking to purchase their leased vehicle at the end of the term, often featuring competitive rates and flexible terms tailored to the vehicle's residual value. Standard auto purchase loans provide broader financing options for both new and used cars, typically requiring a down payment and varying interest rates based on creditworthiness. Choosing between these loans depends on factors such as the vehicle's condition, credit profile, and the overall cost-effectiveness of buying out a lease versus financing a new purchase.

Table of Comparison

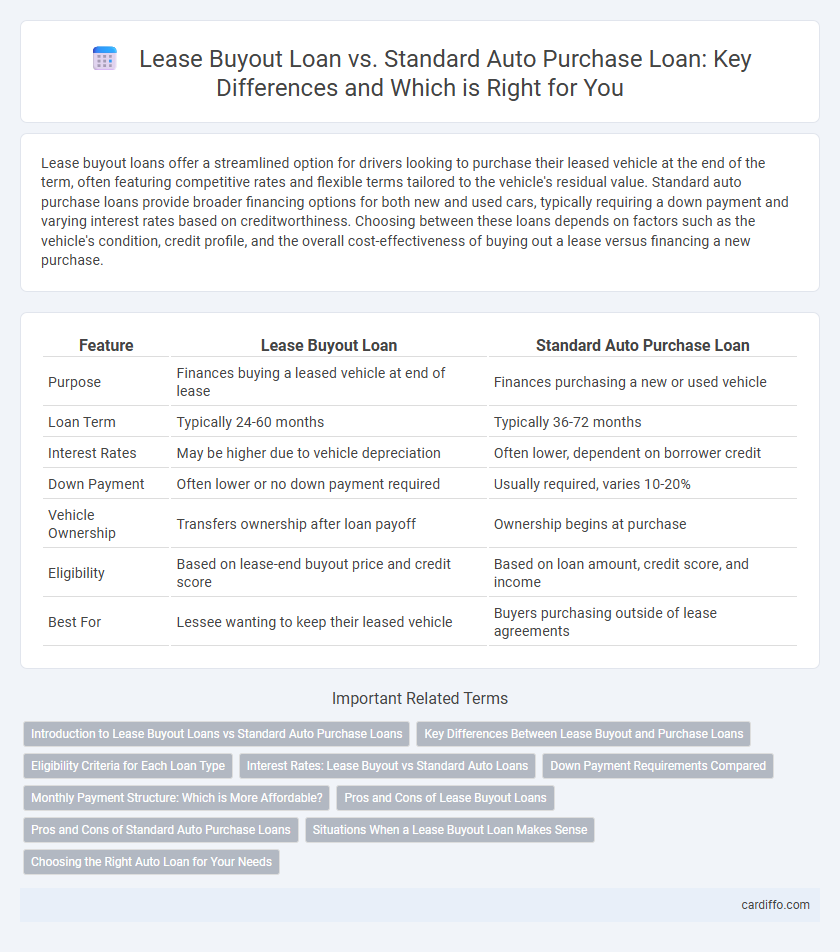

| Feature | Lease Buyout Loan | Standard Auto Purchase Loan |

|---|---|---|

| Purpose | Finances buying a leased vehicle at end of lease | Finances purchasing a new or used vehicle |

| Loan Term | Typically 24-60 months | Typically 36-72 months |

| Interest Rates | May be higher due to vehicle depreciation | Often lower, dependent on borrower credit |

| Down Payment | Often lower or no down payment required | Usually required, varies 10-20% |

| Vehicle Ownership | Transfers ownership after loan payoff | Ownership begins at purchase |

| Eligibility | Based on lease-end buyout price and credit score | Based on loan amount, credit score, and income |

| Best For | Lessee wanting to keep their leased vehicle | Buyers purchasing outside of lease agreements |

Introduction to Lease Buyout Loans vs Standard Auto Purchase Loans

Lease buyout loans enable borrowers to purchase their leased vehicle by financing the remaining residual value, often featuring competitive interest rates tailored for lease-end equity. Standard auto purchase loans provide financing for buying a vehicle outright, whether new or used, with loan terms based on factors like credit score, down payment, and vehicle price. Comparing these options helps borrowers decide between continuing ownership through a lease buyout or initiating a new loan agreement for vehicle purchase.

