Private party loans often offer lower interest rates and more flexible terms compared to dealership loans, which tend to have higher rates due to added fees and dealer commissions. Borrowers seeking private party financing can negotiate directly with the lender or seller, potentially saving money and avoiding inflated costs common in dealership financing. Dealership loans may provide convenience and promotional offers but generally result in higher overall expenses and less favorable repayment terms.

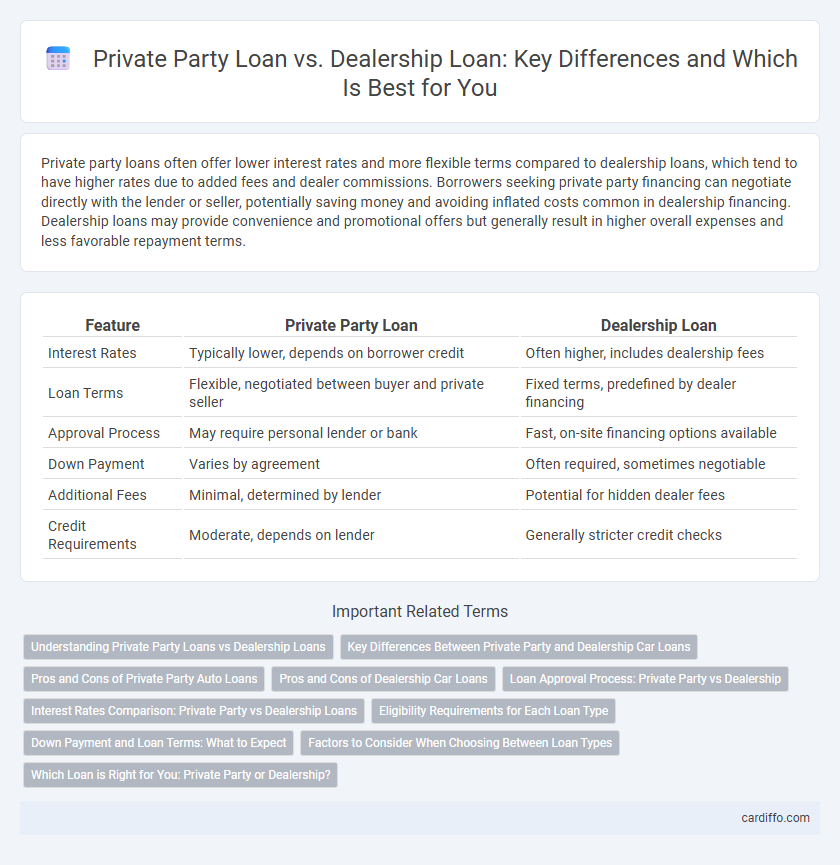

Table of Comparison

| Feature | Private Party Loan | Dealership Loan |

|---|---|---|

| Interest Rates | Typically lower, depends on borrower credit | Often higher, includes dealership fees |

| Loan Terms | Flexible, negotiated between buyer and private seller | Fixed terms, predefined by dealer financing |

| Approval Process | May require personal lender or bank | Fast, on-site financing options available |

| Down Payment | Varies by agreement | Often required, sometimes negotiable |

| Additional Fees | Minimal, determined by lender | Potential for hidden dealer fees |

| Credit Requirements | Moderate, depends on lender | Generally stricter credit checks |

Understanding Private Party Loans vs Dealership Loans

Private party loans typically offer lower interest rates compared to dealership loans because they involve direct agreements between individuals without dealer markup. Dealership loans often include additional fees and higher APRs due to convenience and financing promotions tied to vehicle purchases. Evaluating loan terms, interest rates, and flexibility is crucial when choosing between private party loans and dealership financing options.

