Title loans allow borrowers to use their vehicle's title as collateral to secure quick cash, often with higher interest rates and shorter repayment terms than traditional auto loans. Traditional auto loans typically involve lower interest rates, longer repayment periods, and the vehicle serves as collateral until the loan is fully paid off. Choosing between the two depends on the borrower's financial urgency, credit profile, and ability to repay within the specified terms.

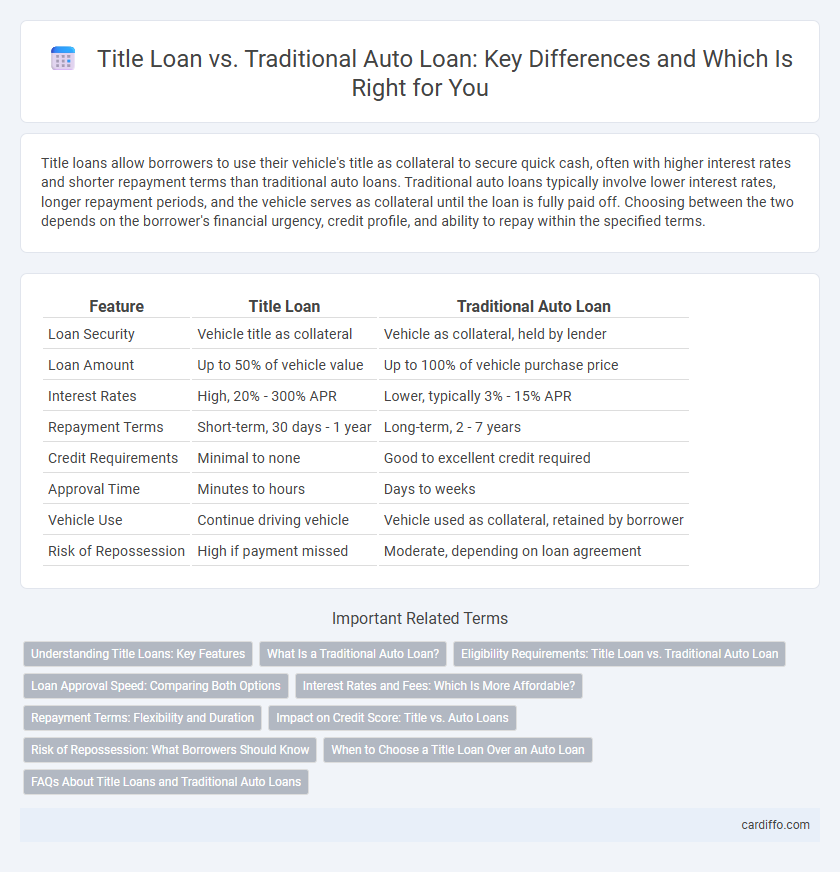

Table of Comparison

| Feature | Title Loan | Traditional Auto Loan |

|---|---|---|

| Loan Security | Vehicle title as collateral | Vehicle as collateral, held by lender |

| Loan Amount | Up to 50% of vehicle value | Up to 100% of vehicle purchase price |

| Interest Rates | High, 20% - 300% APR | Lower, typically 3% - 15% APR |

| Repayment Terms | Short-term, 30 days - 1 year | Long-term, 2 - 7 years |

| Credit Requirements | Minimal to none | Good to excellent credit required |

| Approval Time | Minutes to hours | Days to weeks |

| Vehicle Use | Continue driving vehicle | Vehicle used as collateral, retained by borrower |

| Risk of Repossession | High if payment missed | Moderate, depending on loan agreement |

Understanding Title Loans: Key Features

Title loans utilize your vehicle's title as collateral, enabling faster approval and access to funds compared to traditional auto loans. These loans typically have higher interest rates and shorter repayment terms, posing greater financial risks if the borrower defaults. Understanding the collateral requirement and cost structure is essential for evaluating the suitability of title loans versus traditional auto loans.

What Is a Traditional Auto Loan?