Key Differences Between Lease Buyout and Purchase Loans

Lease buyout loans enable borrowers to purchase their leased vehicles at the end of the lease term, often covering the residual value specified in the lease agreement. Standard auto purchase loans finance the acquisition of new or used vehicles without prior leasing, typically involving different interest rates and loan durations. Key differences include eligibility criteria, with lease buyout loans limited to current lessees, and varying loan terms that impact monthly payments and overall cost.

Eligibility Criteria for Each Loan Type

Eligibility for a lease buyout loan typically requires the borrower to have a current lease agreement, positive payment history, and the vehicle must be eligible for buyout based on lease terms. Standard auto purchase loans generally demand proof of income, a minimum credit score, and the vehicle title to be transferred to the borrower. Lenders may also consider factors like debt-to-income ratio and loan-to-value ratio when determining qualification for either loan type.

Interest Rates: Lease Buyout vs Standard Auto Loans

Lease buyout loans often feature higher interest rates compared to standard auto purchase loans due to increased risk factors and shorter loan terms. Standard auto loans typically benefit from lower rates influenced by longer repayment periods and more extensive lender competition. Borrowers seeking to finance a lease buyout should carefully compare interest rate offers to optimize overall loan costs.

Down Payment Requirements Compared

Lease buyout loans typically require lower down payments compared to standard auto purchase loans, as borrowers are often refinancing the remaining value of a leased vehicle. Standard auto purchase loans usually demand higher down payments, often around 10-20% of the vehicle's purchase price, to reduce lender risk. Lower down payments on lease buyout loans can make transitioning from leasing to ownership more accessible for consumers.

Monthly Payment Structure: Which is More Affordable?

Lease buyout loans typically offer lower monthly payments since they are based on the residual value of the leased vehicle rather than the full purchase price. Standard auto purchase loans generally have higher monthly payments because the borrower finances the entire vehicle cost plus interest over a shorter term. Comparing affordability, lease buyout loans can be more budget-friendly for drivers who want to keep their leased car without a large monthly financial burden.

Pros and Cons of Lease Buyout Loans

Lease buyout loans allow borrowers to purchase their leased vehicle at the end of the lease term, often at a price predetermined in the lease agreement, providing the advantage of acquiring a familiar car without the hassle of selling it. These loans typically have higher interest rates compared to standard auto purchase loans, which can increase the overall cost of ownership. A downside includes potential limited loan amounts based on the lease residual value, whereas standard auto loans offer more flexibility in vehicle selection and purchasing options.

Pros and Cons of Standard Auto Purchase Loans

Standard auto purchase loans offer fixed interest rates and predictable monthly payments, making it easier for borrowers to budget their finances. However, these loans often require a higher down payment compared to lease buyout loans and may come with stricter credit score requirements. Borrowers should consider the longer loan terms and potential depreciation impacts when choosing a standard auto purchase loan over a lease buyout option.

Situations When a Lease Buyout Loan Makes Sense

A lease buyout loan makes sense when you want to keep your leased vehicle without facing the lease-end fees or mileage penalties, offering lower initial costs than purchasing a new car. This option is particularly beneficial if the buyout price is lower than the car's current market value, providing potential financial savings. Additionally, lease buyout loans simplify ownership transfer and often have competitive interest rates compared to standard auto purchase loans.

Choosing the Right Auto Loan for Your Needs

Lease buyout loans offer the opportunity to purchase your leased vehicle at a predetermined buyout price, often with flexible terms tailored to the remaining lease balance. Standard auto purchase loans provide financing for new or used cars with varying interest rates, loan durations, and down payment requirements, catering to buyers seeking a straightforward vehicle acquisition. Evaluating your current lease equity, credit score, and long-term ownership goals is essential for selecting the optimal loan type to fit your financial situation and automotive needs.

Lease Buyout Loan vs Standard Auto Purchase Loan Infographic

cardiffo.com

cardiffo.com