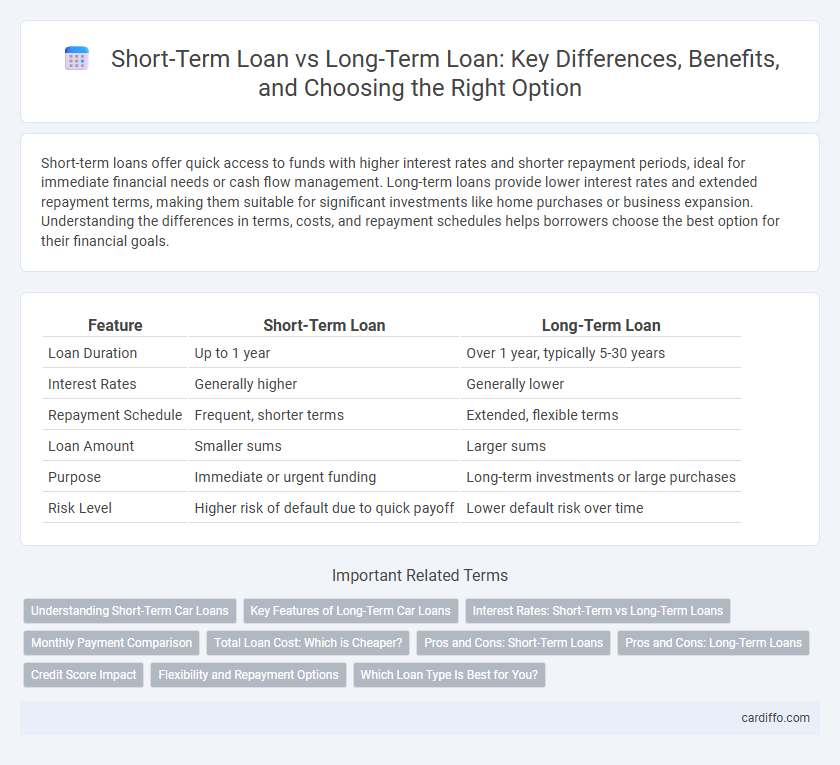

Short-term loans offer quick access to funds with higher interest rates and shorter repayment periods, ideal for immediate financial needs or cash flow management. Long-term loans provide lower interest rates and extended repayment terms, making them suitable for significant investments like home purchases or business expansion. Understanding the differences in terms, costs, and repayment schedules helps borrowers choose the best option for their financial goals.

Table of Comparison

| Feature | Short-Term Loan | Long-Term Loan |

|---|---|---|

| Loan Duration | Up to 1 year | Over 1 year, typically 5-30 years |

| Interest Rates | Generally higher | Generally lower |

| Repayment Schedule | Frequent, shorter terms | Extended, flexible terms |

| Loan Amount | Smaller sums | Larger sums |

| Purpose | Immediate or urgent funding | Long-term investments or large purchases |

| Risk Level | Higher risk of default due to quick payoff | Lower default risk over time |

Understanding Short-Term Car Loans

Short-term car loans typically span from 12 to 36 months, offering lower interest rates and faster ownership compared to long-term loans. These loans reduce overall interest paid but require higher monthly payments, making them suitable for borrowers with steady income and strong credit profiles. Understanding the trade-offs in repayment duration, interest costs, and monthly affordability is crucial when choosing between short-term and long-term car financing options.

Key Features of Long-Term Car Loans

Long-term car loans typically span from 4 to 7 years, offering lower monthly payments compared to short-term loans due to the extended repayment period. These loans often come with higher total interest costs but provide greater financial flexibility, making them ideal for buyers seeking manageable monthly budgets. Lenders may require collateral, such as the vehicle itself, and credit score significantly influences interest rates and loan approval for long-term car financing.

Interest Rates: Short-Term vs Long-Term Loans

Short-term loans generally feature higher interest rates compared to long-term loans due to the increased risk and shorter repayment window for lenders. Long-term loans often offer lower interest rates as the extended repayment period lowers monthly payments and spreads out risk. Borrowers must evaluate interest rate differences alongside their financial goals to choose the optimal loan structure.

Monthly Payment Comparison

Short-term loans typically feature higher monthly payments due to the shorter repayment period, allowing borrowers to pay less interest overall. Long-term loans offer lower monthly payments by extending the repayment schedule, but result in higher total interest costs. Comparing monthly payments between short-term and long-term loans is essential for managing cash flow and budgeting effectively.

Total Loan Cost: Which is Cheaper?

Short-term loans typically have higher monthly payments but lower total loan costs due to reduced interest accumulation over a shorter period. Long-term loans spread payments over many years, resulting in lower monthly installments but higher overall interest expenses. Borrowers seeking to minimize total loan cost often prefer short-term loans despite the higher monthly burden.

Pros and Cons: Short-Term Loans

Short-term loans offer quick access to capital with lower total interest paid due to shorter repayment periods, making them ideal for immediate cash flow needs or emergency expenses. They typically have higher monthly payments and stricter qualification requirements, which can strain borrower finances and limit eligibility. The rapid repayment schedule reduces long-term debt risk but may not suit larger investments that require extended funding.

Pros and Cons: Long-Term Loans

Long-term loans offer lower monthly payments and fixed interest rates, providing financial stability and easier budgeting over extended periods. However, they often result in higher total interest costs and longer debt obligations, which can limit financial flexibility. Borrowers must consider their cash flow and long-term financial goals before committing to extended repayment terms.

Credit Score Impact

Short-term loans typically have a smaller impact on credit scores due to their shorter repayment periods and lower total interest paid, which can lead to quicker improvements if repaid on time. Long-term loans affect credit scores through prolonged debt exposure, increasing the risk of missed payments but potentially boosting credit mix and payment history over time. Maintaining timely payments on either loan type is crucial for positive credit score impact and overall financial health.

Flexibility and Repayment Options

Short-term loans offer higher flexibility with quicker repayment periods, suitable for immediate cash needs and quick debt clearance. Long-term loans provide extended repayment options, allowing lower monthly installments and better budget management for significant expenses. Choosing between them depends on financial goals, cash flow, and repayment capacity preferences.

Which Loan Type Is Best for You?

Choosing between a short-term loan and a long-term loan depends primarily on your financial goals and repayment capacity. Short-term loans offer faster approval and lower overall interest costs but require higher monthly payments, making them ideal for quick cash needs or small purchases. Long-term loans spread repayments over a longer period, reducing monthly payments and improving cash flow, which suits major expenses like home mortgages or business expansion.

Short-Term Loan vs Long-Term Loan Infographic

cardiffo.com

cardiffo.com