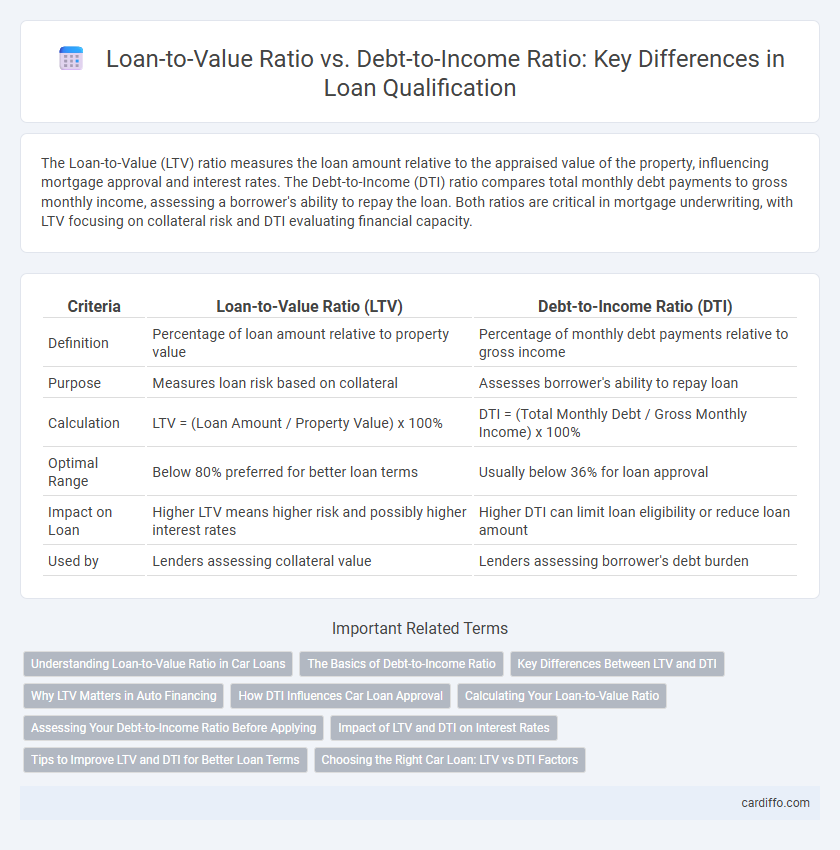

The Loan-to-Value (LTV) ratio measures the loan amount relative to the appraised value of the property, influencing mortgage approval and interest rates. The Debt-to-Income (DTI) ratio compares total monthly debt payments to gross monthly income, assessing a borrower's ability to repay the loan. Both ratios are critical in mortgage underwriting, with LTV focusing on collateral risk and DTI evaluating financial capacity.

Table of Comparison

| Criteria | Loan-to-Value Ratio (LTV) | Debt-to-Income Ratio (DTI) |

|---|---|---|

| Definition | Percentage of loan amount relative to property value | Percentage of monthly debt payments relative to gross income |

| Purpose | Measures loan risk based on collateral | Assesses borrower's ability to repay loan |

| Calculation | LTV = (Loan Amount / Property Value) x 100% | DTI = (Total Monthly Debt / Gross Monthly Income) x 100% |

| Optimal Range | Below 80% preferred for better loan terms | Usually below 36% for loan approval |

| Impact on Loan | Higher LTV means higher risk and possibly higher interest rates | Higher DTI can limit loan eligibility or reduce loan amount |

| Used by | Lenders assessing collateral value | Lenders assessing borrower's debt burden |

Understanding Loan-to-Value Ratio in Car Loans

The Loan-to-Value (LTV) ratio in car loans measures the loan amount against the vehicle's appraised value, indicating the risk level for lenders. A lower LTV ratio suggests a larger down payment and reduced lender risk, often resulting in better interest rates and loan terms. This ratio directly affects loan approval chances and overall financing costs, making it crucial for borrowers to understand before applying.