Key Differences Between Private Party and Dealership Car Loans

Private party loans typically offer lower interest rates compared to dealership loans because they involve direct transactions between individuals without the added costs dealerships incur. Dealership loans often come with promotional rates and flexible terms but may include higher fees and marked-up interest rates to offset the convenience and vehicle licensing services provided. The approval process for private party loans can be stricter, requiring thorough credit checks and sometimes a larger down payment, while dealership loans often allow buyers to secure financing on-site more quickly, facilitating immediate vehicle purchase.

Pros and Cons of Private Party Auto Loans

Private party auto loans typically offer lower interest rates compared to dealership loans, making them a cost-effective option for borrowers with good credit. However, they often require more extensive paperwork and lack the convenience and immediate approval that dealership financing provides. Borrowers must carefully assess the risk of limited consumer protections and potential delays in loan processing when opting for private party loans.

Pros and Cons of Dealership Car Loans

Dealership car loans offer convenience by providing immediate financing on-site, often with promotional interest rates and bundled incentives such as extended warranties or service packages. However, these loans typically have higher APRs compared to private party loans and may include hidden fees or pressure to purchase add-ons, increasing the overall cost. Borrowers should carefully review loan terms, compare rates from multiple lenders, and consider total repayment amounts before committing to dealership financing.

Loan Approval Process: Private Party vs Dealership

The loan approval process for a private party loan typically involves a more rigorous credit evaluation and verification of the vehicle's condition and ownership, as lenders assess higher risk due to the informal transaction. Dealership loans often feature streamlined approval with access to manufacturer incentives and pre-negotiated rates, supported by the dealer's established relationship with lenders. Private party loans may take longer to approve and require more documentation, while dealership loans offer faster processing and integrated financing options.

Interest Rates Comparison: Private Party vs Dealership Loans

Private party loans often offer lower interest rates compared to dealership loans due to reduced overhead and fewer fees. Dealership loans typically include higher rates influenced by dealer markups, promotions, and lender partnerships. Comparing APRs from multiple lenders ensures borrowers find the most cost-effective financing option for vehicle purchases.

Eligibility Requirements for Each Loan Type

Private party loans typically require a strong credit history, proof of income, and often a higher credit score for approval, while dealership loans may offer more flexible eligibility criteria, including lower credit score thresholds and alternative income verification methods. Dealership loans often cater to buyers with limited credit by including in-house financing or subprime loan options, whereas private party loans emphasize stringent verification to mitigate higher risk. Understanding these eligibility differences helps borrowers select the most suitable financing option based on their credit profile and financial documentation.

Down Payment and Loan Terms: What to Expect

Private party loans often require higher down payments, typically ranging from 10% to 20%, due to increased lender risk compared to dealership loans, which may offer lower or no down payment options as part of promotional deals. Loan terms for private party loans are usually shorter, commonly between 12 to 36 months, whereas dealership loans frequently provide longer terms of up to 72 months, affecting monthly payment amounts and total interest paid. Borrowers should anticipate stricter approval criteria and potentially higher interest rates with private party loans, while dealership loans may include incentives such as deferred payments or lower APRs for qualified buyers.

Factors to Consider When Choosing Between Loan Types

Interest rates for private party loans often tend to be lower than dealership loans, influencing the overall cost of borrowing. Loan terms and repayment flexibility differ, with private party loans generally offering more negotiable options compared to fixed dealership loan schedules. Credit requirements and approval speed also vary, as dealerships may provide faster financing tied to vehicle purchase, while private loans rely heavily on borrower creditworthiness and loan purpose.

Which Loan is Right for You: Private Party or Dealership?

Choosing between a private party loan and a dealership loan depends on factors such as interest rates, loan terms, and credit requirements. Private party loans often offer lower interest rates and more flexible terms but require thorough verification of vehicle history and condition. Dealership loans provide convenience and bundled services but may come with higher rates and less negotiation power, so evaluate your financial situation and loan options carefully to determine the best fit.

Private Party Loan vs Dealership Loan Infographic

cardiffo.com

cardiffo.com