Rebate financing offers customers immediate cash back or discounts, reducing the upfront cost of a loan pet purchase, making it attractive for buyers seeking quick savings. Low-interest financing spreads payments over time with minimal added cost, appealing to those who prefer manageable monthly installments without substantial interest charges. Choosing between rebate financing and low-interest financing depends on whether priority lies in reducing initial expenses or minimizing long-term financing costs.

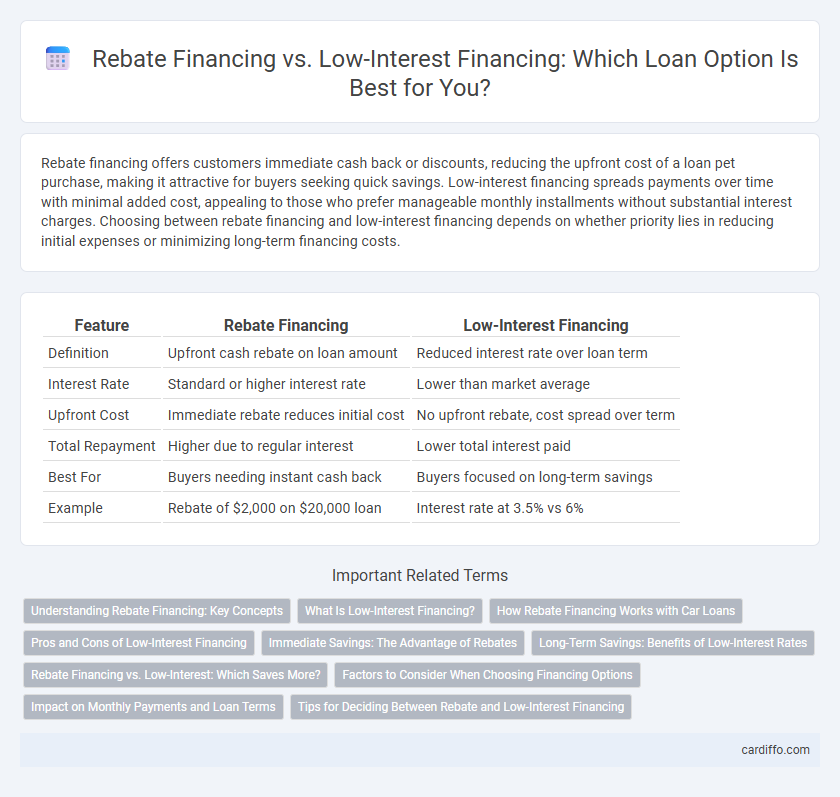

Table of Comparison

| Feature | Rebate Financing | Low-Interest Financing |

|---|---|---|

| Definition | Upfront cash rebate on loan amount | Reduced interest rate over loan term |

| Interest Rate | Standard or higher interest rate | Lower than market average |

| Upfront Cost | Immediate rebate reduces initial cost | No upfront rebate, cost spread over term |

| Total Repayment | Higher due to regular interest | Lower total interest paid |

| Best For | Buyers needing instant cash back | Buyers focused on long-term savings |

| Example | Rebate of $2,000 on $20,000 loan | Interest rate at 3.5% vs 6% |

Understanding Rebate Financing: Key Concepts

Rebate financing involves the lender providing a partial refund or rebate on the loan amount, effectively reducing the borrower's overall cost of borrowing. This method contrasts with low-interest financing, where the borrower benefits from a reduced interest rate over the loan term, impacting the total repayment amount differently. Understanding rebate financing requires analyzing factors such as the rebate percentage, loan principal, and repayment terms to assess its advantages compared to traditional low-interest loans.

What Is Low-Interest Financing?

Low-interest financing refers to loans or credit options offered at an interest rate significantly below the market average, reducing overall borrowing costs and making repayment more affordable. This type of financing is often provided by governments, financial institutions, or special programs to stimulate economic activity or support specific sectors. Low-interest financing improves cash flow management for borrowers by minimizing interest expenses over the loan term.

How Rebate Financing Works with Car Loans

Rebate financing in car loans allows buyers to receive a manufacturer rebate or cash incentive instead of the lender's low-interest rate offer, effectively lowering the purchase price upfront. The borrower pays the standard interest rate on the loan, but the rebate reduces the principal amount financed, which can result in lower overall loan costs. This method contrasts with low-interest financing, where the buyer benefits from reduced interest rates but may miss out on immediate cash rebates.

Pros and Cons of Low-Interest Financing

Low-interest financing offers borrowers reduced interest rates, resulting in lower overall repayment costs and enhanced affordability, making it an attractive option for long-term loans. However, these loans often require higher credit scores and stricter qualification criteria, potentially limiting access for some applicants. Borrowers must also be mindful of possible hidden fees or longer loan terms that could offset the benefits of lower interest rates.

Immediate Savings: The Advantage of Rebates

Rebate financing provides immediate savings by reducing the upfront cost or down payment, making it an attractive option for borrowers seeking quick financial relief. In contrast to low-interest financing, which lowers monthly payments over time, rebates offer instant cash flow benefits. This immediate reduction in expenses can improve affordability and enable borrowers to invest funds elsewhere.

Long-Term Savings: Benefits of Low-Interest Rates

Low-interest financing offers significant long-term savings by reducing the overall cost of borrowing compared to rebate financing, which often includes higher effective interest rates hidden within rebates. Borrowers benefit from lower monthly payments and decreased total interest expenses over the life of the loan, enhancing financial stability and cash flow management. Prioritizing low-interest rates in loan agreements supports sustainable debt repayment and maximizes cost efficiency in long-term financial planning.

Rebate Financing vs. Low-Interest: Which Saves More?

Rebate financing offers an upfront discount based on the loan amount, effectively reducing the principal balance and lowering overall repayment costs. Low-interest financing provides reduced interest rates over the loan term, decreasing monthly payments but potentially resulting in higher total costs if the loan duration is extended. Comparing total savings depends on loan size, interest rate, and repayment period, with rebate financing often saving more on shorter loans and low-interest financing benefiting longer-term borrowing.

Factors to Consider When Choosing Financing Options

When choosing between rebate financing and low-interest financing, key factors include the loan term, total repayment cost, and eligibility criteria that may vary by lender or program. Rebate financing offers upfront cash back but often involves higher interest rates, while low-interest financing reduces overall interest expenses but might not provide immediate financial incentives. Assessing credit score requirements, monthly payment affordability, and long-term financial goals is crucial to optimizing the loan option.

Impact on Monthly Payments and Loan Terms

Rebate financing reduces the loan principal by applying a rebate amount upfront, lowering monthly payments without extending loan terms, making it ideal for borrowers seeking immediate cost savings. Low-interest financing decreases the interest rate, which reduces the overall cost of the loan and can either shorten the loan term or maintain it with lower monthly payments. Borrowers should evaluate their financial goals to determine whether a lower upfront payment or reduced long-term interest provides the best monthly payment impact and loan duration benefits.

Tips for Deciding Between Rebate and Low-Interest Financing

Evaluate monthly payment amounts and total loan costs when choosing between rebate financing and low-interest financing to determine the most cost-effective option. Consider your credit score and eligibility criteria as low-interest financing often requires stronger credit qualifications compared to rebate offers. Analyze the impact of rebates on upfront costs versus long-term interest savings to align the financing choice with your budget and financial goals.

Rebate financing vs Low-interest financing Infographic

cardiffo.com

cardiffo.com