A Trade-In Loan allows borrowers to use the value of their current vehicle as part of the down payment, reducing the overall loan amount and monthly payments. In contrast, a Cash Down Loan requires an upfront payment in cash, lowering the financed amount but requiring immediate out-of-pocket funds. Choosing between these options depends on available assets, financial preferences, and plans for the existing vehicle.

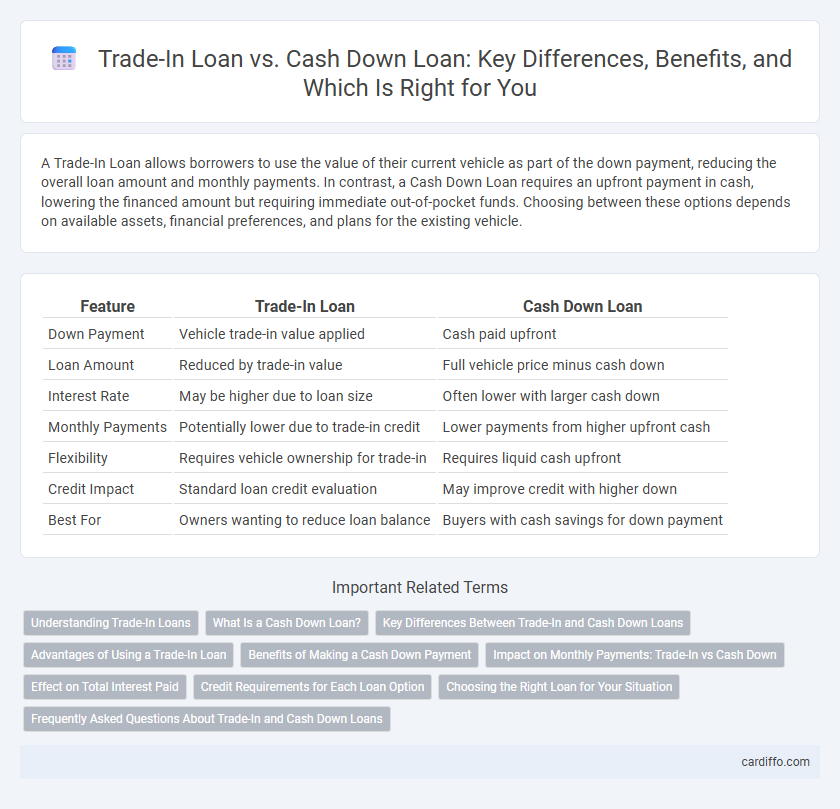

Table of Comparison

| Feature | Trade-In Loan | Cash Down Loan |

|---|---|---|

| Down Payment | Vehicle trade-in value applied | Cash paid upfront |

| Loan Amount | Reduced by trade-in value | Full vehicle price minus cash down |

| Interest Rate | May be higher due to loan size | Often lower with larger cash down |

| Monthly Payments | Potentially lower due to trade-in credit | Lower payments from higher upfront cash |

| Flexibility | Requires vehicle ownership for trade-in | Requires liquid cash upfront |

| Credit Impact | Standard loan credit evaluation | May improve credit with higher down |

| Best For | Owners wanting to reduce loan balance | Buyers with cash savings for down payment |

Understanding Trade-In Loans

Trade-in loans allow borrowers to use the value of their current vehicle as partial payment toward a new loan, effectively reducing the loan amount and monthly payments. This financing option simplifies the trade-in process by rolling the outstanding balance of the old loan into the new one, providing seamless transition without needing additional cash upfront. Understanding trade-in loans enables borrowers to leverage their existing asset's equity while managing loan terms more flexibly compared to a traditional cash down loan.

What Is a Cash Down Loan?

A cash down loan requires the borrower to make an upfront payment using their own funds, reducing the total amount financed and often lowering monthly payments. This type of loan can lead to better interest rates and less overall debt compared to a trade-in loan, which uses the value of a traded-in asset as part of the down payment. Choosing a cash down loan helps build immediate equity and improves loan approval chances by decreasing the lender's risk.

Key Differences Between Trade-In and Cash Down Loans

Trade-In Loans use the value of a current vehicle as partial payment towards a new loan, reducing the principal amount financed, while Cash Down Loans require an upfront cash payment to lower the loan balance. Trade-In Loans streamline the car buying process by combining vehicle sale and loan financing, whereas Cash Down Loans demand liquidity from the borrower at loan initiation. The choice between these loans impacts monthly payments, interest rates, and overall loan term based on the initial equity applied.

Advantages of Using a Trade-In Loan

A Trade-In Loan allows borrowers to reduce the loan amount by applying the trade-in value of their current vehicle, resulting in lower monthly payments and less interest paid over time. This loan option simplifies the buying process by combining the trade-in transaction and financing into one seamless deal, saving time and paperwork. It also helps borrowers leverage the equity of their existing vehicle, making it easier to afford newer or more expensive models without a large upfront cash payment.

Benefits of Making a Cash Down Payment

Making a cash down payment on a loan reduces the principal amount borrowed, leading to lower monthly payments and decreased interest over the loan term. It improves loan approval chances by demonstrating financial stability and reducing lender risk. A sizable down payment also provides immediate equity in the purchased asset, enhancing financial security.

Impact on Monthly Payments: Trade-In vs Cash Down

A Trade-In Loan reduces the principal balance by applying the vehicle's trade-in value, lowering monthly payments more effectively than a Cash Down Loan, which requires upfront cash without directly offsetting the loan amount. Trade-In Loans often result in smaller monthly installments due to the immediate reduction in financed amount, whereas Cash Down Loans decrease the loan principal but may not impact monthly payments as significantly if the down payment is minimal. Evaluating vehicle trade-in value alongside cash available for a down payment helps borrowers optimize monthly payment affordability and loan terms.

Effect on Total Interest Paid

Trade-In Loans typically reduce the total interest paid by lowering the principal amount financed through the vehicle's trade-in value, which directly decreases the loan balance. Cash Down Loans also lower total interest costs by applying an upfront payment to reduce the loan principal, but the immediate cash outlay impacts borrower liquidity. Comparing both, Trade-In Loans optimize interest savings without requiring extra cash, whereas Cash Down Loans rely on available funds to minimize interest charges.

Credit Requirements for Each Loan Option

Trade-In Loans often have more flexible credit requirements since the value of the traded vehicle can offset lower credit scores, making approval easier for buyers with less-than-perfect credit. Cash Down Loans typically demand stronger credit profiles because lenders rely more heavily on the borrower's financial history and upfront payment to mitigate risk. Understanding these differences helps borrowers select the loan option that aligns best with their credit standing and financial situation.

Choosing the Right Loan for Your Situation

Trade-In Loans leverage the value of your current vehicle as part of the down payment, reducing the amount you need to finance and potentially improving loan approval chances. Cash Down Loans require an upfront payment, lowering your principal balance and interest over the loan term for those with available savings. Assess your financial stability, vehicle equity, and monthly budget to determine which loan structure aligns best with your repayment ability and long-term goals.

Frequently Asked Questions About Trade-In and Cash Down Loans

Trade-in loans allow borrowers to apply the value of their current vehicle as a down payment, reducing the overall loan amount and monthly payments. Cash down loans require an upfront cash payment, often leading to lower interest rates and shorter loan terms since the lender's risk is reduced. Common questions typically address eligibility criteria, impact on credit scores, and whether the trade-in value fully covers the down payment in each loan type.

Trade-In Loan vs Cash Down Loan Infographic

cardiffo.com

cardiffo.com