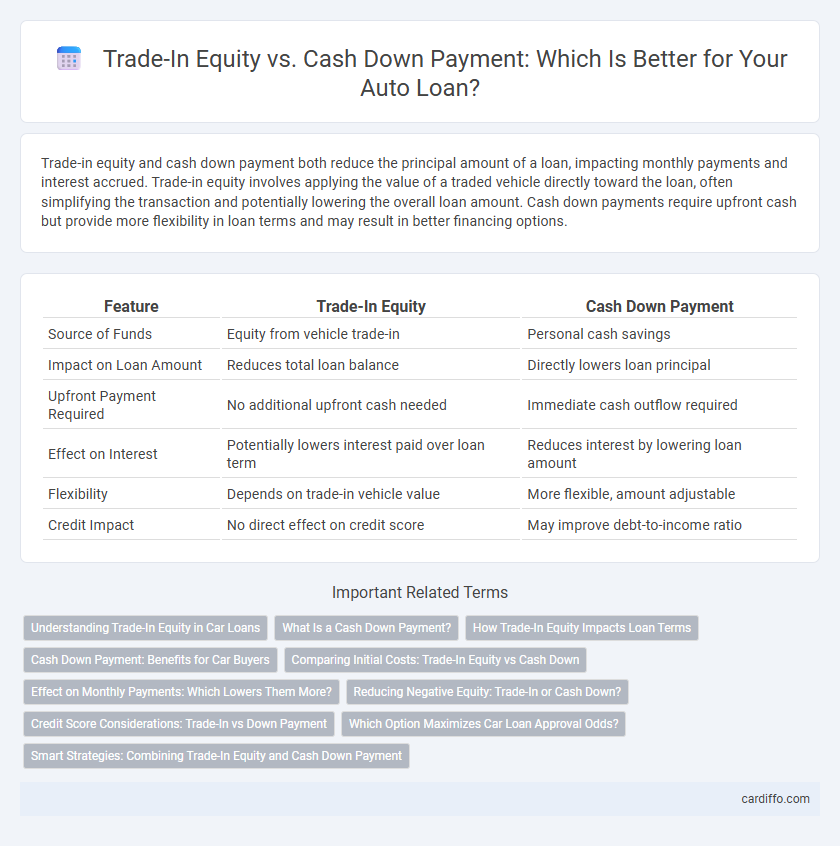

Trade-in equity and cash down payment both reduce the principal amount of a loan, impacting monthly payments and interest accrued. Trade-in equity involves applying the value of a traded vehicle directly toward the loan, often simplifying the transaction and potentially lowering the overall loan amount. Cash down payments require upfront cash but provide more flexibility in loan terms and may result in better financing options.

Table of Comparison

| Feature | Trade-In Equity | Cash Down Payment |

|---|---|---|

| Source of Funds | Equity from vehicle trade-in | Personal cash savings |

| Impact on Loan Amount | Reduces total loan balance | Directly lowers loan principal |

| Upfront Payment Required | No additional upfront cash needed | Immediate cash outflow required |

| Effect on Interest | Potentially lowers interest paid over loan term | Reduces interest by lowering loan amount |

| Flexibility | Depends on trade-in vehicle value | More flexible, amount adjustable |

| Credit Impact | No direct effect on credit score | May improve debt-to-income ratio |

Understanding Trade-In Equity in Car Loans

Trade-in equity in car loans refers to the difference between the trade-in vehicle's market value and the remaining loan balance, which can be applied as a down payment on a new car purchase. Utilizing trade-in equity reduces the amount financed, potentially lowering monthly payments and interest costs. Understanding trade-in equity helps borrowers leverage existing assets to improve loan terms and minimize upfront cash requirements.

What Is a Cash Down Payment?

A cash down payment is an upfront sum of money paid by a borrower at the time of purchasing an asset, such as a car or home, reducing the total loan amount needed. This payment directly decreases the principal balance, which can lower monthly loan payments and potentially improve loan terms. Unlike trade-in equity, which involves applying the value of a traded asset toward the purchase, a cash down payment involves actual cash disbursement to the lender.

How Trade-In Equity Impacts Loan Terms

Trade-in equity reduces the principal amount of the auto loan, lowering monthly payments and potentially improving loan approval rates by decreasing the borrower's overall debt-to-income ratio. Applying trade-in equity can also shorten the loan term, saving interest costs over time, while preserving cash flow since it doesn't require upfront cash outlay like a down payment. Lenders view trade-in equity as a form of collateral contribution, enhancing loan security and possibly qualifying borrowers for better interest rates.

Cash Down Payment: Benefits for Car Buyers

Cash down payment for car loans improves loan approval chances by reducing lender risk and lowering interest rates, resulting in long-term savings. It decreases the principal amount, leading to smaller monthly installments and faster loan repayment. Car buyers also build immediate equity, providing stronger financial stability and flexibility for future trade-ins or refinancing.

Comparing Initial Costs: Trade-In Equity vs Cash Down

Trade-in equity reduces the initial loan amount by applying the value of your traded vehicle directly to the purchase, lowering the financed balance and potentially improving loan terms. Cash down payment requires upfront liquid funds, increasing immediate out-of-pocket costs but can also decrease loan principal and interest over time. Comparing initial costs, trade-in equity minimizes cash expenditure while cash down impacts your immediate budget more significantly.

Effect on Monthly Payments: Which Lowers Them More?

Trade-in equity directly lowers the loan principal by applying the vehicle's trade-in value, resulting in reduced monthly payments compared to a cash down payment of the same amount, which also lowers principal but may not impact loan terms or interest as effectively. Monthly payments typically decrease more with trade-in equity because it immediately reduces the loan balance and can sometimes improve the loan-to-value ratio, leading to better interest rates. Cash down payments provide upfront reduction without affecting financing incentives that often accompany trade-in transactions.

Reducing Negative Equity: Trade-In or Cash Down?

Utilizing trade-in equity can effectively reduce negative equity by applying the value of your current vehicle toward the new loan balance, minimizing the amount financed. A cash down payment directly lowers the principal amount borrowed, decreasing monthly payments and interest costs over the loan term. Strategic use of trade-in equity often provides immediate financial relief, but combining both methods maximizes reduction of negative equity risk.

Credit Score Considerations: Trade-In vs Down Payment

Trade-in equity can positively impact your credit score by reducing the loan amount and demonstrating financial responsibility, whereas a cash down payment directly decreases loan-to-value ratio without altering credit history. Lenders often favor trade-ins because they reduce outstanding debt balances, which may improve credit utilization ratios and potentially boost credit scores. Conversely, a substantial cash down payment lessens loan risk but has no immediate effect on credit score improvement.

Which Option Maximizes Car Loan Approval Odds?

Trade-in equity leverages the value of your current vehicle to reduce the overall loan amount, often increasing approval odds by lowering lender risk through immediate asset value. Cash down payments provide direct upfront funds, improving the loan-to-value ratio and demonstrating borrower financial stability, which lenders favor for approval. Opting for trade-in equity typically maximizes car loan approval chances when the vehicle's value is substantial, while cash down payment is more effective if liquidity and credit profile are stronger.

Smart Strategies: Combining Trade-In Equity and Cash Down Payment

Combining trade-in equity with a cash down payment maximizes loan affordability by reducing the principal balance and lowering monthly payments. Utilizing trade-in equity leverages the vehicle's current value, while a strategic cash down payment strengthens creditworthiness and increases lender confidence. Balancing both methods ensures optimal financing terms and accelerates loan payoff.

Trade-In Equity vs Cash Down Payment Infographic

cardiffo.com

cardiffo.com