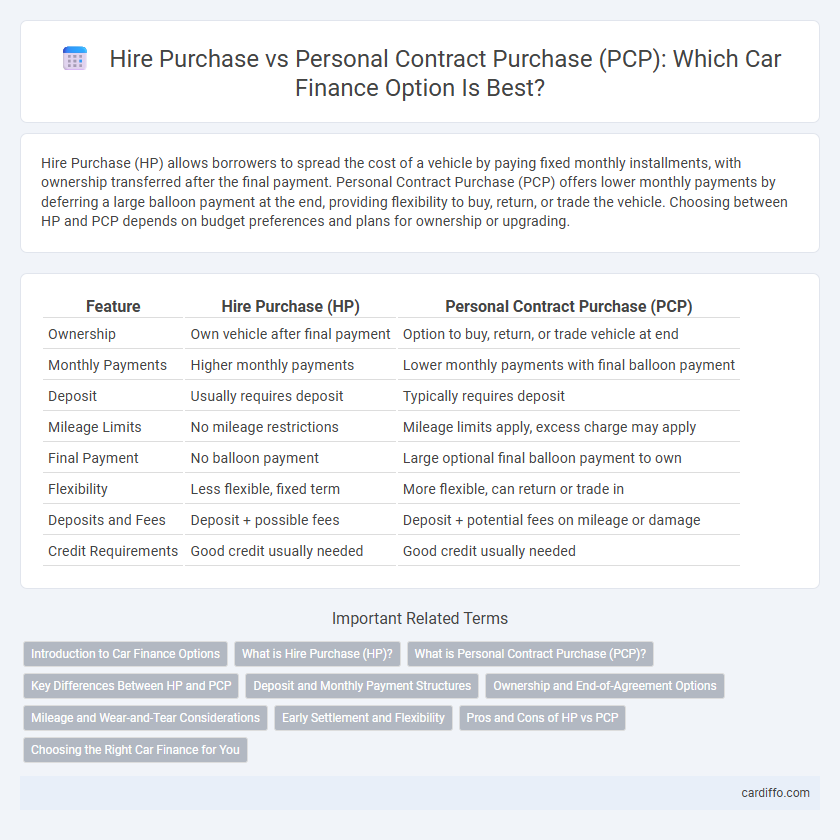

Hire Purchase (HP) allows borrowers to spread the cost of a vehicle by paying fixed monthly installments, with ownership transferred after the final payment. Personal Contract Purchase (PCP) offers lower monthly payments by deferring a large balloon payment at the end, providing flexibility to buy, return, or trade the vehicle. Choosing between HP and PCP depends on budget preferences and plans for ownership or upgrading.

Table of Comparison

| Feature | Hire Purchase (HP) | Personal Contract Purchase (PCP) |

|---|---|---|

| Ownership | Own vehicle after final payment | Option to buy, return, or trade vehicle at end |

| Monthly Payments | Higher monthly payments | Lower monthly payments with final balloon payment |

| Deposit | Usually requires deposit | Typically requires deposit |

| Mileage Limits | No mileage restrictions | Mileage limits apply, excess charge may apply |

| Final Payment | No balloon payment | Large optional final balloon payment to own |

| Flexibility | Less flexible, fixed term | More flexible, can return or trade in |

| Deposits and Fees | Deposit + possible fees | Deposit + potential fees on mileage or damage |

| Credit Requirements | Good credit usually needed | Good credit usually needed |

Introduction to Car Finance Options

Hire Purchase (HP) allows borrowers to pay fixed monthly installments to gradually own the vehicle outright after the agreement ends, with payments covering the total car value plus interest. Personal Contract Purchase (PCP) offers lower monthly payments by deferring a significant portion of the car's cost into a final balloon payment, giving consumers flexibility to buy, return, or trade the vehicle at contract completion. Both car finance options provide alternative methods to traditional loans, catering to different budget preferences and ownership plans in vehicle financing.

What is Hire Purchase (HP)?

Hire Purchase (HP) is a type of loan agreement where the borrower hires an asset, typically a vehicle, by paying monthly installments until the total price plus interest is fully paid. Ownership of the asset transfers to the borrower only after the final payment is made, unlike PCP where a balloon payment or return option exists. HP agreements usually involve fixed interest rates and fixed monthly payments, providing clarity and predictable budgeting for borrowers.

