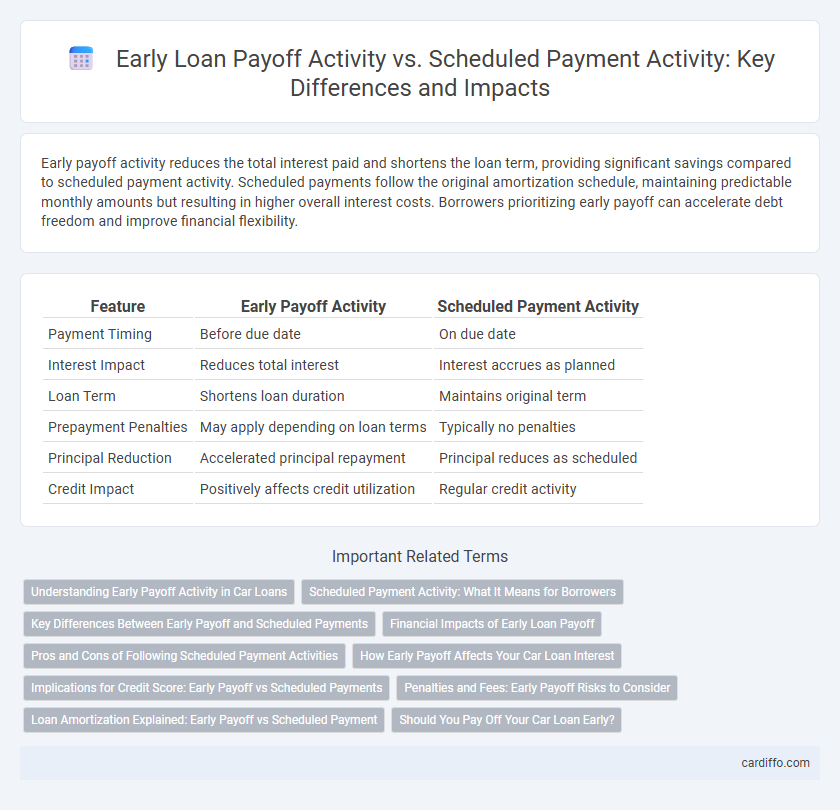

Early payoff activity reduces the total interest paid and shortens the loan term, providing significant savings compared to scheduled payment activity. Scheduled payments follow the original amortization schedule, maintaining predictable monthly amounts but resulting in higher overall interest costs. Borrowers prioritizing early payoff can accelerate debt freedom and improve financial flexibility.

Table of Comparison

| Feature | Early Payoff Activity | Scheduled Payment Activity |

|---|---|---|

| Payment Timing | Before due date | On due date |

| Interest Impact | Reduces total interest | Interest accrues as planned |

| Loan Term | Shortens loan duration | Maintains original term |

| Prepayment Penalties | May apply depending on loan terms | Typically no penalties |

| Principal Reduction | Accelerated principal repayment | Principal reduces as scheduled |

| Credit Impact | Positively affects credit utilization | Regular credit activity |

Understanding Early Payoff Activity in Car Loans

Early payoff activity in car loans refers to borrowers paying off their loan balances before the scheduled due dates, which can reduce overall interest costs and loan tenure. Tracking early payoff trends helps lenders assess borrower behavior, manage cash flow, and adjust risk models effectively. Understanding the distinction between early payoff activity and scheduled payment activity allows for improved loan servicing strategies and enhanced customer relationship management.

Scheduled Payment Activity: What It Means for Borrowers

Scheduled Payment Activity represents the regular, pre-determined installments borrowers commit to for repaying a loan over time. This activity ensures consistent cash flow management and helps borrowers avoid penalties or negative credit impacts by meeting set due dates. Understanding scheduled payments allows borrowers to plan their finances effectively and maintain a positive credit history throughout the loan term.

Key Differences Between Early Payoff and Scheduled Payments

Early payoff activity involves repaying the loan principal before the due date, reducing overall interest and shortening the loan term, whereas scheduled payment activity follows the predetermined payment schedule without altering the loan duration. Early payoff transactions often require payoff statements and may include prepayment penalties, while scheduled payments are typically fixed amounts outlined in the loan agreement. Understanding these distinctions is crucial for borrowers aiming to manage their loan costs and timelines effectively.

Financial Impacts of Early Loan Payoff

Early payoff activity reduces the total interest paid over the life of the loan by shortening the principal balance timeline, resulting in significant cost savings for borrowers. Scheduled payment activity adheres to the original amortization schedule, maintaining predictable cash flow but accruing higher interest costs. Financial impacts of early loan payoff include improved credit utilization rates and increased financial flexibility, allowing borrowers to allocate funds toward other investments or obligations.

Pros and Cons of Following Scheduled Payment Activities

Following scheduled payment activities ensures consistent credit score improvement and avoids prepayment penalties often associated with early payoff activity. It maintains predictable cash flow management for borrowers and lenders but prolongs interest costs over the loan term. Scheduled payments support financial stability yet may delay debt freedom compared to early payoffs.

How Early Payoff Affects Your Car Loan Interest

Paying off your car loan early reduces the total interest paid by shortening the loan term and decreasing the number of future interest accruals. Early payoff activity accelerates principal repayment, which limits the lender's ability to charge interest on the outstanding balance over time. This contrasts with scheduled payment activity, where interest accumulates according to the original loan amortization schedule.

Implications for Credit Score: Early Payoff vs Scheduled Payments

Early payoff activity can positively impact a credit score by reducing overall debt faster and demonstrating responsible repayment behavior, which lenders favor. Scheduled payment activity shows consistent on-time payments that build a reliable credit history, crucial for maintaining or improving credit scores. However, early payoffs may temporarily lower credit mix or account age, requiring careful management to avoid unintended credit score fluctuations.

Penalties and Fees: Early Payoff Risks to Consider

Early payoff activity can trigger specific penalties and fees that borrowers often overlook, increasing the overall loan cost despite reducing interest expenses. Lenders may impose prepayment penalties designed to recoup lost interest revenue, making early payoff less financially advantageous in certain loan agreements. Understanding these potential fees and their impact on the loan payoff schedule is essential for borrowers aiming to avoid unexpected charges.

Loan Amortization Explained: Early Payoff vs Scheduled Payment

Loan amortization schedules outline how each payment breaks down into principal and interest, with scheduled payments spread evenly over the loan term to gradually reduce the balance. Early payoff activity accelerates the reduction of the principal, resulting in fewer total interest payments and a shortened loan term. Understanding the difference between early payoff and scheduled payments helps borrowers optimize interest savings and manage loan duration effectively.

Should You Pay Off Your Car Loan Early?

Paying off your car loan early can save you money on interest and improve your credit utilization ratio, boosting your credit score. Early payoff activity reduces the total interest expense compared to scheduled payment activity, which follows the loan amortization timeline. Evaluate prepayment penalties and your financial goals to determine if accelerating your car loan payments aligns with your overall financial strategy.

Early Payoff Activity vs Scheduled Payment Activity Infographic

cardiffo.com

cardiffo.com