Personal Contract Purchase (PCP) offers lower monthly payments and a flexible option to buy, return, or trade your vehicle at the end of the term, making it ideal for those who prefer changing cars frequently. Car loans provide full ownership after repayment with higher monthly installments but no restrictions on mileage or wear and tear, suited for long-term car ownership. Choosing between PCP and a car loan depends on your budget, driving habits, and preference for ownership versus flexibility.

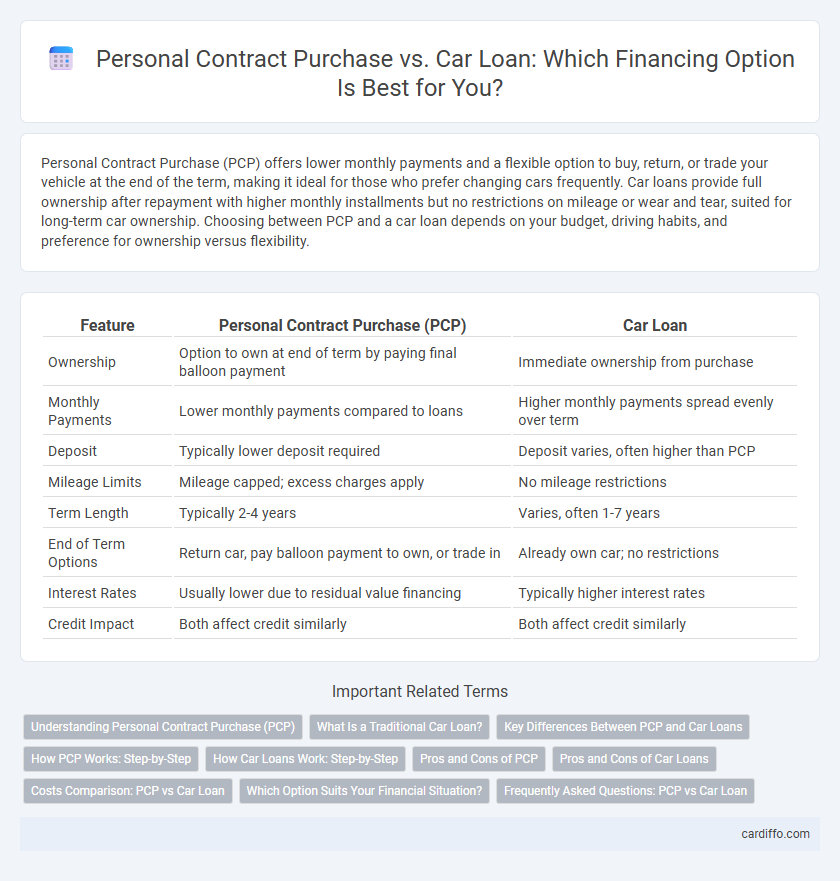

Table of Comparison

| Feature | Personal Contract Purchase (PCP) | Car Loan |

|---|---|---|

| Ownership | Option to own at end of term by paying final balloon payment | Immediate ownership from purchase |

| Monthly Payments | Lower monthly payments compared to loans | Higher monthly payments spread evenly over term |

| Deposit | Typically lower deposit required | Deposit varies, often higher than PCP |

| Mileage Limits | Mileage capped; excess charges apply | No mileage restrictions |

| Term Length | Typically 2-4 years | Varies, often 1-7 years |

| End of Term Options | Return car, pay balloon payment to own, or trade in | Already own car; no restrictions |

| Interest Rates | Usually lower due to residual value financing | Typically higher interest rates |

| Credit Impact | Both affect credit similarly | Both affect credit similarly |

Understanding Personal Contract Purchase (PCP)

Personal Contract Purchase (PCP) offers lower monthly payments compared to a traditional car loan by allowing borrowers to pay a deposit, followed by fixed monthly instalments, and a final balloon payment if they choose to keep the vehicle. PCP agreements typically last between two to four years, after which customers can return the car, make the final payment to own it, or trade it in for a new model. This flexible ownership model appeals to drivers seeking lower short-term costs and the option to upgrade vehicles regularly while managing depreciation risk.

