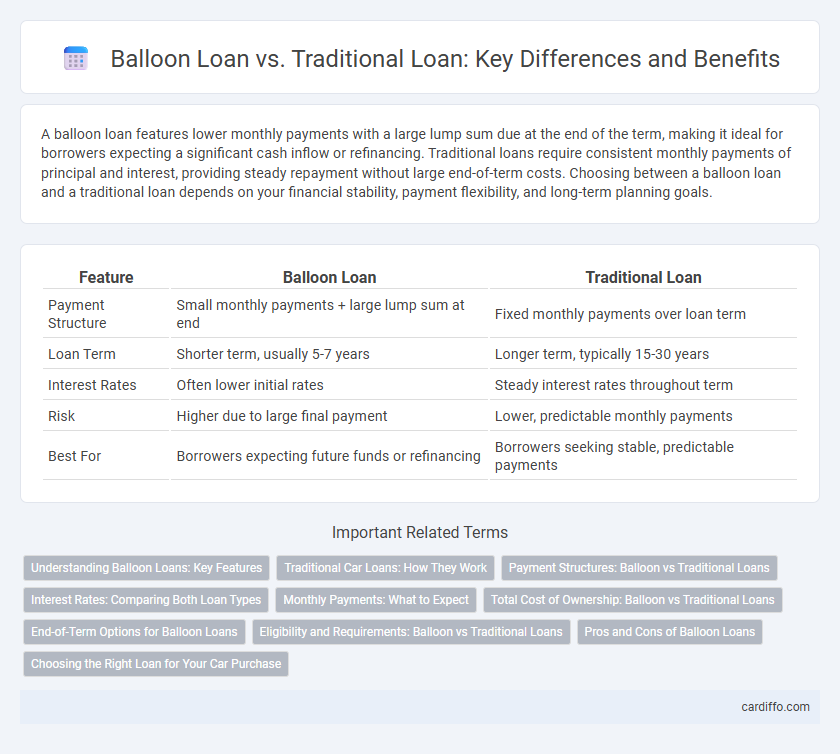

A balloon loan features lower monthly payments with a large lump sum due at the end of the term, making it ideal for borrowers expecting a significant cash inflow or refinancing. Traditional loans require consistent monthly payments of principal and interest, providing steady repayment without large end-of-term costs. Choosing between a balloon loan and a traditional loan depends on your financial stability, payment flexibility, and long-term planning goals.

Table of Comparison

| Feature | Balloon Loan | Traditional Loan |

|---|---|---|

| Payment Structure | Small monthly payments + large lump sum at end | Fixed monthly payments over loan term |

| Loan Term | Shorter term, usually 5-7 years | Longer term, typically 15-30 years |

| Interest Rates | Often lower initial rates | Steady interest rates throughout term |

| Risk | Higher due to large final payment | Lower, predictable monthly payments |

| Best For | Borrowers expecting future funds or refinancing | Borrowers seeking stable, predictable payments |

Understanding Balloon Loans: Key Features

Balloon loans feature smaller monthly payments with a large lump sum due at the end of the term, differentiating them from traditional loans that have evenly amortized payments throughout. These loans often have shorter terms, typically 5 to 7 years, and are commonly used in real estate financing or business loans where borrowers anticipate refinancing or selling before the balloon payment is due. Understanding the balloon payment structure and potential risks, such as refinancing challenges or market fluctuations, is crucial for borrowers considering this loan type.

Traditional Car Loans: How They Work

Traditional car loans involve borrowing a fixed amount of money to purchase a vehicle, with monthly payments spread over a set term typically ranging from 36 to 72 months. Interest rates are generally fixed, and each payment reduces both the principal and interest until the loan is fully repaid. This structure provides predictable expenses and gradual equity buildup, contrasting with balloon loans where a large payment is deferred to the end of the term.

Payment Structures: Balloon vs Traditional Loans

Balloon loans feature lower monthly payments with a large lump sum due at the end of the term, ideal for borrowers expecting increased future income or refinancing. Traditional loans require consistent monthly payments that cover both principal and interest, ensuring gradual loan payoff over time. Understanding these payment structures helps borrowers align loan choice with cash flow and financial goals.

Interest Rates: Comparing Both Loan Types

Balloon loans typically feature lower initial interest rates compared to traditional loans, making them attractive for short-term financing. Traditional loans generally have fixed or variable interest rates spread evenly over the loan term, resulting in consistent monthly payments. Borrowers choosing balloon loans must be prepared for a large lump-sum payment at the end, which can affect long-term cost due to interest accrual differences.

Monthly Payments: What to Expect

Balloon loans feature significantly lower monthly payments compared to traditional loans because only interest or a portion of the principal is paid during the term, culminating in a large lump sum balloon payment at the end. Traditional loans require consistent monthly payments that cover both principal and interest, leading to higher but predictable monthly costs. Borrowers opting for balloon loans should prepare for the substantial final payment, while those choosing traditional loans benefit from steady amortization and budget stability.

Total Cost of Ownership: Balloon vs Traditional Loans

Balloon loans typically offer lower initial monthly payments but require a large lump-sum payment at the end of the term, often increasing the total cost of ownership due to interest accumulation and potential refinancing fees. Traditional loans spread payments evenly over the loan period, resulting in predictable monthly costs and generally lower overall interest expenses. Evaluating the total cost of ownership for balloon versus traditional loans involves considering the borrower's ability to manage the final balloon payment versus steady, consistent installments.

End-of-Term Options for Balloon Loans

Balloon loans require a large payment at the end of the term, unlike traditional loans which have consistent payments throughout. Borrowers with balloon loans often face options such as refinancing the balloon payment, selling the asset, or paying off the lump sum if funds are available. Understanding these end-of-term options is crucial for managing financial risk and avoiding default.

Eligibility and Requirements: Balloon vs Traditional Loans

Balloon loans often require borrowers to have a stronger credit profile and proof of income due to the significant lump-sum payment at the end of the term, making eligibility stricter compared to traditional loans. Traditional loans typically have more straightforward requirements, such as steady income, a reasonable credit score, and a manageable debt-to-income ratio, enabling a wider range of borrowers to qualify. Lenders assess risk differently, with balloon loans demanding more robust financial documentation and often higher down payments to mitigate the final large payment risk.

Pros and Cons of Balloon Loans

Balloon loans offer lower initial monthly payments due to smaller principal repayments, making them attractive for borrowers expecting increased income or refinancing opportunities before the large balloon payment is due. However, the significant lump-sum payment at the end poses a risk if the borrower cannot secure refinancing or accumulate enough funds, potentially leading to default or forced sale of the asset. Compared to traditional loans with evenly amortized payments, balloon loans provide short-term affordability but require careful financial planning to manage the substantial final payment.

Choosing the Right Loan for Your Car Purchase

A balloon loan offers lower monthly payments by deferring a large portion of the principal to the final payment, making it ideal for buyers anticipating increased income or planning to refinance. Traditional loans provide consistent monthly payments over the term, suitable for those seeking predictable budgeting and full loan payoff without a lump sum at the end. Evaluating your financial stability, repayment capacity, and long-term goals is essential to select the best loan for your car purchase.

Balloon Loan vs Traditional Loan Infographic

cardiffo.com

cardiffo.com