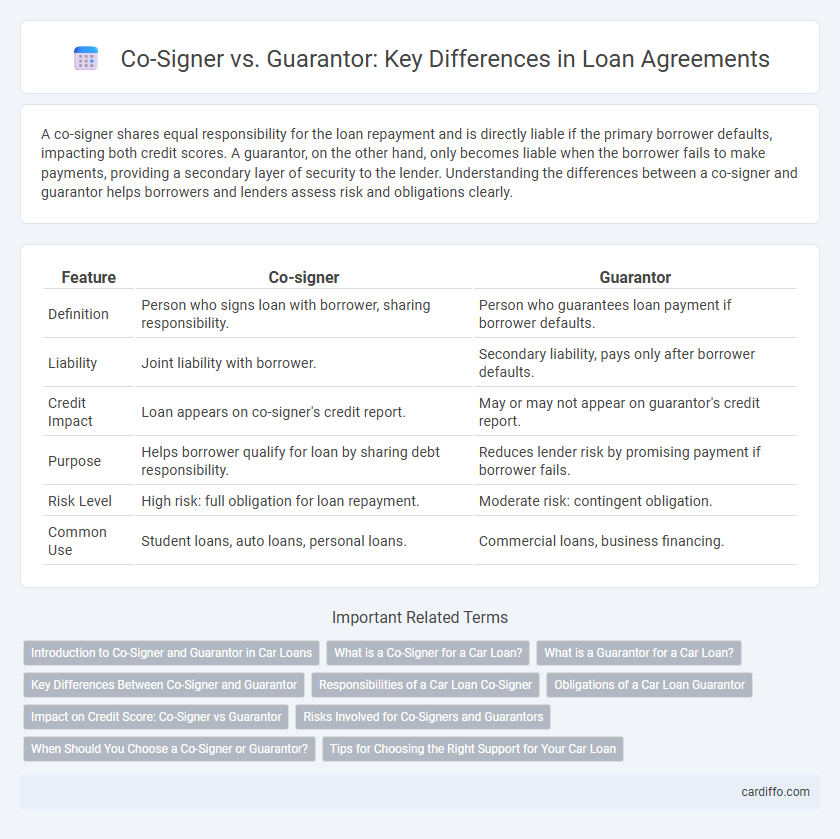

A co-signer shares equal responsibility for the loan repayment and is directly liable if the primary borrower defaults, impacting both credit scores. A guarantor, on the other hand, only becomes liable when the borrower fails to make payments, providing a secondary layer of security to the lender. Understanding the differences between a co-signer and guarantor helps borrowers and lenders assess risk and obligations clearly.

Table of Comparison

| Feature | Co-signer | Guarantor |

|---|---|---|

| Definition | Person who signs loan with borrower, sharing responsibility. | Person who guarantees loan payment if borrower defaults. |

| Liability | Joint liability with borrower. | Secondary liability, pays only after borrower defaults. |

| Credit Impact | Loan appears on co-signer's credit report. | May or may not appear on guarantor's credit report. |

| Purpose | Helps borrower qualify for loan by sharing debt responsibility. | Reduces lender risk by promising payment if borrower fails. |

| Risk Level | High risk: full obligation for loan repayment. | Moderate risk: contingent obligation. |

| Common Use | Student loans, auto loans, personal loans. | Commercial loans, business financing. |

Introduction to Co-Signer and Guarantor in Car Loans

In car loans, a co-signer is an individual who agrees to share equal responsibility for the loan repayment alongside the primary borrower, directly impacting both parties' credit scores. A guarantor, however, only assumes liability if the primary borrower defaults, acting as a secondary level of security for the lender. Understanding the distinction between co-signers and guarantors is critical for borrowers seeking approval in cases of limited or poor credit history.

What is a Co-Signer for a Car Loan?

A co-signer for a car loan is an individual who agrees to share responsibility for the loan repayment if the primary borrower defaults, significantly increasing the likelihood of loan approval. Unlike a guarantor, a co-signer is equally liable and their credit history directly impacts the loan terms and interest rates. This role is crucial for borrowers with limited credit history or poor credit scores seeking better financing options.

What is a Guarantor for a Car Loan?

A guarantor for a car loan is an individual who agrees to repay the loan if the primary borrower defaults, providing additional security to the lender. Unlike a co-signer, the guarantor's obligation typically activates only after the borrower fails to make payments, reducing the lender's risk. This role is crucial for borrowers with low credit scores or insufficient credit history, as it increases their chances of approval.

Key Differences Between Co-Signer and Guarantor

A co-signer shares equal responsibility with the primary borrower for repaying the loan, making their credit directly affected by any missed payments. A guarantor, however, only assumes liability if the borrower defaults, acting as a backup payer rather than an initial co-debtor. The co-signer's involvement appears on the credit report from the start, while the guarantor's impact triggers only upon borrower default.

Responsibilities of a Car Loan Co-Signer

A car loan co-signer shares equal responsibility for the loan repayment, meaning they are legally obligated to pay the debt if the primary borrower defaults. Unlike a guarantor who only pays after the lender exhausts all options with the borrower, the co-signer's credit score and financial standing are immediately impacted by the loan's status. Co-signers often help borrowers with less-than-perfect credit qualify for car loans by reducing lender risk through shared liability.

Obligations of a Car Loan Guarantor

A car loan guarantor is legally obligated to repay the loan if the primary borrower defaults, ensuring the lender receives payment. Unlike a co-signer, the guarantor's responsibility typically activates only after the lender exhausts efforts to collect from the borrower. This role involves significant financial risk, as the guarantor's credit score and assets may be impacted if the borrower fails to meet loan obligations.

Impact on Credit Score: Co-Signer vs Guarantor

A co-signer's credit score is directly impacted by the loan, as missed payments or defaults appear on their credit report, increasing their financial liability. In contrast, a guarantor's credit score is typically unaffected unless the primary borrower defaults and the guarantor is required to fulfill the loan obligations. Lenders view co-signers as equally responsible, which can influence their credit utilization and debt-to-income ratio more significantly than guarantors.

Risks Involved for Co-Signers and Guarantors

Co-signers face significant risks as they become equally responsible for loan repayment, potentially damaging their credit score if the borrower defaults. Guarantors, while often called upon only after exhaustive collection attempts, still risk legal action and financial liability if the primary borrower fails to pay. Both roles carry the risk of strained personal relationships and long-term financial consequences due to loan defaults.

When Should You Choose a Co-Signer or Guarantor?

Choose a co-signer when the primary borrower has insufficient credit history or income, as the co-signer shares equal responsibility for the loan repayment and can help secure approval. Opt for a guarantor if the borrower needs additional assurance for the lender without immediate repayment obligations, since the guarantor only pays if the borrower defaults. Evaluating creditworthiness and risk tolerance determines the best choice between a co-signer and a guarantor for loan approval.

Tips for Choosing the Right Support for Your Car Loan

Evaluate your credit profile carefully before deciding between a co-signer or guarantor for your car loan, as a co-signer shares full responsibility while a guarantor only pays when the primary borrower defaults. Consider the financial stability and willingness of the supporter to assume potential risks, ensuring they understand the loan terms thoroughly. Opt for a co-signer if you need stronger loan approval leverage and a guarantor if you want limited liability support with less frequent involvement.

Co-signer vs Guarantor Infographic

cardiffo.com

cardiffo.com