A co-signer loan involves a second party who guarantees the loan, often enabling approval for borrowers with lower credit scores by providing additional security to lenders. In contrast, an individual loan relies solely on the borrower's creditworthiness and income, which may result in higher interest rates or stricter approval criteria. Choosing between a co-signer loan and an individual loan depends on credit history and the ability to meet repayment terms independently.

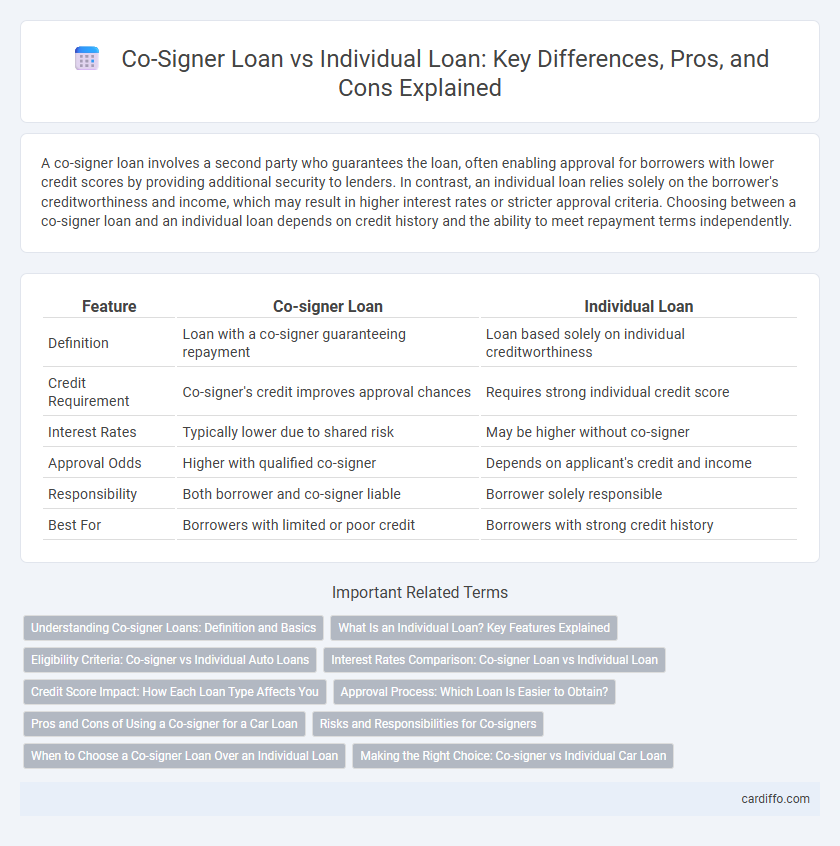

Table of Comparison

| Feature | Co-signer Loan | Individual Loan |

|---|---|---|

| Definition | Loan with a co-signer guaranteeing repayment | Loan based solely on individual creditworthiness |

| Credit Requirement | Co-signer's credit improves approval chances | Requires strong individual credit score |

| Interest Rates | Typically lower due to shared risk | May be higher without co-signer |

| Approval Odds | Higher with qualified co-signer | Depends on applicant's credit and income |

| Responsibility | Both borrower and co-signer liable | Borrower solely responsible |

| Best For | Borrowers with limited or poor credit | Borrowers with strong credit history |

Understanding Co-signer Loans: Definition and Basics

A co-signer loan involves a secondary borrower who agrees to pay the loan if the primary borrower defaults, providing additional security for lenders. This arrangement often enables individuals with limited credit history or lower credit scores to access better loan terms and higher credit limits. Understanding the responsibilities and risks for both the primary borrower and co-signer is crucial before entering into this loan agreement.

What Is an Individual Loan? Key Features Explained

An individual loan is a type of personal loan granted to a single borrower based on their creditworthiness, income, and financial history, without needing a co-signer. Key features of an individual loan include fixed or variable interest rates, predetermined repayment terms, and loan amounts that vary according to the borrower's credit profile and lender policies. Borrowers benefit from sole responsibility for loan repayment, which can build individual credit history but also carries full liability for any defaults.

Eligibility Criteria: Co-signer vs Individual Auto Loans

Co-signer auto loans require the co-signer to meet credit score thresholds, income stability, and debt-to-income ratio standards similar to the primary borrower, enhancing the loan approval chances. Individual auto loans rely solely on the primary borrower's credit history, income verification, and overall financial health to determine eligibility, often demanding higher credit scores and stronger financial profiles. Lending institutions assess both types by analyzing payment history, employment status, and outstanding debts, but co-signer loans distribute risk across two applicants, potentially broadening access to financing.

Interest Rates Comparison: Co-signer Loan vs Individual Loan

Co-signer loans often feature lower interest rates compared to individual loans due to the added security provided by the co-signer's creditworthiness. Lenders perceive less risk in co-signer loans, resulting in more favorable terms and reduced APR for borrowers. Individual loans typically carry higher interest rates as they rely solely on the primary borrower's credit profile and financial history.

Credit Score Impact: How Each Loan Type Affects You

A co-signer loan can positively impact both the primary borrower's and the co-signer's credit scores if payments are made on time, spreading credit responsibility and improving creditworthiness. In contrast, an individual loan affects only the borrower's credit score, with payment history, credit utilization, and loan balance directly influencing their credit profile. Missed payments on a co-signer loan can harm both parties' credit scores, making it crucial to ensure financial reliability before choosing this option.

Approval Process: Which Loan Is Easier to Obtain?

A co-signer loan often has a higher approval rate due to the added security provided by the co-signer's creditworthiness and income, reducing the lender's risk. Individual loans require the borrower to meet all credit and income criteria independently, which can be more challenging for those with limited credit history or lower income. Lenders typically view co-signer loans as easier to obtain, especially for first-time borrowers or those with less established credit profiles.

Pros and Cons of Using a Co-signer for a Car Loan

Using a co-signer for a car loan can improve approval chances and secure lower interest rates by leveraging the co-signer's stronger credit profile, which benefits borrowers with limited or poor credit history. However, the co-signer assumes significant financial responsibility, as missed payments affect both parties' credit scores and may strain personal relationships. Individual loans offer sole control and independence but typically involve higher interest rates and stricter qualification criteria for borrowers with less established credit.

Risks and Responsibilities for Co-signers

Co-signer loans carry significant risks, as co-signers are legally responsible for the entire debt if the primary borrower defaults, affecting their credit score and financial stability. Unlike individual loans, where only the borrower assumes responsibility, co-signers must ensure timely payments to avoid legal action and damage to their credit history. The co-signer's obligation extends until the loan is fully repaid, making it essential to understand the financial commitment and potential consequences before agreeing to co-sign.

When to Choose a Co-signer Loan Over an Individual Loan

Choose a co-signer loan when your credit score is low or limited credit history prevents approval for an individual loan with favorable terms. A co-signer with strong credit can improve the chances of loan approval and secure lower interest rates, reducing overall borrowing costs. This option is ideal for first-time borrowers or those facing financial instability who need to build credit while accessing necessary funds.

Making the Right Choice: Co-signer vs Individual Car Loan

Choosing between a co-signer loan and an individual car loan depends on credit score and financial stability. A co-signer loan can increase approval chances and secure lower interest rates by leveraging the co-signer's stronger credit profile. An individual loan offers full autonomy and responsibility but may come with higher interest rates if the borrower's credit is less optimal.

Co-signer Loan vs Individual Loan Infographic

cardiffo.com

cardiffo.com