What is Personal Contract Purchase (PCP)?

Personal Contract Purchase (PCP) is a flexible vehicle financing option involving lower monthly payments compared to traditional loans, with a balloon payment at the end of the agreement. Borrowers pay an initial deposit, followed by fixed monthly installments based on the vehicle's expected depreciation. At the contract's conclusion, customers can either return the car, pay the balloon payment to own it, or trade it in for a new model, offering multiple exit strategies tailored to individual financial situations.

Key Differences Between HP and PCP

Hire Purchase (HP) involves paying fixed monthly installments to own the vehicle outright by the end of the contract, while Personal Contract Purchase (PCP) offers lower monthly payments with a final balloon payment option to buy, return, or trade the car. HP agreements typically require a higher initial deposit and result in ownership once all payments are completed, whereas PCP contracts provide more flexibility but vehicle ownership depends on the final payment decision. Mileage limits and condition clauses are stricter in PCP deals, which can affect the overall cost if the vehicle is returned.

Deposit and Monthly Payment Structures

Hire Purchase (HP) typically requires a higher initial deposit, often around 10-20% of the vehicle's price, with fixed monthly payments spread evenly over the loan term. Personal Contract Purchase (PCP) allows for a lower deposit, sometimes as low as 5-10%, and features lower monthly payments due to a balloon payment at the end of the contract. PCP's flexible payment structure helps borrowers manage cash flow, while HP's straightforward approach leads to full ownership once all payments are completed.

Ownership and End-of-Agreement Options

Hire Purchase offers straightforward ownership as the borrower gains the vehicle title after all installments are paid, making it ideal for those wanting full ownership. Personal Contract Purchase (PCP) provides flexible end-of-agreement options including returning the car, paying a balloon payment to own it, or trading it in, appealing to users seeking lower monthly payments and adaptability. Both loan types require adherence to payment schedules but differ significantly in ownership transfer timing and flexibility of final options.

Mileage and Wear-and-Tear Considerations

Mileage limits in Hire Purchase (HP) agreements are typically flexible with no penalties for exceeding a certain mileage, while Personal Contract Purchase (PCP) contracts impose strict annual mileage caps to avoid excess mileage charges at the end of the term. Wear-and-tear policies in PCP are more stringent, requiring the vehicle to be returned in good condition to avoid additional fees, whereas HP owners assume full responsibility for maintenance and repairs since they own the car outright after the final payment. Understanding these differences is crucial for borrowers who drive frequently or plan long-term ownership, ensuring they choose a financing option that aligns with their lifestyle and financial goals.

Early Settlement and Flexibility

Early settlement of Hire Purchase (HP) agreements often involves paying off the remaining balance including interest, offering limited flexibility since the total cost is typically fixed over the term. Personal Contract Purchase (PCP) plans provide greater flexibility with options to settle early by paying a balloon payment or refinancing, potentially reducing the total cost if the vehicle's value exceeds this amount. PCP allows borrowers to choose between returning the vehicle, making the final payment to own it, or part-exchanging it, enhancing adaptability compared to the fixed structure of Hire Purchase.

Pros and Cons of HP vs PCP

Hire Purchase (HP) offers straightforward ownership with fixed monthly payments and no mileage restrictions, making it ideal for buyers seeking full vehicle ownership after the term. Personal Contract Purchase (PCP) provides lower monthly payments and flexible end-of-term options, including returning the car or purchasing it with a balloon payment, but it imposes mileage limits and potential charges for excess wear. HP suits those prioritizing eventual ownership without usage constraints, while PCP is better for drivers desiring lower initial costs and vehicle flexibility.

Choosing the Right Car Finance for You

Hire Purchase (HP) offers a straightforward path to car ownership with fixed monthly payments and full ownership after the final installment, ideal for those wanting to keep the vehicle long-term. Personal Contract Purchase (PCP) provides lower monthly repayments and flexibility at the end of the term, including options to return, buy, or trade the car, suited for drivers seeking short-term use or frequent upgrades. Evaluating factors like budget, ownership preferences, and mileage limits helps in selecting the optimal car finance solution tailored to individual financial goals and driving habits.

Hire Purchase vs Personal Contract Purchase (PCP) Infographic

cardiffo.com

cardiffo.com