What Is a Traditional Car Loan?

A traditional car loan is a financing option where the borrower takes a fixed-term loan to purchase a vehicle, repaying the principal and interest over monthly installments. The borrower owns the car outright once all payments are completed, allowing flexibility to sell or modify the vehicle at any time. Interest rates and loan terms vary based on credit score, loan amount, and lender policies, making it essential to compare options for the best deal.

Key Differences Between PCP and Car Loans

Personal Contract Purchase (PCP) offers lower monthly payments by focusing on vehicle depreciation with a balloon payment at the end, whereas car loans require full repayment of the loan amount through fixed monthly installments. PCP typically includes mileage limits and condition requirements, while car loans provide full ownership once payments are complete without restrictions. PCP suits those who want flexibility to change cars frequently, whereas car loans benefit buyers aiming for long-term ownership and no mileage constraints.

How PCP Works: Step-by-Step

Personal Contract Purchase (PCP) works by initially paying a deposit followed by fixed monthly installments covering vehicle depreciation rather than full value. At the end of the agreement, the customer can choose to return the car, pay a final balloon payment to own it, or trade it in for a new PCP deal. This structure offers lower monthly payments compared to a traditional car loan, where the borrower repays the entire vehicle price plus interest over the term.

How Car Loans Work: Step-by-Step

Car loans work by providing an upfront loan amount to purchase a vehicle, which is then repaid through fixed monthly installments over an agreed term, typically ranging from 12 to 72 months. Interest rates are either fixed or variable, influencing the total repayment cost, and the vehicle often serves as collateral, protecting the lender's investment. Borrowers must complete a credit assessment, and once approved, funds are released directly to the dealer or seller, enabling immediate vehicle ownership.

Pros and Cons of PCP

Personal Contract Purchase (PCP) offers lower monthly payments and the flexibility to return, keep, or upgrade the vehicle at the end of the term, making it ideal for those who prefer driving newer cars without long-term commitment. However, PCP contracts include mileage limits and potential excess wear charges, which can increase costs if terms are exceeded. Unlike traditional car loans that build ownership equity from the start, PCP only transfers ownership after the final balloon payment, potentially leading to higher overall expenses.

Pros and Cons of Car Loans

Car loans offer straightforward ownership with fixed repayment terms, making budgeting easier and allowing full control of the vehicle. However, they often require a higher monthly payment and larger deposit compared to Personal Contract Purchase (PCP) plans. Borrowers bear full depreciation risks but gain equity in the car, unlike PCP agreements where ownership is optional at the end.

Costs Comparison: PCP vs Car Loan

Personal Contract Purchase (PCP) typically offers lower monthly payments compared to a traditional car loan, making it more affordable upfront. However, PCP may incur higher overall costs due to balloon payments and mileage restrictions, whereas car loans provide full ownership without extra fees but with higher monthly installments. Evaluating the total cost of ownership, including interest rates, fees, and depreciation, is crucial when comparing PCP and car loans.

Which Option Suits Your Financial Situation?

Personal Contract Purchase (PCP) offers lower monthly payments and flexibility to change your vehicle every few years, making it ideal for those who prefer budget-friendly installments and frequent upgrades. A car loan typically involves higher monthly payments but results in full ownership of the vehicle, suitable for buyers who plan to keep their car long-term and want to build equity. Evaluating your financial stability, monthly budget, and long-term plans will determine whether the affordability of PCP or the ownership benefits of a car loan better suit your situation.

Frequently Asked Questions: PCP vs Car Loan

Personal Contract Purchase (PCP) and car loans differ primarily in ownership and monthly payments, with PCP offering lower monthly fees but requiring a final balloon payment to own the vehicle. Common questions compare total costs, mileage limits, and end-of-term options such as returning the car, paying the balloon sum, or trading it in. Understanding credit requirements, deposit amounts, and flexibility in terms helps borrowers decide which financing option suits their budget and vehicle usage.

Personal Contract Purchase vs Car Loan Infographic

cardiffo.com

cardiffo.com