The Basics of Debt-to-Income Ratio

The Debt-to-Income (DTI) ratio measures the percentage of a borrower's gross monthly income allocated to debt payments, playing a crucial role in loan eligibility assessments. Lenders typically prefer a DTI ratio below 43%, indicating manageable debt levels relative to income. Understanding and maintaining a healthy DTI ratio helps borrowers improve loan approval chances and secure favorable interest rates.

Key Differences Between LTV and DTI

Loan-to-Value (LTV) ratio measures the loan amount relative to the appraised value of the property, indicating the risk level for lenders in mortgage lending. Debt-to-Income (DTI) ratio calculates a borrower's monthly debt payments against their gross monthly income, assessing the borrower's ability to manage debt obligations. LTV focuses on property value security, while DTI evaluates overall financial capacity, both critical for loan approval decisions.

Why LTV Matters in Auto Financing

Loan-to-Value (LTV) ratio is crucial in auto financing as it directly impacts the loan approval process and interest rates by comparing the loan amount to the vehicle's market value. A lower LTV indicates less risk for lenders, often resulting in better financing terms and reducing the chance of negative equity if the car's value depreciates. Debt-to-Income (DTI) ratio, while important for overall creditworthiness, does not specifically address the collateral value, making LTV a key metric for securing favorable auto loans.

How DTI Influences Car Loan Approval

Debt-to-Income (DTI) ratio plays a critical role in car loan approval by measuring a borrower's monthly debt payments against gross income, helping lenders assess repayment capacity. A lower DTI ratio increases the likelihood of loan approval as it indicates better financial stability and ability to manage additional debt. Compared to Loan-to-Value (LTV) ratio, which evaluates the collateral value, DTI directly impacts affordability and credit risk assessment in the car loan underwriting process.

Calculating Your Loan-to-Value Ratio

Calculating your Loan-to-Value (LTV) ratio involves dividing the loan amount by the appraised value or purchase price of the property, whichever is lower, and multiplying by 100 to get a percentage. This ratio is crucial for lenders to assess risk, with typical LTV limits ranging from 80% to 97% depending on the loan type. A lower LTV ratio often leads to better loan terms, including lower interest rates and reduced mortgage insurance costs.

Assessing Your Debt-to-Income Ratio Before Applying

Assessing your debt-to-income (DTI) ratio before applying for a loan is crucial, as lenders prioritize this metric to evaluate your ability to manage monthly payments relative to your gross income. A lower DTI ratio typically indicates better financial stability and increases your chances of loan approval, often allowing you to secure more favorable interest rates. Understanding the difference between DTI and loan-to-value (LTV) ratio helps borrowers focus on income-based affordability rather than just collateral value.

Impact of LTV and DTI on Interest Rates

Loan-to-Value (LTV) ratio and Debt-to-Income (DTI) ratio are critical metrics that lenders use to determine interest rates on loans. A lower LTV indicates less risk due to higher borrower equity, often leading to more favorable interest rates, while a high DTI suggests a greater debt burden and can increase rates to reflect the higher risk. Lenders balance these ratios to set interest rates that correspond to the borrower's overall financial stability and ability to repay the loan.

Tips to Improve LTV and DTI for Better Loan Terms

Improving your Loan-to-Value (LTV) ratio can be achieved by increasing your down payment, which reduces the loan amount compared to the property value. To lower your Debt-to-Income (DTI) ratio, focus on paying down existing debts and avoiding new credit obligations before applying for a loan. Maintaining a strong credit score and providing complete financial documentation can also enhance your loan terms by demonstrating financial stability.

Choosing the Right Car Loan: LTV vs DTI Factors

Choosing the right car loan requires understanding the impact of Loan-to-Value (LTV) and Debt-to-Income (DTI) ratios on your borrowing options. A lower LTV ratio indicates a smaller loan amount relative to the vehicle's value, often resulting in better interest rates and loan terms. Meanwhile, a manageable DTI ratio demonstrates your ability to handle monthly payments, influencing lender approval and the loan's affordability.

Loan-to-Value Ratio vs Debt-to-Income Ratio Infographic

cardiffo.com

cardiffo.com