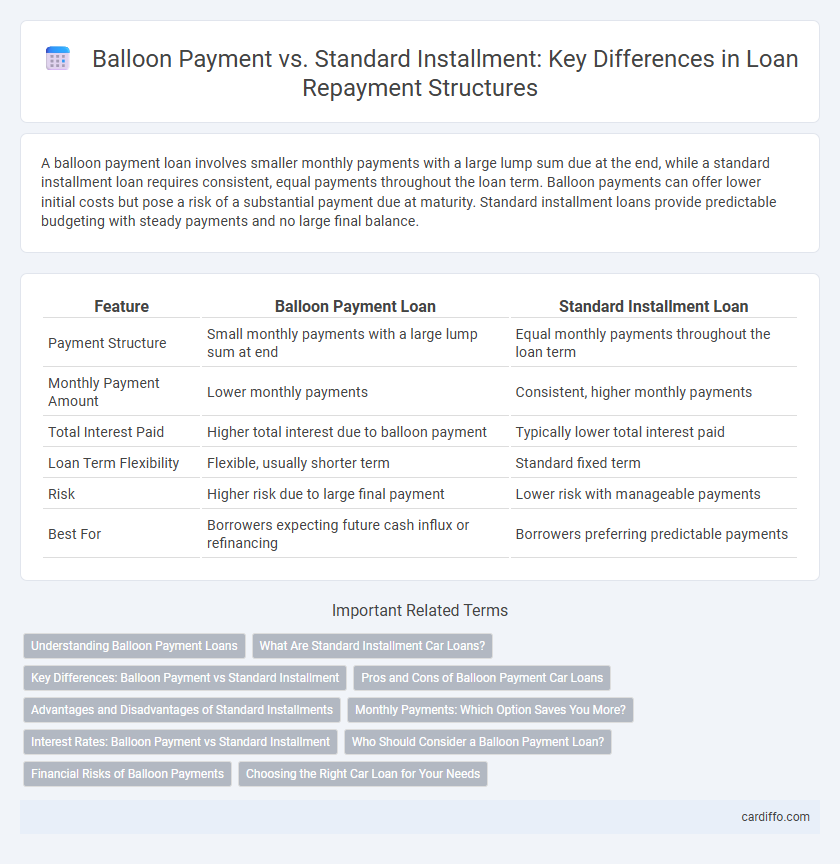

A balloon payment loan involves smaller monthly payments with a large lump sum due at the end, while a standard installment loan requires consistent, equal payments throughout the loan term. Balloon payments can offer lower initial costs but pose a risk of a substantial payment due at maturity. Standard installment loans provide predictable budgeting with steady payments and no large final balance.

Table of Comparison

| Feature | Balloon Payment Loan | Standard Installment Loan |

|---|---|---|

| Payment Structure | Small monthly payments with a large lump sum at end | Equal monthly payments throughout the loan term |

| Monthly Payment Amount | Lower monthly payments | Consistent, higher monthly payments |

| Total Interest Paid | Higher total interest due to balloon payment | Typically lower total interest paid |

| Loan Term Flexibility | Flexible, usually shorter term | Standard fixed term |

| Risk | Higher risk due to large final payment | Lower risk with manageable payments |

| Best For | Borrowers expecting future cash influx or refinancing | Borrowers preferring predictable payments |

Understanding Balloon Payment Loans

Balloon payment loans require borrowers to make smaller monthly payments with a large lump sum due at the end of the loan term, contrasting with standard installment loans that have fixed monthly payments over the entire period. This structure can lower initial payments but introduces the risk of a significant final payment that may require refinancing or asset sale. Understanding these dynamics is crucial for managing cash flow and avoiding potential default associated with balloon payments.

What Are Standard Installment Car Loans?

Standard installment car loans involve fixed monthly payments that cover both principal and interest over a set term, providing predictable budgeting for borrowers. These loans typically span three to seven years, ensuring full loan repayment by the end of the term without any large final payments. Compared to balloon payment loans, standard installment loans reduce financial risk by spreading payments evenly and avoiding a substantial lump sum at the loan's conclusion.

Key Differences: Balloon Payment vs Standard Installment

Balloon payment loans require lower monthly installments with a large lump sum due at the end, while standard installment loans have fixed, evenly distributed payments throughout the loan term. Balloon payments can lead to higher risk due to the substantial final amount, whereas standard installments offer predictable budgeting with stable monthly obligations. Borrowers choosing balloon payments often benefit from lower initial costs but must plan for refinancing or a large payoff, unlike standard installment loans that simplify debt management by spreading payments evenly.

Pros and Cons of Balloon Payment Car Loans

Balloon payment car loans offer lower monthly payments compared to standard installment loans, making them attractive for buyers seeking short-term affordability. However, the large final payment can pose a financial risk if borrowers are unprepared or unable to refinance, leading to potential default or repossession. These loans benefit those expecting increased future income or intending to sell the vehicle before the balloon payment is due, but they are less suitable for budget-conscious consumers requiring steady, predictable payments.

Advantages and Disadvantages of Standard Installments

Standard installment loans offer predictable monthly payments, making budgeting easier and reducing financial stress for borrowers. However, they typically require higher monthly payments compared to balloon payments, which could strain cash flow. The consistent payment structure also results in gradual principal reduction, minimizing interest costs over the loan term.

Monthly Payments: Which Option Saves You More?

Balloon payments feature low monthly installments with a large lump sum due at loan end, reducing monthly cash flow but increasing total interest if unpaid early. Standard installments evenly distribute principal and interest, leading to higher but consistent monthly payments and less interest over the loan term. Choosing standard installments often saves more in overall costs by minimizing risk and preventing large end-period financial burdens.

Interest Rates: Balloon Payment vs Standard Installment

Balloon payment loans typically feature lower initial interest rates compared to standard installment loans, making early payments more affordable. Standard installment loans have consistent interest rates spread evenly over the loan term, resulting in predictable monthly payments. Borrowers opting for balloon payments should prepare for a large final lump sum, as lower interim interest rates are offset by this substantial closing balance.

Who Should Consider a Balloon Payment Loan?

Borrowers with irregular income streams or those expecting a significant cash influx, such as a bonus or inheritance, should consider a balloon payment loan to manage lower monthly repayments initially. Real estate investors or business owners aiming to maximize short-term cash flow may benefit from this loan structure, aligning large payments with anticipated revenue events. Balloon loans suit individuals comfortable with the risk of a large final payment or planning to refinance before maturity.

Financial Risks of Balloon Payments

Balloon payments involve large lump-sum amounts due at the end of a loan term, increasing the borrower's risk of default if they fail to secure sufficient funds. Unlike standard installment loans with fixed, manageable monthly payments, balloon loans can cause significant cash flow challenges and potential financial distress. The unpredictability of refinancing options or asset value depreciation further amplifies the financial risks associated with balloon payments.

Choosing the Right Car Loan for Your Needs

Balloon payment loans offer lower monthly installments with a large final payment, ideal for those expecting future cash inflows or planning to refinance, while standard installment loans provide fixed payments over the loan term for predictable budgeting. Evaluating your financial stability, future income projections, and vehicle usage helps determine which loan structure aligns with your repayment capacity. Comparing interest rates, loan durations, and total cost of borrowing ensures selecting the optimal car loan tailored to your financial situation.

Balloon Payment vs Standard Installment Infographic

cardiffo.com

cardiffo.com