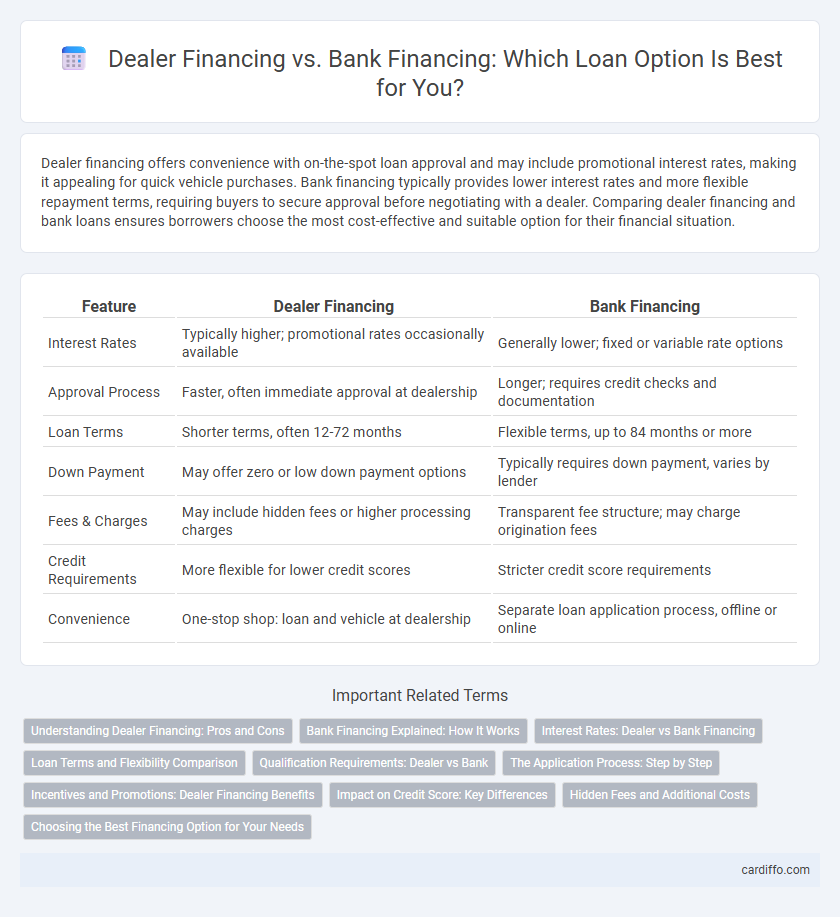

Dealer financing offers convenience with on-the-spot loan approval and may include promotional interest rates, making it appealing for quick vehicle purchases. Bank financing typically provides lower interest rates and more flexible repayment terms, requiring buyers to secure approval before negotiating with a dealer. Comparing dealer financing and bank loans ensures borrowers choose the most cost-effective and suitable option for their financial situation.

Table of Comparison

| Feature | Dealer Financing | Bank Financing |

|---|---|---|

| Interest Rates | Typically higher; promotional rates occasionally available | Generally lower; fixed or variable rate options |

| Approval Process | Faster, often immediate approval at dealership | Longer; requires credit checks and documentation |

| Loan Terms | Shorter terms, often 12-72 months | Flexible terms, up to 84 months or more |

| Down Payment | May offer zero or low down payment options | Typically requires down payment, varies by lender |

| Fees & Charges | May include hidden fees or higher processing charges | Transparent fee structure; may charge origination fees |

| Credit Requirements | More flexible for lower credit scores | Stricter credit score requirements |

| Convenience | One-stop shop: loan and vehicle at dealership | Separate loan application process, offline or online |

Understanding Dealer Financing: Pros and Cons

Dealer financing offers convenience by allowing buyers to secure a loan directly through the car dealership, often providing promotional interest rates and streamlined approval processes. However, dealer financing can result in higher overall costs due to marked-up interest rates and limited negotiation flexibility compared to traditional bank loans. Understanding these pros and cons helps borrowers weigh the ease of dealer financing against potential long-term financial impacts.

