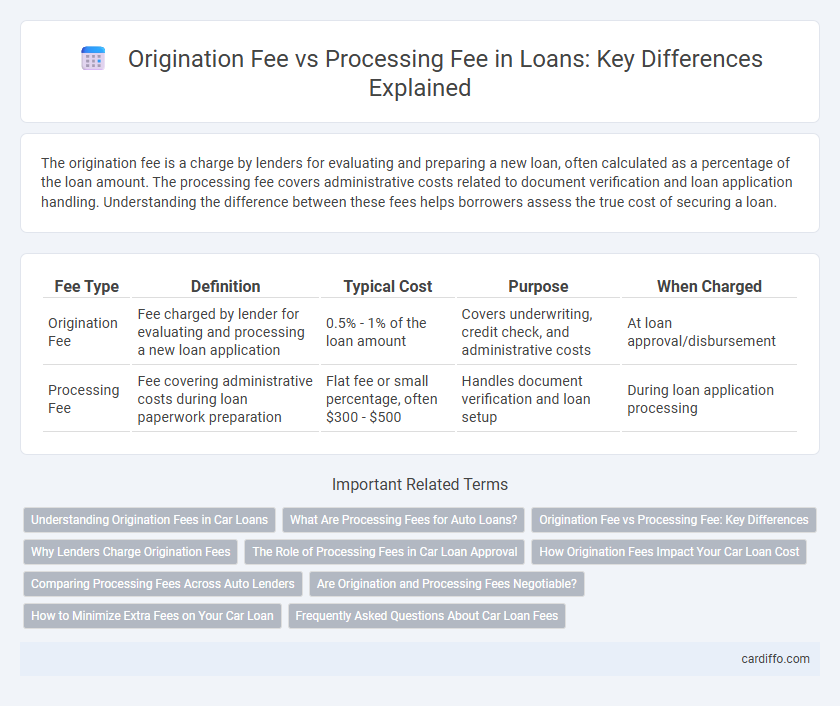

The origination fee is a charge by lenders for evaluating and preparing a new loan, often calculated as a percentage of the loan amount. The processing fee covers administrative costs related to document verification and loan application handling. Understanding the difference between these fees helps borrowers assess the true cost of securing a loan.

Table of Comparison

| Fee Type | Definition | Typical Cost | Purpose | When Charged |

|---|---|---|---|---|

| Origination Fee | Fee charged by lender for evaluating and processing a new loan application | 0.5% - 1% of the loan amount | Covers underwriting, credit check, and administrative costs | At loan approval/disbursement |

| Processing Fee | Fee covering administrative costs during loan paperwork preparation | Flat fee or small percentage, often $300 - $500 | Handles document verification and loan setup | During loan application processing |

Understanding Origination Fees in Car Loans

Origination fees in car loans typically range from 1% to 5% of the loan amount, covering the lender's costs to process and underwrite the loan. These fees are distinct from processing fees, which are usually smaller and charged for administrative tasks like document verification. Understanding the origination fee helps borrowers accurately compare loan offers and anticipate the total cost of financing a vehicle.

What Are Processing Fees for Auto Loans?

Processing fees for auto loans are charges imposed by lenders to cover the administrative costs involved in handling the loan application, including document verification, credit checks, and underwriting. These fees typically range from $50 to $300 and are separate from origination fees, which are a percentage of the loan amount for initiating the loan. Processing fees help streamline the loan approval process but do not directly affect the loan amount or interest rate.

Origination Fee vs Processing Fee: Key Differences

Origination fees are charges lenders impose to cover the costs of evaluating and preparing a loan, typically calculated as a percentage of the loan amount. Processing fees are smaller, fixed fees that cover administrative tasks like document handling and verification. The key difference lies in their purpose and calculation method, with origination fees impacting the overall loan cost more significantly than processing fees.

Why Lenders Charge Origination Fees

Lenders charge origination fees to cover the costs of evaluating and verifying a borrower's creditworthiness, income, and employment during the loan approval process. This fee compensates for the administrative expenses and risk assessment involved in creating the loan agreement. Origination fees typically range from 0.5% to 1% of the loan amount, directly impacting the overall cost of borrowing.

The Role of Processing Fees in Car Loan Approval

Processing fees play a crucial role in car loan approval by covering the administrative costs incurred during the loan application process, including document verification, credit checks, and loan underwriting. Unlike origination fees, which are typically a percentage of the loan amount charged for initiating the loan, processing fees are fixed amounts that ensure the lender's expenses are met regardless of the loan size. Lenders evaluate the processing fee payment as part of the overall application to confirm borrower commitment and operational cost coverage, influencing the loan's timely approval.

How Origination Fees Impact Your Car Loan Cost

Origination fees, typically ranging from 1% to 5% of the loan amount, directly increase the overall cost of a car loan by adding upfront charges that are part of the loan principal. Unlike processing fees, which cover administrative tasks and are often fixed or nominal, origination fees affect your monthly payments and total interest paid, as they are financed along with the vehicle price. Understanding the impact of origination fees helps borrowers compare loan offers more effectively and manage the total expense of financing a car.

Comparing Processing Fees Across Auto Lenders

Processing fees vary significantly among auto lenders, often ranging from $100 to $500, influencing the overall cost of securing an auto loan. While some lenders incorporate processing fees into the interest rate, others charge them upfront as a separate cost, impacting borrowers' cash flow at loan initiation. Comparing these fees across auto lenders is essential for consumers aiming to minimize loan expenses and select the most transparent and cost-effective financing option.

Are Origination and Processing Fees Negotiable?

Origination fees, typically ranging from 0.5% to 1% of the loan amount, are often negotiable depending on the lender and borrower's creditworthiness. Processing fees, generally fixed and meant to cover administrative costs, may have less flexibility but can sometimes be waived or reduced during promotions or by requesting. Understanding lender policies and demonstrating strong financial profiles can increase the chances of negotiating both origination and processing fees.

How to Minimize Extra Fees on Your Car Loan

Origination fees and processing fees are common charges in car loans, often adding 1% to 5% of the loan amount to your costs. To minimize these extra fees, compare lenders carefully, seek loans with no or reduced origination fees, and negotiate fee waivers during the application process. Always review the loan estimate and ask your lender for a breakdown of fees to avoid unexpected charges.

Frequently Asked Questions About Car Loan Fees

Origination fees for car loans cover the lender's cost to evaluate and approve the application, typically ranging from 1% to 3% of the loan amount, while processing fees are smaller charges that handle paperwork and administrative tasks. Borrowers often ask if these fees can be negotiated or waived; lenders may adjust origination fees based on creditworthiness but processing fees are usually fixed. Understanding these distinctions helps car buyers budget accurately when calculating the total cost of securing an auto loan.

Origination Fee vs Processing Fee Infographic

cardiffo.com

cardiffo.com