A traditional auto loan is a type of secured loan designed specifically for purchasing a vehicle, where the car itself serves as collateral. Borrowers typically repay the loan in fixed monthly installments over a set term, with interest rates influenced by credit scores and loan duration. This financing option often offers lower interest rates compared to unsecured loans, making it a popular choice for long-term vehicle ownership.

Eligibility Requirements: Title Loan vs. Traditional Auto Loan

Title loans require vehicle ownership with a clear title as collateral, often allowing approval regardless of credit score, making them accessible for borrowers with poor credit. Traditional auto loans demand a strong credit history, steady income, and thorough financial verification to qualify, reflecting a more stringent eligibility process. Lenders for traditional loans prioritize creditworthiness and debt-to-income ratios, whereas title loans primarily focus on the vehicle's value and condition.

Loan Approval Speed: Comparing Both Options

Title loans typically offer faster approval speeds, often providing funds within hours due to minimal credit checks and using the vehicle title as collateral. Traditional auto loans require longer processing times, averaging several days to weeks, as they involve comprehensive credit evaluations and verification of financial documents. Borrowers seeking quick access to cash may prefer title loans, while those prioritizing lower interest rates and longer repayment terms might opt for traditional auto loans despite slower approval.

Interest Rates and Fees: Which Is More Affordable?

Title loans typically have much higher interest rates, often exceeding 25% APR, compared to traditional auto loans that average between 4% and 7% APR. Fees for title loans can include origination fees, late payment penalties, and repossession fees, making the overall cost significantly more expensive than traditional auto loans, which generally have lower, more transparent fees. Borrowers seeking affordability usually find traditional auto loans more cost-effective due to their lower interest rates and fewer additional fees.

Repayment Terms: Flexibility and Duration

Title loans typically offer shorter repayment durations, often ranging from 15 to 30 days, with less flexibility in repayment schedules, leading to higher interest rates and potential late fees. Traditional auto loans provide extended repayment terms, commonly spanning 36 to 72 months, allowing for more manageable monthly payments and customizable loan structures. Borrowers seeking flexible, long-term repayment plans generally benefit more from traditional auto loans than from title loans.

Impact on Credit Score: Title vs. Auto Loans

Title loans often have a higher risk of negatively affecting credit scores due to their short-term nature and high interest rates, which can lead to missed payments or defaults. Traditional auto loans tend to positively impact credit scores by promoting consistent monthly payments over a longer period, demonstrating financial responsibility. Lenders typically report traditional auto loan activity to credit bureaus, while title loans may not, limiting opportunities for credit improvement.

Risk of Repossession: What Borrowers Should Know

Title loans carry a significantly higher risk of repossession compared to traditional auto loans, as lenders hold the vehicle title as collateral and can seize the car quickly if payments are missed. Traditional auto loans also present a repossession risk, but the repayment terms and credit checks typically reduce default probability. Borrowers should carefully evaluate their financial stability before choosing a title loan due to the immediate repossession consequences.

When to Choose a Title Loan Over an Auto Loan

Title loans offer quick access to cash by using your vehicle's title as collateral, making them ideal for urgent financial needs or if you have poor credit. Traditional auto loans typically require higher credit scores and more extensive approval processes, but offer longer repayment terms and lower interest rates. Choose a title loan when immediate funds are necessary, and you can afford to risk temporarily losing your vehicle if repayments aren't met.

FAQs About Title Loans and Traditional Auto Loans

Title loans offer quick access to cash by using your vehicle's title as collateral, typically featuring higher interest rates and shorter repayment terms compared to traditional auto loans. Traditional auto loans involve borrowing a fixed amount with structured monthly payments over a longer period, often providing lower interest rates and less risk of repossession if payments are missed. Common FAQs include eligibility criteria, loan amounts, repayment schedules, risks of vehicle repossession, and the impact on credit scores associated with both loan types.

Title Loan vs Traditional Auto Loan Infographic

cardiffo.com

cardiffo.com