Bank Financing Explained: How It Works

Bank financing involves obtaining a loan directly from a financial institution, where the bank evaluates the borrower's creditworthiness, income, and financial history to determine eligibility and terms. The process often requires a formal application, collateral, and adherence to strict repayment schedules, providing secured or unsecured loan options depending on the type of asset or loan purpose. Interest rates and repayment periods are typically competitive, influenced by market conditions and borrower credit profiles, making bank financing a reliable option for consumers seeking structured loan agreements.

Interest Rates: Dealer vs Bank Financing

Dealer financing often features higher interest rates compared to bank financing due to dealer markups and promotional terms. Banks typically offer lower interest rates based on credit scores and lending standards, resulting in more favorable loan terms. Borrowers with good credit can secure bank financing at rates significantly below those commonly found through dealership loans.

Loan Terms and Flexibility Comparison

Dealer financing often provides more flexible loan terms, including lower down payments and tailored repayment schedules that can accommodate varying credit profiles. Bank financing typically offers more stringent loan conditions with fixed interest rates and less room for negotiation, but may provide lower overall interest costs for borrowers with strong credit histories. Understanding these differences helps borrowers choose the optimal financing option based on loan term flexibility and long-term financial impact.

Qualification Requirements: Dealer vs Bank

Dealer financing often features more flexible qualification requirements, appealing to buyers with lower credit scores or limited credit history by offering in-house credit evaluations. Bank financing typically demands stricter qualifications, including higher credit scores, stable income verification, and thorough financial documentation to approve loans. Understanding these differences helps borrowers select the financing option best aligned with their credit profiles and approval likelihood.

The Application Process: Step by Step

Dealer financing application begins with selecting a vehicle and submitting required documents directly at the dealership, often resulting in immediate pre-approval or credit checks. Bank financing requires obtaining loan applications separately, providing extensive income verification, credit history, and collateral details before approval. Dealer financing typically offers a streamlined process with quicker decisions, while bank financing involves a more thorough evaluation that may take several days.

Incentives and Promotions: Dealer Financing Benefits

Dealer financing often includes exclusive incentives like cashback offers, zero-percent interest rates, and flexible payment terms that banks typically do not provide. Automakers frequently partner with dealerships to offer seasonal promotions and rebates, making dealer financing more attractive for buyers seeking immediate savings. These tailored incentives can significantly reduce the overall cost of a loan and increase affordability for consumers.

Impact on Credit Score: Key Differences

Dealer financing often involves a soft credit inquiry, which may have little to no immediate impact on a borrower's credit score, while bank financing usually requires a hard credit pull that can temporarily lower the credit score. Approval criteria differ, as banks typically have stricter credit requirements that influence loan terms and interest rates, potentially affecting credit utilization and payment history reported to credit bureaus. Understanding these distinctions helps borrowers strategically manage credit impacts when choosing between dealer and bank financing options.

Hidden Fees and Additional Costs

Dealer financing often includes hidden fees such as processing charges, documentation fees, and high interest markups that can significantly increase the total loan cost. Bank financing typically offers more transparent fee structures with clearly disclosed interest rates and fewer additional costs, making it easier to compare loan offers. Borrowers should carefully review the loan agreement for any undisclosed expenses to avoid unexpected financial burdens.

Choosing the Best Financing Option for Your Needs

Dealer financing offers convenience with streamlined approval processes and promotional rates, ideal for buyers prioritizing speed and simplicity. Bank financing typically provides lower interest rates and greater flexibility in loan terms, benefiting those with strong credit and a focus on cost savings. Assessing factors such as credit score, interest rates, loan duration, and total cost enables informed decisions when selecting the optimal financing method.

Dealer Financing vs Bank Financing Infographic

cardiffo.com

cardiffo.com