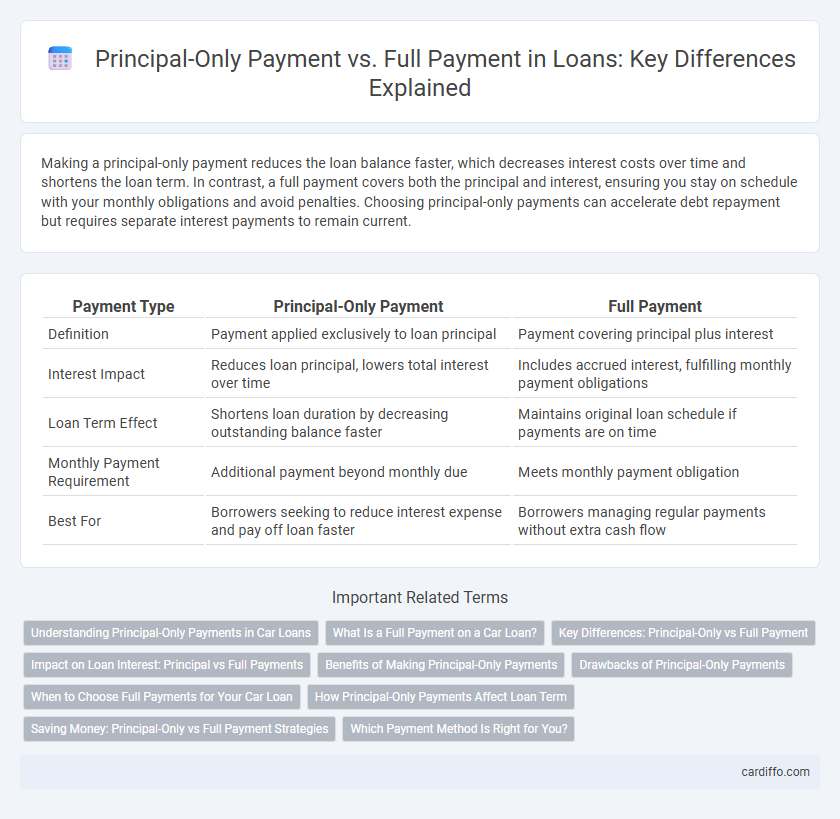

Making a principal-only payment reduces the loan balance faster, which decreases interest costs over time and shortens the loan term. In contrast, a full payment covers both the principal and interest, ensuring you stay on schedule with your monthly obligations and avoid penalties. Choosing principal-only payments can accelerate debt repayment but requires separate interest payments to remain current.

Table of Comparison

| Payment Type | Principal-Only Payment | Full Payment |

|---|---|---|

| Definition | Payment applied exclusively to loan principal | Payment covering principal plus interest |

| Interest Impact | Reduces loan principal, lowers total interest over time | Includes accrued interest, fulfilling monthly payment obligations |

| Loan Term Effect | Shortens loan duration by decreasing outstanding balance faster | Maintains original loan schedule if payments are on time |

| Monthly Payment Requirement | Additional payment beyond monthly due | Meets monthly payment obligation |

| Best For | Borrowers seeking to reduce interest expense and pay off loan faster | Borrowers managing regular payments without extra cash flow |

Understanding Principal-Only Payments in Car Loans

Principal-only payments in car loans directly reduce the outstanding loan balance without affecting the interest accrued on the remaining term, allowing borrowers to pay off the loan faster and decrease total interest paid. Unlike full payments, which cover both principal and interest, principal-only payments specifically target lowering the loan's principal. Making principal-only payments can significantly reduce the loan term, save money on interest payments, and improve equity in the vehicle.

What Is a Full Payment on a Car Loan?

A full payment on a car loan refers to paying off the entire outstanding balance, including principal, interest, and any applicable fees, in a single transaction. This eliminates future interest accrual and closes the loan account, potentially improving credit score by reducing debt-to-income ratio. Making full payments can save money compared to principal-only payments, which only reduce the loan balance without covering accruing interest.

Key Differences: Principal-Only vs Full Payment

Principal-only payments reduce the loan balance faster by applying funds exclusively to the principal, lowering interest over time and shortening loan duration. Full payments cover both principal and interest, maintaining the agreed amortization schedule and keeping monthly payments consistent. Choosing principal-only payments can lead to significant interest savings, while full payments ensure predictable financial planning over the loan term.

Impact on Loan Interest: Principal vs Full Payments

Principal-only payments reduce the loan balance faster, resulting in lower overall interest charges by decreasing the amount on which interest accrues. Full payments cover both principal and interest, maintaining the agreed amortization schedule but generating higher interest costs over time compared to principal-only payments. Prioritizing principal-only payments accelerates loan payoff and maximizes interest savings.

Benefits of Making Principal-Only Payments

Making principal-only payments reduces the total loan balance faster, decreasing the overall interest paid throughout the loan term. This accelerates the loan payoff date, potentially saving thousands of dollars in interest costs. By lowering the principal, borrowers improve equity in their property and enhance financial flexibility.

Drawbacks of Principal-Only Payments

Principal-only payments reduce the loan balance but do not cover accrued interest, which can lead to continued interest accumulation and slower overall payoff. Borrowers may face higher total interest costs and extended loan terms if they consistently make principal-only payments. Additionally, such payments may delay the benefits of reducing monthly interest expenses compared to full payments that cover both principal and interest.

When to Choose Full Payments for Your Car Loan

Choosing full payments for your car loan is ideal when aiming to reduce overall interest costs and shorten the loan term, as full payments cover both principal and interest simultaneously. This strategy accelerates equity buildup in the vehicle and minimizes the total loan balance faster than principal-only payments. Full payments also prevent the accrual of interest on deferred amounts, providing better control over your debt and improving credit standing.

How Principal-Only Payments Affect Loan Term

Principal-only payments directly reduce the outstanding loan balance, accelerating the payoff timeline and decreasing total interest paid over the life of the loan. By applying extra funds exclusively to the principal, borrowers shorten the loan term without increasing monthly payments. This strategy effectively lowers long-term debt obligations and enhances financial flexibility.

Saving Money: Principal-Only vs Full Payment Strategies

Making principal-only payments on a loan reduces the outstanding balance faster, lowering the total interest paid over the loan term and accelerating debt repayment. Full payments include both principal and interest, maintaining the original amortization schedule but result in higher cumulative interest costs compared to principal-only strategies. Opting for principal-only payments saves money by minimizing interest accrual, which directly impacts overall loan expenses and payoff speed.

Which Payment Method Is Right for You?

Choosing between principal-only payments and full payments depends on your financial goals and loan terms. Principal-only payments reduce the loan balance faster, lowering interest costs and shortening the loan duration. Full payments cover both principal and interest, maintaining the standard repayment schedule and avoiding penalties for underpayment.

Principal-Only Payment vs Full Payment Infographic

cardiffo.com

cardiffo.com