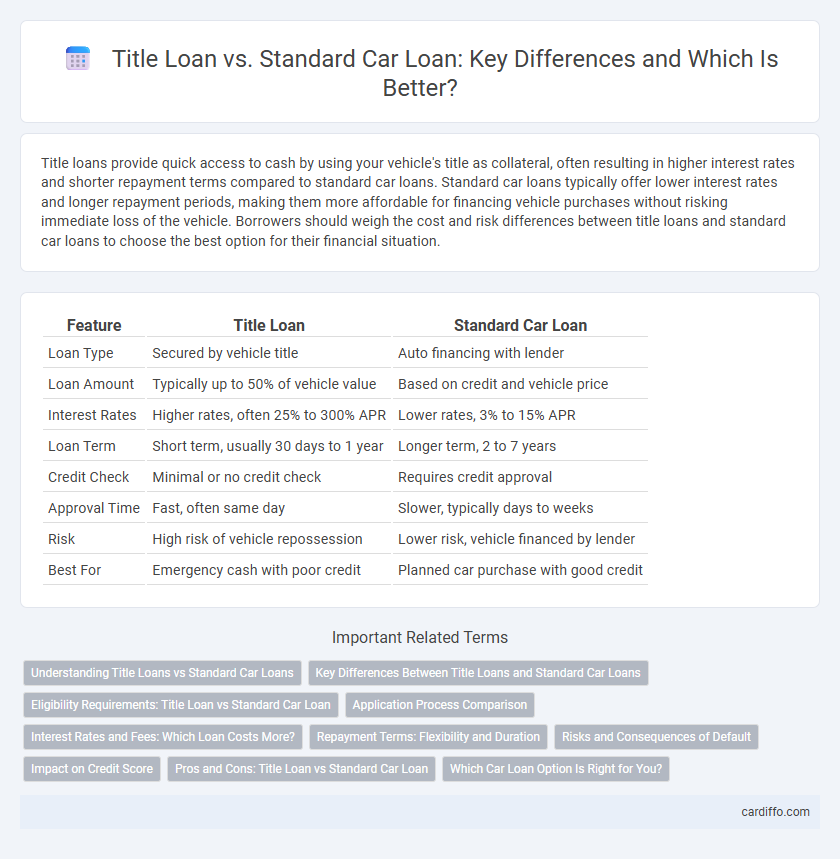

Title loans provide quick access to cash by using your vehicle's title as collateral, often resulting in higher interest rates and shorter repayment terms compared to standard car loans. Standard car loans typically offer lower interest rates and longer repayment periods, making them more affordable for financing vehicle purchases without risking immediate loss of the vehicle. Borrowers should weigh the cost and risk differences between title loans and standard car loans to choose the best option for their financial situation.

Table of Comparison

| Feature | Title Loan | Standard Car Loan |

|---|---|---|

| Loan Type | Secured by vehicle title | Auto financing with lender |

| Loan Amount | Typically up to 50% of vehicle value | Based on credit and vehicle price |

| Interest Rates | Higher rates, often 25% to 300% APR | Lower rates, 3% to 15% APR |

| Loan Term | Short term, usually 30 days to 1 year | Longer term, 2 to 7 years |

| Credit Check | Minimal or no credit check | Requires credit approval |

| Approval Time | Fast, often same day | Slower, typically days to weeks |

| Risk | High risk of vehicle repossession | Lower risk, vehicle financed by lender |

| Best For | Emergency cash with poor credit | Planned car purchase with good credit |

Understanding Title Loans vs Standard Car Loans

Title loans use the borrower's vehicle title as collateral, typically offering faster approval but higher interest rates and shorter repayment terms than standard car loans. Standard car loans are unsecured or secured by the vehicle itself, feature lower interest rates, and longer repayment periods, making them a more affordable financing option for purchasing or refinancing a car. Borrowers should weigh the quick access and risk of repossession with title loans against the cost-effectiveness and credit benefits of standard car loans.

Key Differences Between Title Loans and Standard Car Loans

Title loans use vehicle ownership as collateral, often allowing faster approval but at higher interest rates compared to standard car loans. Standard car loans typically involve fixed terms, lower interest rates, and require credit checks, making them more accessible for borrowers with good credit. Title loans pose increased risk due to potential vehicle repossession, whereas standard loans focus on creditworthiness and long-term repayment plans.

Eligibility Requirements: Title Loan vs Standard Car Loan

Title loans require borrowers to own their vehicle outright with a clear title, often allowing approval despite poor credit, making them accessible to individuals with low credit scores or unstable income. Standard car loans typically demand a higher credit score, steady income verification, and proof of residency, reflecting stricter eligibility to mitigate lender risk. While title loans prioritize vehicle ownership as collateral, standard auto loans emphasize overall financial stability and creditworthiness.

Application Process Comparison

Title loans require the borrower to provide the vehicle title as collateral, enabling faster approval with minimal credit checks, often within hours. Standard car loans involve a more detailed application process, including credit evaluation, income verification, and loan underwriting, which can take several days to finalize. Title loans are typically more accessible for individuals with poor credit but come with higher interest rates and shorter repayment terms compared to standard car loans.

Interest Rates and Fees: Which Loan Costs More?

Title loans typically carry higher interest rates, often ranging from 25% to 300% APR, compared to standard car loans which usually have rates between 3% and 7% APR for borrowers with good credit. Fees for title loans can include origination fees, late payment penalties, and repossession charges, significantly increasing the overall cost. Standard car loans generally have lower and more transparent fees, making them less expensive over the loan term despite sometimes longer repayment periods.

Repayment Terms: Flexibility and Duration

Title loans typically offer shorter repayment durations ranging from 30 days to a few months with less flexibility, often requiring a lump-sum payment or higher monthly installments. Standard car loans usually provide longer repayment terms spanning 36 to 72 months, allowing more manageable monthly payments and greater flexibility in adjusting schedules or refinancing. Borrowers seeking extended repayment periods and predictable terms generally prefer standard car loans over the rigid and brief timeline of title loans.

Risks and Consequences of Default

Title loans carry higher risks due to steep interest rates and the immediate threat of vehicle repossession if repayments default, often leading to loss of transportation and credit damage. Standard car loans typically offer structured repayment plans with lower interest, but missing payments still results in repossession and long-term credit score decline. Defaulting on either loan type can cause severe financial stress, but title loans present quicker and more aggressive consequences.

Impact on Credit Score

Title loans typically have a higher risk profile and shorter repayment terms, which can lead to rapid credit score fluctuations if payments are missed. Standard car loans often feature longer terms and more structured payment plans, providing a more predictable impact on credit scores through consistent on-time payments. Lenders report activity on both loan types to credit bureaus, but timely repayment on standard car loans generally contributes more positively to long-term credit health.

Pros and Cons: Title Loan vs Standard Car Loan

Title loans offer quick cash by using the vehicle's title as collateral but come with high interest rates and risk of repossession. Standard car loans provide lower interest rates and longer repayment terms but require good credit and longer approval times. Borrowers should weigh immediate cash needs against potential financial strain and credit impact when choosing between title loans and standard car loans.

Which Car Loan Option Is Right for You?

Title loans offer quick access to cash using your vehicle's title as collateral but come with higher interest rates and shorter repayment terms compared to standard car loans. Standard car loans typically provide lower interest rates and longer repayment periods, making them more affordable for buyers with good credit scores. Choosing the right option depends on your credit situation, urgency of funds, and ability to meet repayment terms without risking vehicle repossession.

Title Loan vs Standard Car Loan Infographic

cardiffo.com

cardiffo.com