Leasing a vehicle typically offers lower monthly payments and the opportunity to drive a new car every few years, while a loan provides full ownership after the repayment period, allowing unlimited mileage and customization. Loans build equity over time but usually involve higher monthly costs compared to leases. Choosing between lease and loan depends on your budget, driving habits, and long-term financial goals.

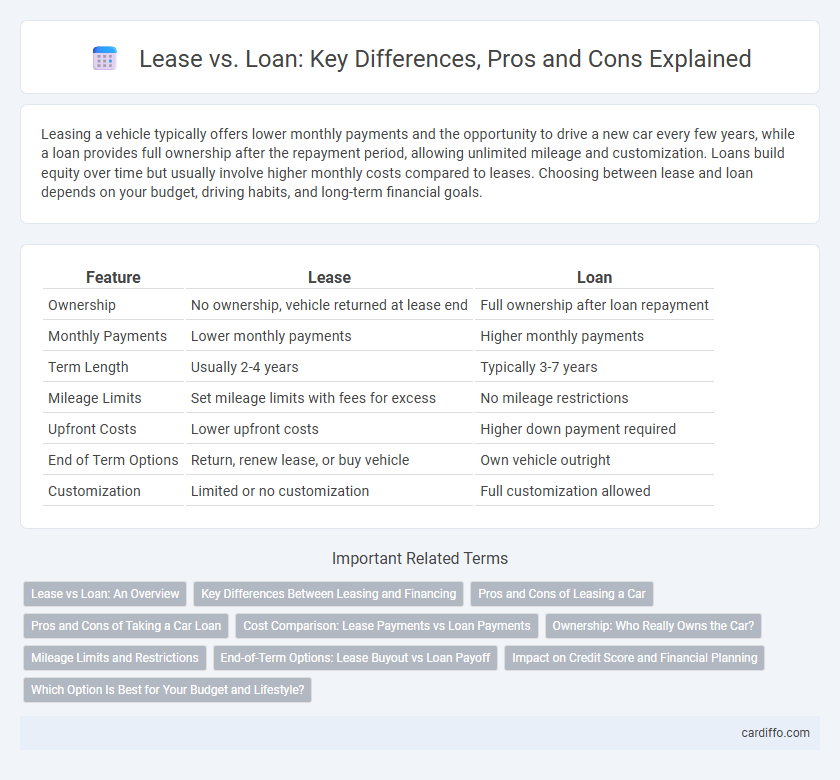

Table of Comparison

| Feature | Lease | Loan |

|---|---|---|

| Ownership | No ownership, vehicle returned at lease end | Full ownership after loan repayment |

| Monthly Payments | Lower monthly payments | Higher monthly payments |

| Term Length | Usually 2-4 years | Typically 3-7 years |

| Mileage Limits | Set mileage limits with fees for excess | No mileage restrictions |

| Upfront Costs | Lower upfront costs | Higher down payment required |

| End of Term Options | Return, renew lease, or buy vehicle | Own vehicle outright |

| Customization | Limited or no customization | Full customization allowed |

Lease vs Loan: An Overview

Lease agreements provide the option to use an asset for a fixed period with lower monthly payments and no ownership rights, making them suitable for short-term needs or businesses seeking flexibility. Loans involve borrowing funds to purchase an asset outright, resulting in ownership after the loan is repaid and typically higher monthly payments but potential asset appreciation. Choosing between lease and loan depends on factors like cash flow, asset usage duration, and long-term financial goals.

Key Differences Between Leasing and Financing

Leasing a vehicle involves lower monthly payments and no ownership, while financing a loan requires higher payments but results in full ownership after the term. Lease agreements often include mileage limits and return conditions, whereas loan contracts provide flexibility to modify or sell the asset. Financing builds equity over time, whereas leasing is essentially renting without asset accumulation.

Pros and Cons of Leasing a Car

Leasing a car offers lower monthly payments and access to newer models more frequently, making it appealing for those who prefer driving the latest vehicles without committing to ownership. However, leases typically come with mileage limits and may charge penalties for excess wear, restricting customization and long-term cost savings. Unlike loans, leasing does not build equity, resulting in no ownership stake at the end of the term, which can be a disadvantage for buyers seeking asset accumulation.

Pros and Cons of Taking a Car Loan

Taking a car loan allows ownership of the vehicle after the repayment period, providing asset accumulation and potential resale value. Interest payments and the risk of depreciation can increase the overall cost, while monthly loan installments may impact budget flexibility. Unlike leasing, a loan offers unlimited mileage and freedom to modify the car without restrictions.

Cost Comparison: Lease Payments vs Loan Payments

Lease payments typically offer lower monthly costs compared to loan payments, making leases more affordable upfront for borrowers. However, loan payments build equity over time, potentially offering greater long-term financial benefits despite higher monthly expenses. Total cost of ownership analysis reveals that loans may be more cost-effective in the long run due to asset ownership and residual value.

Ownership: Who Really Owns the Car?

When choosing between a lease and a loan, ownership plays a crucial role in decision-making. A loan grants immediate ownership of the car, allowing the borrower full control and the ability to sell or modify the vehicle at will. In contrast, leasing means the leasing company retains ownership, and the lessee must return the car at the end of the term unless they opt to buy it.

Mileage Limits and Restrictions

Lease agreements typically impose strict mileage limits, often ranging between 10,000 to 15,000 miles annually, with charges for exceeding these limits that can significantly increase overall costs. Loans, on the other hand, do not have mileage restrictions, allowing borrowers unlimited vehicle use without additional fees tied to distance driven. Understanding these differences is crucial for selecting financing options based on driving habits and long-term vehicle ownership plans.

End-of-Term Options: Lease Buyout vs Loan Payoff

At the end of a lease term, the lessee has the option to purchase the vehicle through a lease buyout, often at a predetermined residual value, providing predictable costs and ownership transition. In contrast, a loan payoff involves fully repaying the outstanding loan balance to gain outright ownership, which may allow for flexible negotiation but can result in variable final costs due to interest. Understanding the financial implications and residual value versus loan payoff amount is critical for making an informed decision between lease buyout and loan payoff options.

Impact on Credit Score and Financial Planning

Leases typically have less impact on credit scores compared to loans, as lease payments are often not reported to credit bureaus, whereas loan repayments directly influence credit history and score. Financial planning with loans requires budgeting for principal and interest payments over time, which can build equity and improve credit if managed well, while leases involve fixed monthly payments without asset ownership, potentially offering more predictable short-term cash flow but no long-term financial gain. Choosing between lease and loan depends on one's credit management goals and asset accumulation strategy.

Which Option Is Best for Your Budget and Lifestyle?

Choosing between lease and loan depends heavily on your financial goals and lifestyle preferences. Leasing often suits those seeking lower monthly payments and the opportunity to drive a new vehicle every few years, ideal for budget-conscious individuals valuing flexibility. Loans benefit buyers aiming for long-term ownership, building equity and avoiding mileage restrictions, which aligns with those prioritizing asset accumulation and cost-efficiency over time.

Lease vs Loan Infographic

cardiffo.com

cardiffo.com