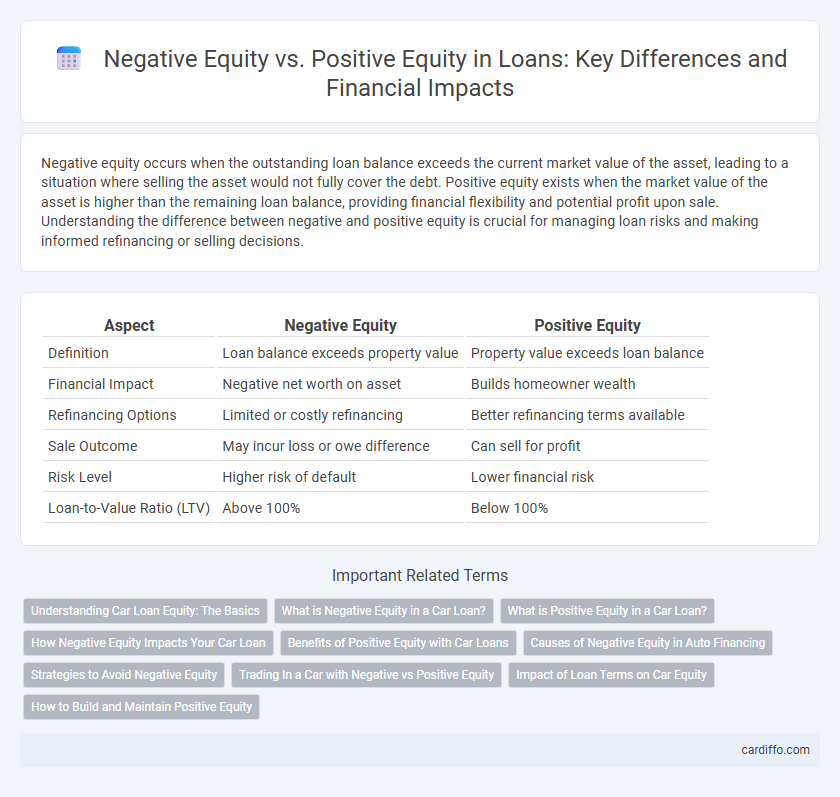

Negative equity occurs when the outstanding loan balance exceeds the current market value of the asset, leading to a situation where selling the asset would not fully cover the debt. Positive equity exists when the market value of the asset is higher than the remaining loan balance, providing financial flexibility and potential profit upon sale. Understanding the difference between negative and positive equity is crucial for managing loan risks and making informed refinancing or selling decisions.

Table of Comparison

| Aspect | Negative Equity | Positive Equity |

|---|---|---|

| Definition | Loan balance exceeds property value | Property value exceeds loan balance |

| Financial Impact | Negative net worth on asset | Builds homeowner wealth |

| Refinancing Options | Limited or costly refinancing | Better refinancing terms available |

| Sale Outcome | May incur loss or owe difference | Can sell for profit |

| Risk Level | Higher risk of default | Lower financial risk |

| Loan-to-Value Ratio (LTV) | Above 100% | Below 100% |

Understanding Car Loan Equity: The Basics

Car loan equity represents the difference between a vehicle's current market value and the outstanding loan balance. Positive equity occurs when the car's value exceeds the loan amount, allowing owners to sell or trade in the vehicle without owing extra money. Negative equity happens when the loan balance is higher than the vehicle's worth, often leading to financial challenges during refinancing or resale.

What is Negative Equity in a Car Loan?

Negative equity in a car loan occurs when the outstanding loan balance exceeds the current market value of the vehicle. This situation often arises due to rapid depreciation or borrowing a large amount relative to the car's worth. Borrowers with negative equity may face challenges refinancing, selling, or trading in their vehicle without incurring additional costs.

What is Positive Equity in a Car Loan?

Positive equity in a car loan occurs when the vehicle's current market value exceeds the outstanding loan balance, allowing the owner to sell the car for more than they owe or trade it in with reduced or no additional cost. It reflects the owner's financial advantage and equity buildup, enhancing borrowing power and flexibility in refinancing or upgrading to a new vehicle. Maintaining positive equity is essential to avoid repossession risks and improve overall financial health related to auto financing.

How Negative Equity Impacts Your Car Loan

Negative equity occurs when your car's loan balance exceeds its current market value, leading to a financial shortfall if you need to sell or trade the vehicle. This situation increases monthly payments and reduces refinancing options because lenders view negative equity as a higher risk. Positive equity, where the car's value is higher than the loan balance, provides better financial flexibility and easier loan management.

Benefits of Positive Equity with Car Loans

Positive equity in car loans means the vehicle's market value exceeds the outstanding loan balance, providing owners with financial flexibility and security. This equity can be leveraged for trade-ins, refinancing at better rates, or selling the car without incurring debt. Maintaining positive equity also protects against depreciation risks and helps avoid owing more than the vehicle is worth, enhancing overall financial stability.

Causes of Negative Equity in Auto Financing

Negative equity in auto financing occurs when the outstanding loan balance exceeds the vehicle's current market value, often caused by rapid depreciation of the car, high-interest rates, or low down payments. Factors such as purchasing a new vehicle that loses value quickly or financing for extended terms increase the likelihood of owing more than the car is worth. Trade-in decisions and regional market fluctuations also significantly contribute to the emergence of negative equity.

Strategies to Avoid Negative Equity

Maintaining consistent loan repayments and making a substantial down payment are effective strategies to avoid negative equity in property loans. Choosing a loan term that matches your financial capacity helps ensure the property's market value remains above the outstanding balance. Regularly monitoring market trends and refinancing when interest rates drop can also protect against negative equity risks.

Trading In a Car with Negative vs Positive Equity

Trading in a car with negative equity means owing more on the loan than the vehicle's current market value, which can increase the total loan amount when rolling the balance into a new car loan. Positive equity occurs when the car's value exceeds the remaining loan balance, allowing buyers to use this surplus as a down payment for their next vehicle, reducing the loan amount and monthly payments. Understanding the difference impacts financing options and the overall cost when trading in a car during loan refinancing or purchase.

Impact of Loan Terms on Car Equity

Loan terms such as interest rates, loan duration, and down payment size significantly impact car equity, determining whether a borrower experiences negative or positive equity. Higher interest rates and longer loan terms often lead to slower principal repayment, increasing the likelihood of negative equity where the car's market value falls below the outstanding loan balance. Conversely, larger down payments and shorter loan periods accelerate equity buildup, reducing risk and improving financial stability in vehicle financing.

How to Build and Maintain Positive Equity

Building and maintaining positive equity in a loan requires consistent payments that reduce the principal balance faster than the asset's depreciation. Regularly increasing the property's value through improvements and market appreciation strengthens equity by boosting its current market worth. Monitoring loan terms and refinancing at favorable rates can also optimize equity growth and maintain financial stability.

Negative Equity vs Positive Equity Infographic

cardiffo.com

cardiffo.com