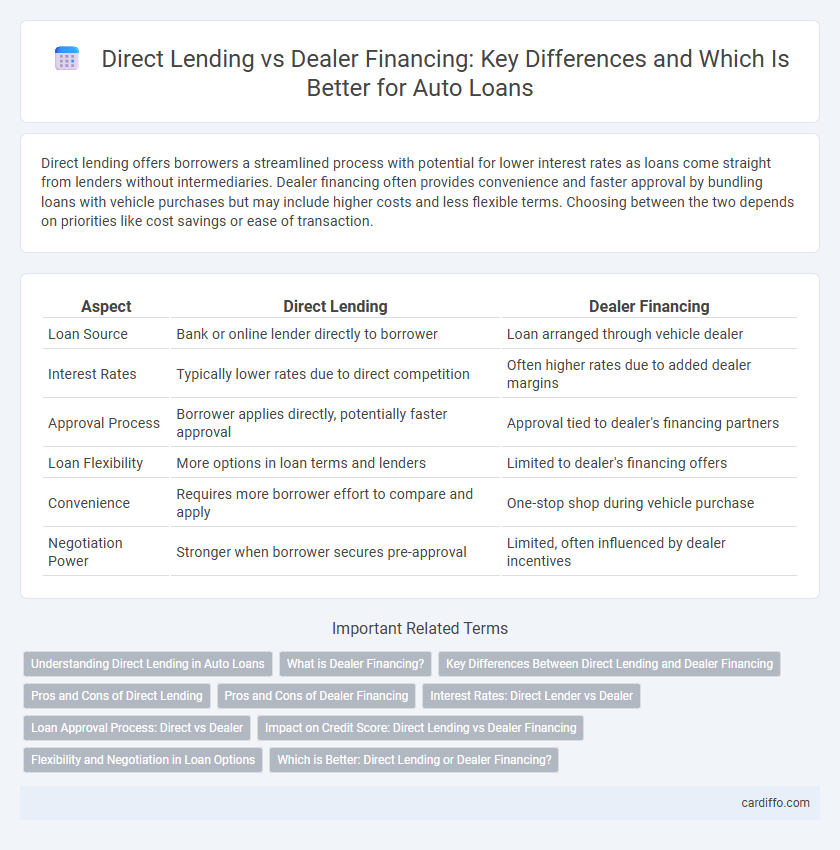

Direct lending offers borrowers a streamlined process with potential for lower interest rates as loans come straight from lenders without intermediaries. Dealer financing often provides convenience and faster approval by bundling loans with vehicle purchases but may include higher costs and less flexible terms. Choosing between the two depends on priorities like cost savings or ease of transaction.

Table of Comparison

| Aspect | Direct Lending | Dealer Financing |

|---|---|---|

| Loan Source | Bank or online lender directly to borrower | Loan arranged through vehicle dealer |

| Interest Rates | Typically lower rates due to direct competition | Often higher rates due to added dealer margins |

| Approval Process | Borrower applies directly, potentially faster approval | Approval tied to dealer's financing partners |

| Loan Flexibility | More options in loan terms and lenders | Limited to dealer's financing offers |

| Convenience | Requires more borrower effort to compare and apply | One-stop shop during vehicle purchase |

| Negotiation Power | Stronger when borrower secures pre-approval | Limited, often influenced by dealer incentives |

Understanding Direct Lending in Auto Loans

Direct lending in auto loans involves borrowers obtaining financing directly from banks, credit unions, or online lenders without dealership involvement. This method offers competitive interest rates and transparent loan terms, enhancing financial control for consumers. Borrowers benefit from faster approval processes and the ability to shop for the best loan options before visiting a dealership.

What is Dealer Financing?

Dealer financing is a loan option provided directly through a vehicle dealership, allowing buyers to secure credit onsite when purchasing a car. This financing method often offers convenience and promotional interest rates but may include higher overall costs compared to direct lending from banks or credit unions. Buyers should compare dealer financing terms with direct lending options to ensure the best loan conditions and total repayment amount.

Key Differences Between Direct Lending and Dealer Financing

Direct lending involves borrowing funds directly from financial institutions such as banks or credit unions, offering potentially lower interest rates and more flexible loan terms. Dealer financing is provided through vehicle dealerships, often featuring promotional rates or incentives but may involve higher interest costs and less transparency. The key difference lies in the source of the loan, affecting interest rates, loan terms, and overall cost.

Pros and Cons of Direct Lending

Direct lending offers borrowers lower interest rates and faster approval processes compared to dealer financing, making it a cost-effective option for qualified individuals. It provides greater transparency and flexibility in loan terms but may require more stringent credit qualifications and down payments. Unlike dealer financing, direct lending avoids potential markup costs embedded in vehicle prices, enhancing overall loan affordability.

Pros and Cons of Dealer Financing

Dealer financing offers convenience by streamlining the loan approval process directly at the dealership, often providing promotional rates and incentives tied to vehicle purchases. However, interest rates through dealer financing can be higher compared to direct lending options, and loan terms may be less flexible, potentially resulting in increased overall costs. Buyers should carefully compare offers and consider credit scores, as dealer financing may prioritize ease over personalized loan conditions.

Interest Rates: Direct Lender vs Dealer

Direct lending typically offers lower interest rates compared to dealer financing due to reduced overhead costs and fewer intermediaries. Dealer financing often comes with higher interest rates as dealers may mark up rates to increase profit margins or provide promotional incentives that inflate costs. Borrowers seeking the most competitive loan terms should carefully compare the annual percentage rates (APRs) from direct lenders and dealer financing options.

Loan Approval Process: Direct vs Dealer

Direct lending typically involves a streamlined loan approval process where borrowers work directly with financial institutions, allowing for faster decision-making and potentially lower interest rates. Dealer financing often requires additional layers of approval, as dealerships coordinate with lenders, which can result in longer processing times but may offer convenience by bundling financing with vehicle purchase. Understanding the differences in approval timelines and requirements is crucial for borrowers seeking efficient and competitive loan options.

Impact on Credit Score: Direct Lending vs Dealer Financing

Direct lending often involves a hard inquiry on the borrower's credit report, which can cause a slight, temporary dip in the credit score but may offer better loan terms due to direct negotiation with lenders. Dealer financing may result in multiple credit checks called rate shopping, but these inquiries are typically treated as a single inquiry if made within a short period, minimizing impact on the credit score. Comparing the two, direct lending provides more control over credit usage visibility, whereas dealer financing's multiple lender inquiries may impact the credit score less aggressively when managed within specified timeframes.

Flexibility and Negotiation in Loan Options

Direct lending offers greater flexibility and room for negotiation in loan terms compared to dealer financing, enabling borrowers to tailor interest rates, repayment schedules, and loan amounts to their financial needs. Dealer financing often comes with pre-set interest rates and loan conditions influenced by manufacturer incentives, limiting borrower leverage. Borrowers seeking customized loan solutions benefit from direct lending's adaptability, which supports better financial planning and cost management.

Which is Better: Direct Lending or Dealer Financing?

Direct lending often offers lower interest rates and more flexible terms since it eliminates the middleman, providing borrowers with greater control over the loan process. Dealer financing can be more convenient and may include promotional rates or incentives tied to vehicle purchases, but it sometimes comes with higher costs and less transparency. Choosing between direct lending and dealer financing depends on comparing interest rates, loan terms, and overall costs to determine the most cost-effective option for the borrower's financial situation.

Direct Lending vs Dealer Financing Infographic

cardiffo.com

cardiffo.com