Choosing between a buyout option and early termination in a loan agreement depends on financial goals and contract terms. The buyout option allows borrowers to pay a predetermined amount to fully own the asset before the loan term ends, often minimizing long-term interest costs. Early termination may involve penalties or fees, making it essential to carefully compare costs and benefits before deciding.

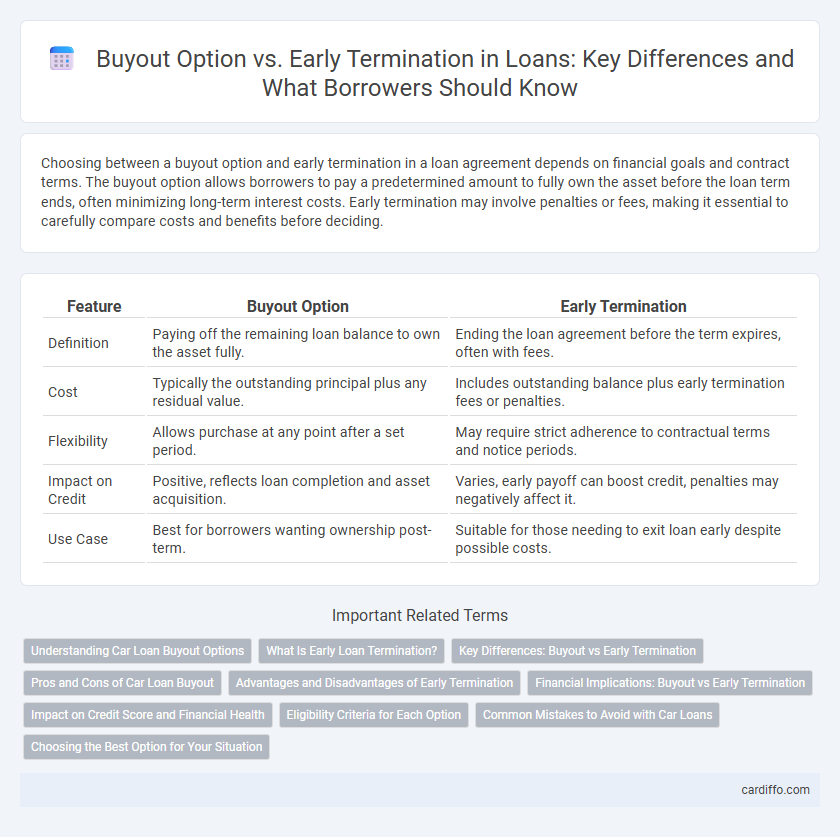

Table of Comparison

| Feature | Buyout Option | Early Termination |

|---|---|---|

| Definition | Paying off the remaining loan balance to own the asset fully. | Ending the loan agreement before the term expires, often with fees. |

| Cost | Typically the outstanding principal plus any residual value. | Includes outstanding balance plus early termination fees or penalties. |

| Flexibility | Allows purchase at any point after a set period. | May require strict adherence to contractual terms and notice periods. |

| Impact on Credit | Positive, reflects loan completion and asset acquisition. | Varies, early payoff can boost credit, penalties may negatively affect it. |

| Use Case | Best for borrowers wanting ownership post-term. | Suitable for those needing to exit loan early despite possible costs. |

Understanding Car Loan Buyout Options

Car loan buyout options allow borrowers to purchase the vehicle outright at the end of the lease or loan term, often at a predetermined price known as the residual value. Early termination involves paying off the loan before the scheduled end date, which may result in penalties or fees and can impact credit score if not managed properly. Understanding the financial implications, such as buyout pricing versus early termination costs, helps borrowers make informed decisions that align with their budget and ownership goals.

What Is Early Loan Termination?

Early loan termination refers to the process of paying off a loan before its scheduled maturity date, which can result in interest savings but may also involve prepayment penalties depending on the loan agreement. This option allows borrowers to reduce debt faster, improving their credit utilization and financial flexibility. Unlike a buyout option, early termination specifically involves closing the existing loan rather than transferring or refinancing it under a new condition.

Key Differences: Buyout vs Early Termination

Buyout options in loans allow borrowers to pay a predetermined lump sum to fully settle the debt before maturity, often involving a fixed formula or discount. Early termination typically involves closing the loan ahead of schedule but may incur penalties based on the remaining balance or interest, without guaranteeing a specific payoff amount. The key difference lies in buyout offering a structured payoff amount, while early termination depends on loan terms and potential penalties for early closure.

Pros and Cons of Car Loan Buyout

A car loan buyout allows borrowers to purchase the vehicle outright, often at a predetermined price, providing ownership and eliminating future monthly payments. This option is beneficial for those who want to keep the car but may require significant upfront cash, which can be a financial burden. However, early termination of a loan may involve penalties or fees, making buyouts more costly compared to simply finishing the loan term, though buyouts offer greater control over the vehicle and potential savings on interest.

Advantages and Disadvantages of Early Termination

Early termination of a loan allows borrowers to repay the outstanding balance before the agreed loan term, potentially saving on interest costs and improving cash flow flexibility. However, early termination may incur penalties, fees, or loss of negotiated benefits such as lower interest rates or waiver of closing costs, increasing the overall cost of the loan. Borrowers must weigh the financial advantages of reduced interest payments against the disadvantages of early termination charges to determine the best course of action.

Financial Implications: Buyout vs Early Termination

A buyout option allows borrowers to pay a predetermined amount to settle their loan early, often resulting in lower overall costs compared to early termination fees that can include penalties and accrued interest. Early termination typically triggers higher financial liabilities due to penalties designed to compensate lenders for lost interest revenue. Evaluating the total payout in buyout options against potential penalties in early termination provides a clearer financial picture for borrowers deciding to exit their loan agreements.

Impact on Credit Score and Financial Health

Choosing the buyout option on a loan typically results in fewer negative impacts on credit score compared to early termination, as it often involves fulfilling contractual obligations without default. Early termination may trigger penalties and reported defaults, leading to a drop in credit score and potential difficulties in obtaining future credit. Evaluating the cost-benefit of each choice is essential for maintaining long-term financial health and creditworthiness.

Eligibility Criteria for Each Option

The buyout option typically requires the borrower to have completed a minimum number of payments or reached a specific tenure, often outlined in the loan agreement, to qualify for repurchasing the asset or settling the loan early. Early termination eligibility generally depends on the borrower's ability to pay any applicable prepayment penalties and outstanding loan balance before the scheduled maturity date, alongside meeting lender-specific conditions such as creditworthiness and no defaults. Understanding these eligibility criteria helps borrowers strategically choose between buyout and early termination based on cost implications and financial readiness.

Common Mistakes to Avoid with Car Loans

Buyout options and early termination clauses in car loans often confuse borrowers, leading to costly mistakes like underestimating payoff amounts or ignoring prepayment penalties. Failing to review the loan agreement details can result in unexpected fees and credit impacts during early termination or buyout scenarios. Properly understanding terms such as residual value, balloon payments, and early termination fees is crucial to avoid financial pitfalls.

Choosing the Best Option for Your Situation

Evaluating buyout options versus early termination in a loan requires assessing the remaining balance, potential penalties, and interest savings. Buyout options often provide a structured payoff method with predictable costs, while early termination may involve higher penalties but quicker debt relief. Carefully calculating total expenses and personal financial goals helps determine which strategy minimizes overall costs and benefits your specific situation.

Buyout Option vs Early Termination Infographic

cardiffo.com

cardiffo.com