Gap insurance covers the difference between your auto loan balance and the actual cash value of your vehicle in case of total loss, preventing significant out-of-pocket expenses. Without gap insurance, you remain responsible for paying off the full loan amount even if your car is totaled or stolen, which can lead to financial strain. Choosing gap insurance provides peace of mind by protecting against depreciation gaps that standard insurance policies do not cover.

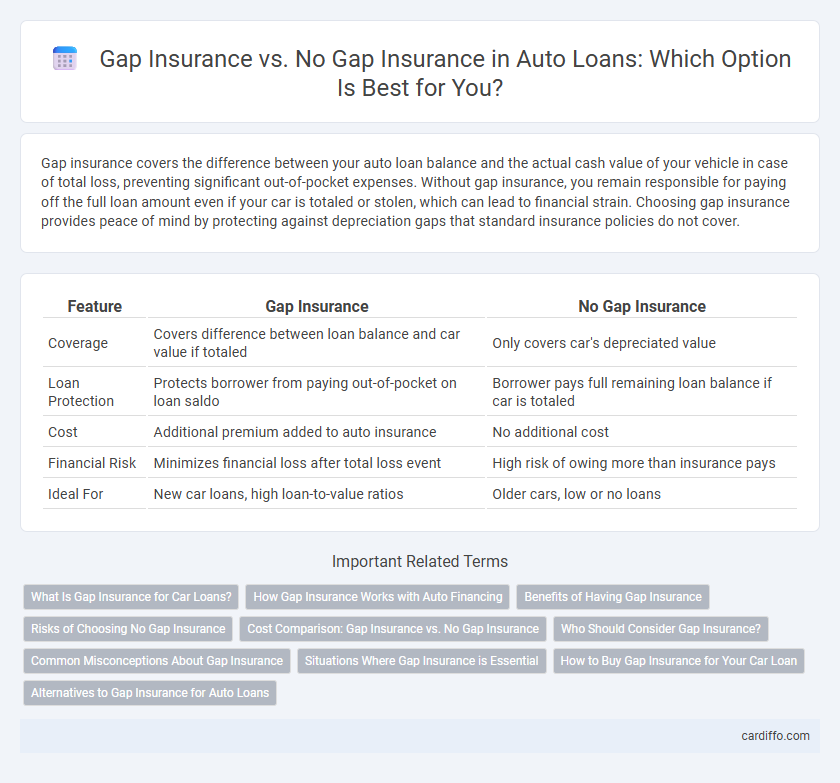

Table of Comparison

| Feature | Gap Insurance | No Gap Insurance |

|---|---|---|

| Coverage | Covers difference between loan balance and car value if totaled | Only covers car's depreciated value |

| Loan Protection | Protects borrower from paying out-of-pocket on loan saldo | Borrower pays full remaining loan balance if car is totaled |

| Cost | Additional premium added to auto insurance | No additional cost |

| Financial Risk | Minimizes financial loss after total loss event | High risk of owing more than insurance pays |

| Ideal For | New car loans, high loan-to-value ratios | Older cars, low or no loans |

What Is Gap Insurance for Car Loans?

Gap insurance for car loans covers the difference between the vehicle's actual cash value and the outstanding loan balance if the car is totaled or stolen. This insurance protects borrowers from financial liability when their auto loan exceeds the car's depreciated worth, ensuring they do not owe money on a vehicle they no longer possess. Without gap insurance, borrowers must pay the remaining loan balance out-of-pocket, which can result in significant financial strain.

How Gap Insurance Works with Auto Financing

Gap insurance covers the difference between your auto loan balance and the actual cash value of the vehicle if it's totaled or stolen, protecting borrowers from out-of-pocket expenses. Without gap insurance, standard auto insurance typically pays only the car's depreciated value, which can leave a substantial loan balance unpaid. This coverage is especially crucial for those with low down payments or extended loan terms, ensuring financial security in the event of total loss.

Benefits of Having Gap Insurance

Gap insurance covers the difference between a car's actual cash value and the remaining loan balance in case of total loss due to theft or accident, preventing out-of-pocket expenses. It safeguards borrowers from financial liability when depreciation outpaces loan payoff, ensuring the loan is fully covered. Without gap insurance, vehicle owners risk owing thousands on a totaled car, even after insurance payout.

Risks of Choosing No Gap Insurance

Choosing no gap insurance when financing a vehicle exposes borrowers to the risk of owing more than the car's depreciated value after a total loss or theft. This financial shortfall can lead to significant out-of-pocket expenses, as standard auto insurance policies typically cover only the current market value of the vehicle. Without gap insurance, borrowers face potential challenges in settling outstanding loan balances, increasing the likelihood of financial strain.

Cost Comparison: Gap Insurance vs. No Gap Insurance

Gap insurance typically costs between $20 and $40 per year, adding a relatively small expense to a loan compared to potentially thousands in out-of-pocket expenses if your vehicle is totaled and the loan balance exceeds the car's value. Without gap insurance, the borrower is responsible for paying the difference between the car's actual cash value and the remaining loan balance, which can result in significant financial loss. Considering the minimal annual cost of gap insurance versus the risk of large unexpected expenses, gap insurance offers substantial financial protection in loan agreements.

Who Should Consider Gap Insurance?

Gap insurance is essential for auto loan borrowers who owe more on their vehicle than its current market value, especially those with low down payments or long loan terms. Drivers who lease vehicles or frequently finance brand-new cars should also consider gap coverage to avoid out-of-pocket expenses if the vehicle is totaled or stolen. Without gap insurance, these individuals risk being responsible for the loan balance beyond the standard insurance payout.

Common Misconceptions About Gap Insurance

Many borrowers mistakenly believe that gap insurance automatically covers all financial shortfalls after a total loss, but it specifically covers the difference between the loan balance and the car's actual cash value. Another common misconception is that gap insurance is unnecessary if you have full coverage collision insurance; however, collision coverage only reimburses the vehicle's market value, not the remaining loan amount. Some also assume gap insurance is expensive or only beneficial for new cars, though costs are typically minimal and it can be crucial for used vehicle loans with high depreciation rates.

Situations Where Gap Insurance is Essential

Gap insurance is essential when financing or leasing a vehicle that depreciates quickly, as it covers the difference between the car's actual cash value and the outstanding loan balance if the vehicle is totaled. Borrowers with low down payments or long loan terms benefit most, since the amount owed often exceeds the depreciated value in the early years. Without gap insurance, owners risk owing money on a totaled car, leading to significant financial loss.

How to Buy Gap Insurance for Your Car Loan

When purchasing gap insurance for your car loan, start by checking if your lender or auto insurer offers this coverage, as it can often be bundled with your existing policy for convenience. Compare quotes from specialized gap insurance providers to ensure competitive pricing and coverage terms that protect against the vehicle's depreciation during loan repayment. Confirm the policy details, including the deductible and claim process, to avoid unexpected costs in case your car is totaled or stolen.

Alternatives to Gap Insurance for Auto Loans

Alternatives to gap insurance for auto loans include extended warranty coverage, which protects against major repair costs, and vehicle depreciation protection plans that cover the difference between loan balance and vehicle value. Loan payoff insurance is another option, ensuring outstanding loan amounts are covered in case of total loss or theft. These alternatives help borrowers mitigate financial risk without the need for traditional gap insurance policies.

Gap insurance vs No gap insurance Infographic

cardiffo.com

cardiffo.com