A balloon loan requires a large lump sum payment at the end of the term, resulting in lower monthly payments but higher risk due to the final payment amount. A fully amortizing loan spreads both principal and interest evenly over the loan term, ensuring the loan is completely paid off at maturity with consistent monthly payments. Choosing between these loans depends on the borrower's cash flow stability and long-term financial strategy.

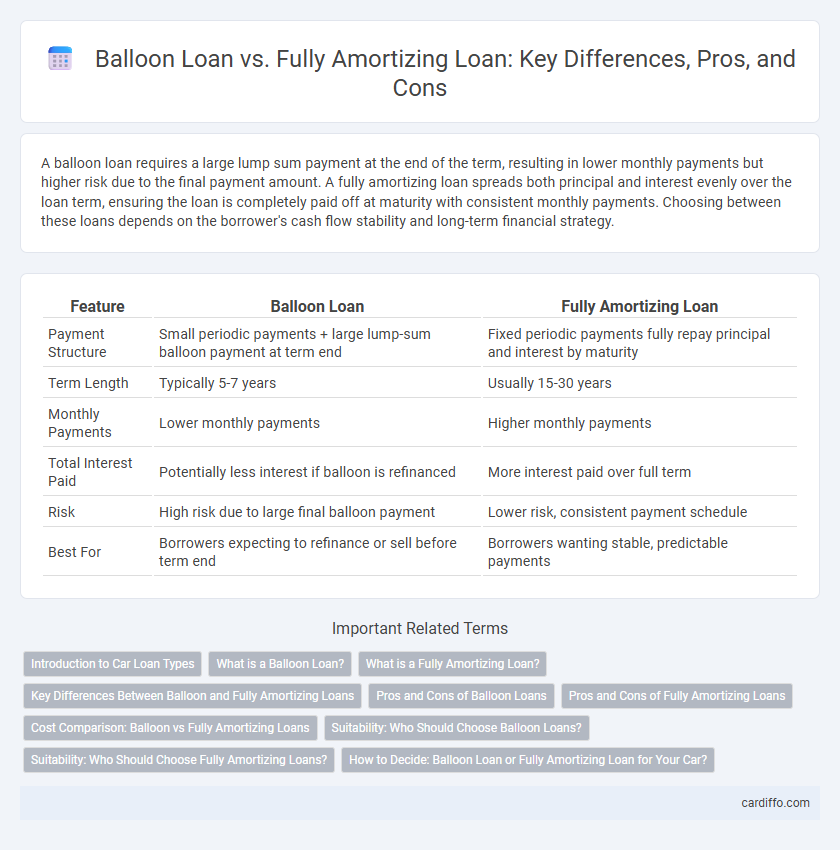

Table of Comparison

| Feature | Balloon Loan | Fully Amortizing Loan |

|---|---|---|

| Payment Structure | Small periodic payments + large lump-sum balloon payment at term end | Fixed periodic payments fully repay principal and interest by maturity |

| Term Length | Typically 5-7 years | Usually 15-30 years |

| Monthly Payments | Lower monthly payments | Higher monthly payments |

| Total Interest Paid | Potentially less interest if balloon is refinanced | More interest paid over full term |

| Risk | High risk due to large final balloon payment | Lower risk, consistent payment schedule |

| Best For | Borrowers expecting to refinance or sell before term end | Borrowers wanting stable, predictable payments |

Introduction to Car Loan Types

Balloon loans for cars require smaller monthly payments with a large final payment, offering lower initial costs but higher risk at loan end. Fully amortizing car loans spread payments evenly over the term, fully paying off principal and interest by the last installment. Choosing between these depends on budget flexibility and long-term financial planning for vehicle ownership.

What is a Balloon Loan?

A balloon loan is a type of loan that requires a large lump-sum payment at the end of the term, often after lower monthly installments. Unlike fully amortizing loans, which spread payments evenly to cover principal and interest throughout the loan period, balloon loans postpone significant principal repayment until maturity. This structure can result in lower initial payments but poses the risk of refinancing or paying a large due amount at loan conclusion.

What is a Fully Amortizing Loan?

A fully amortizing loan requires fixed monthly payments over the loan term that cover both principal and interest, ensuring the loan balance reaches zero by the end of the term. This structure provides predictable payment amounts and eliminates the need for a large lump-sum payment at maturity, unlike balloon loans. Common examples include traditional mortgages and auto loans where the entire loan is repaid through systematic installments.

Key Differences Between Balloon and Fully Amortizing Loans

Balloon loans require a large lump-sum payment at the end of the term, contrasting with fully amortizing loans that spread payments evenly to repay the entire principal and interest by maturity. Fully amortizing loans reduce risk through predictable monthly payments, while balloon loans often have lower initial payments but higher end-term financial obligations. Borrowers choosing balloon loans must plan for refinancing or payoff at term-end, unlike fully amortizing loans that eliminate lump-sum payment risk.

Pros and Cons of Balloon Loans

Balloon loans offer lower initial monthly payments and greater cash flow flexibility, making them suitable for borrowers expecting higher income or refinancing opportunities before the balloon payment is due. However, the large lump-sum payment at the end poses significant risk if the borrower cannot refinance or sell the asset in time, potentially leading to default. Compared to fully amortizing loans, balloon loans may result in higher long-term costs and financial uncertainty despite their short-term affordability.

Pros and Cons of Fully Amortizing Loans

Fully amortizing loans have the advantage of predictable monthly payments that cover both principal and interest, reducing the risk of a large lump-sum payment at the end of the term. Borrowers benefit from building equity steadily, which can improve creditworthiness and facilitate refinancing options. However, the fixed payment schedule might result in higher monthly installments compared to balloon loans, potentially limiting cash flow flexibility.

Cost Comparison: Balloon vs Fully Amortizing Loans

Balloon loans often feature lower initial monthly payments compared to fully amortizing loans, making them more affordable in the short term, but they require a large lump-sum payment at the end of the term that can increase overall costs. Fully amortizing loans spread principal and interest evenly over the loan period, typically resulting in higher monthly payments but no large final balance, reducing the risk of refinancing costs or penalties. Borrowers must weigh the potential savings in interest over time against the risk and cost of the balloon payment to determine the most cost-effective option.

Suitability: Who Should Choose Balloon Loans?

Balloon loans are suitable for borrowers expecting a significant increase in income or planning to refinance before the large final payment is due, such as real estate investors or business owners with fluctuating cash flows. These loans offer lower monthly payments compared to fully amortizing loans, making them attractive for those needing short-term affordability with a repayment strategy in place. Borrowers seeking predictable, consistent payments over the loan term should prefer fully amortizing loans instead.

Suitability: Who Should Choose Fully Amortizing Loans?

Borrowers seeking stable, predictable monthly payments and long-term financial planning should choose fully amortizing loans, as these loans steadily reduce principal over time until fully paid off. Homebuyers with steady income who prioritize building equity without a large lump-sum payment at the end benefit most from fully amortizing loans. These loans suit risk-averse individuals who prefer financial certainty and want to avoid refinancing or sudden large payments inherent in balloon loans.

How to Decide: Balloon Loan or Fully Amortizing Loan for Your Car?

Choosing between a balloon loan and a fully amortizing loan for your car depends on your financial goals and cash flow. Balloon loans offer lower monthly payments with a large final payment, suitable if you expect a lump sum later or plan to refinance, while fully amortizing loans spread payments evenly, ensuring full ownership after the term. Evaluate your ability to manage a hefty balloon payment against the predictability and stability of regular, full amortization payments.

Balloon Loan vs Fully Amortizing Loan Infographic

cardiffo.com

cardiffo.com