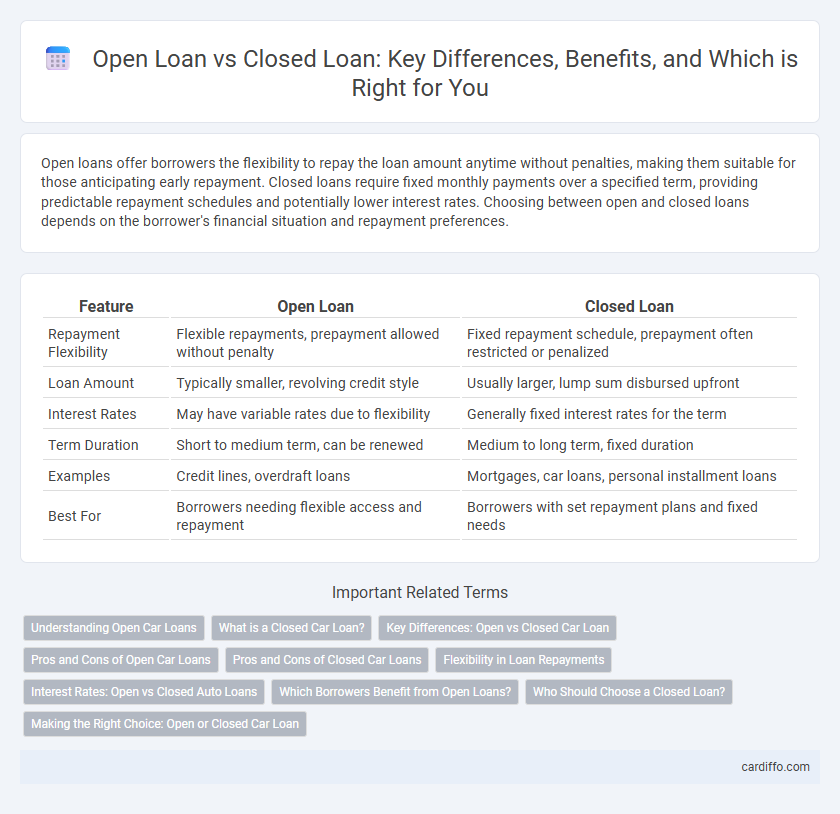

Open loans offer borrowers the flexibility to repay the loan amount anytime without penalties, making them suitable for those anticipating early repayment. Closed loans require fixed monthly payments over a specified term, providing predictable repayment schedules and potentially lower interest rates. Choosing between open and closed loans depends on the borrower's financial situation and repayment preferences.

Table of Comparison

| Feature | Open Loan | Closed Loan |

|---|---|---|

| Repayment Flexibility | Flexible repayments, prepayment allowed without penalty | Fixed repayment schedule, prepayment often restricted or penalized |

| Loan Amount | Typically smaller, revolving credit style | Usually larger, lump sum disbursed upfront |

| Interest Rates | May have variable rates due to flexibility | Generally fixed interest rates for the term |

| Term Duration | Short to medium term, can be renewed | Medium to long term, fixed duration |

| Examples | Credit lines, overdraft loans | Mortgages, car loans, personal installment loans |

| Best For | Borrowers needing flexible access and repayment | Borrowers with set repayment plans and fixed needs |

Understanding Open Car Loans

Open car loans allow borrowers to make extra payments or pay off the balance early without penalties, offering greater flexibility compared to closed loans. These loans typically have variable repayment terms, making them ideal for individuals expecting fluctuating income or seeking to reduce interest costs by accelerating payments. Understanding the terms and conditions of open car loans helps buyers optimize their financing strategy and manage debt more effectively.

What is a Closed Car Loan?

A closed car loan is a fixed-term loan where the borrower agrees to repay the entire amount, including interest, by a specified date without additional borrowing during the term. This type of loan typically features fixed interest rates and set monthly payments, offering predictability and structured repayment schedules. Closed car loans often require collateral, such as the vehicle itself, which protects lenders and can lead to more favorable interest rates for borrowers.

Key Differences: Open vs Closed Car Loan

Open car loans offer flexible repayment options with no fixed tenure, allowing borrowers to prepay or repay in varying amounts without penalties, ideal for uncertain cash flow situations. Closed car loans have a fixed repayment schedule and tenure, requiring consistent monthly payments and limiting prepayment options, often resulting in lower interest rates due to reduced lender risk. The key difference lies in repayment flexibility and cost, where open loans provide freedom at potentially higher interest, while closed loans enforce discipline with possible savings.

Pros and Cons of Open Car Loans

Open car loans offer flexibility by allowing borrowers to repay the loan amount at any time without penalties, which can help reduce overall interest costs. However, the interest rates on open loans are often higher compared to closed loans due to the lender's increased risk. This type of loan is ideal for individuals who anticipate fluctuating finances or want the freedom to pay off the car loan early.

Pros and Cons of Closed Car Loans

Closed car loans offer the advantage of fixed repayment terms and consistent monthly payments, enabling better budget management and financial planning. Borrowers can fully own the vehicle once the loan term ends, avoiding penalties for early repayment common in open loans. However, closed car loans may have higher interest rates and less flexibility in repayment schedules, potentially resulting in higher overall costs if the borrower's financial situation changes.

Flexibility in Loan Repayments

Open loans offer high flexibility in loan repayments, allowing borrowers to make additional payments or repay the loan early without penalties. Closed loans require fixed repayments on a set schedule with limited or no opportunity for early repayment adjustments. This difference significantly impacts borrower control over their loan term and interest costs.

Interest Rates: Open vs Closed Auto Loans

Open auto loans typically have higher interest rates compared to closed auto loans due to the flexibility they offer in repayment terms and potential for early loan closure without penalties. Closed auto loans generally feature lower interest rates as they require fixed monthly payments and maintain strict borrowing terms throughout the loan tenure. Lenders price closed loans more competitively, incentivizing borrowers to commit to a fixed amortization schedule that reduces lender risk.

Which Borrowers Benefit from Open Loans?

Open loans benefit borrowers who anticipate fluctuating financial needs or want the flexibility to repay principal early without penalties. These loans are ideal for individuals with irregular income streams, such as freelancers and business owners, as they allow multiple withdrawals and repayments within a set credit limit. Borrowers seeking adaptable credit options to manage cash flow efficiently often prefer open loans over closed loans.

Who Should Choose a Closed Loan?

Borrowers who prefer fixed repayment schedules and predictable monthly payments should choose a closed loan, as it typically requires repayments within a set term without the option for early withdrawal of funds. Closed loans suit individuals with stable income and a clear financial plan, making it easier to manage debt and improve credit scores. This loan type is ideal for large, one-time expenses like mortgages or auto loans, where borrowers want structured payments to ensure timely loan closure.

Making the Right Choice: Open or Closed Car Loan

Choosing between an open car loan, which allows early repayment without penalties, and a closed car loan, offering lower interest rates but fixed terms, hinges on your financial flexibility and repayment strategy. Open loans suit borrowers expecting irregular income or potential early payoff, minimizing extra interest costs, while closed loans benefit those preferring stable, predictable monthly payments and lower overall borrowing costs. Evaluating your budget, cash flow, and loan terms ensures making the right choice to manage debt efficiently and optimize financial health.

Open Loan vs Closed Loan Infographic

cardiffo.com

cardiffo.com