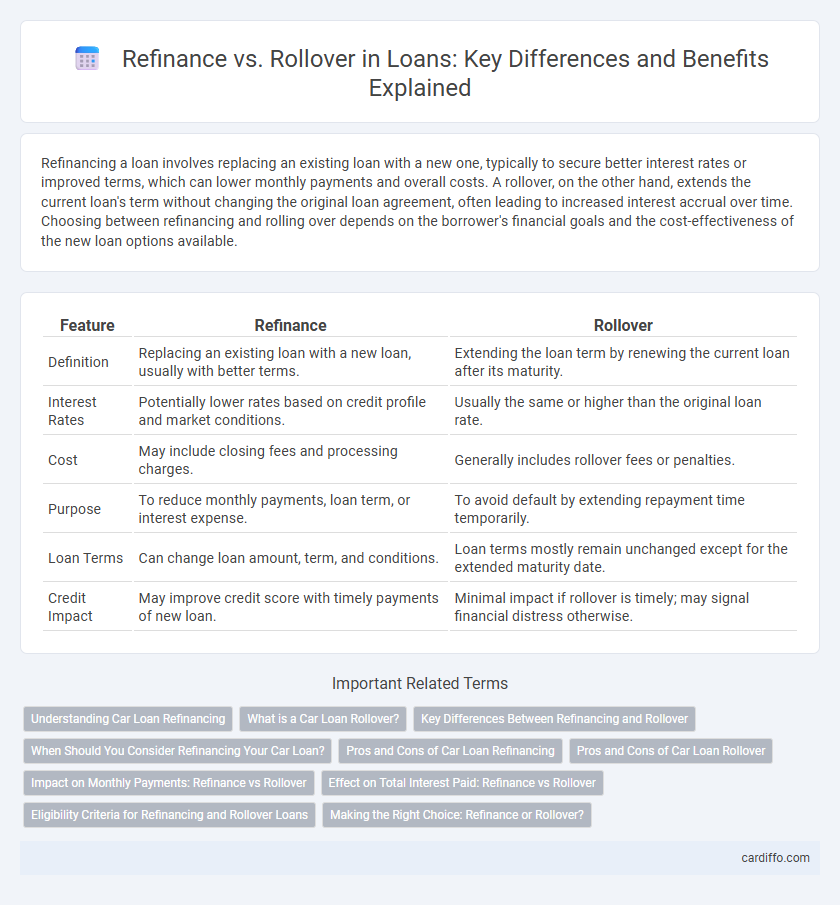

Refinancing a loan involves replacing an existing loan with a new one, typically to secure better interest rates or improved terms, which can lower monthly payments and overall costs. A rollover, on the other hand, extends the current loan's term without changing the original loan agreement, often leading to increased interest accrual over time. Choosing between refinancing and rolling over depends on the borrower's financial goals and the cost-effectiveness of the new loan options available.

Table of Comparison

| Feature | Refinance | Rollover |

|---|---|---|

| Definition | Replacing an existing loan with a new loan, usually with better terms. | Extending the loan term by renewing the current loan after its maturity. |

| Interest Rates | Potentially lower rates based on credit profile and market conditions. | Usually the same or higher than the original loan rate. |

| Cost | May include closing fees and processing charges. | Generally includes rollover fees or penalties. |

| Purpose | To reduce monthly payments, loan term, or interest expense. | To avoid default by extending repayment time temporarily. |

| Loan Terms | Can change loan amount, term, and conditions. | Loan terms mostly remain unchanged except for the extended maturity date. |

| Credit Impact | May improve credit score with timely payments of new loan. | Minimal impact if rollover is timely; may signal financial distress otherwise. |

Understanding Car Loan Refinancing

Car loan refinancing involves replacing your existing auto loan with a new one, typically to secure a lower interest rate or reduce monthly payments, whereas a rollover usually refers to extending the loan term without changing the lender or interest rate. Refinancing can improve loan terms, save money on interest, and enhance your credit profile when done through reputable lenders. Understanding key factors like lender fees, loan term adjustments, and credit score impact is essential for making an informed decision between refinancing and rolling over a car loan.

What is a Car Loan Rollover?

A car loan rollover occurs when an existing auto loan is extended by adding the outstanding balance to a new loan, effectively pushing the debt further into the future. This practice increases the total amount owed due to additional interest and fees, often leading to higher overall costs compared to refinancing. Understanding the difference between a rollover and a refinance is crucial for borrowers seeking better loan terms and lower monthly payments.

Key Differences Between Refinancing and Rollover

Refinancing involves replacing an existing loan with a new one, often to secure better terms such as lower interest rates or extended repayment periods. A rollover, in contrast, typically refers to extending the maturity of an existing loan by paying off the current balance and taking on a new loan with similar conditions. Key differences include the purpose, with refinancing aimed at cost savings or improved loan terms, while rollover mainly focuses on delaying repayment without altering the loan structure significantly.

When Should You Consider Refinancing Your Car Loan?

Refinancing your car loan is a smart option when you can secure a lower interest rate, reduce monthly payments, or change the loan term to better fit your financial situation. Consider refinancing if your credit score has improved significantly since your original loan, or if market interest rates have dropped, making it possible to save money over the life of the loan. Evaluating your current loan terms against new offers helps determine if refinancing will provide tangible financial benefits.

Pros and Cons of Car Loan Refinancing

Car loan refinancing offers lower interest rates and reduced monthly payments, improving financial flexibility and potentially saving thousands over the loan term. However, refinancing may extend the loan duration, increasing overall interest paid, and could involve fees such as application or title transfer costs. Borrowers with strong credit scores and stable income benefit most, while those with declining vehicle value or poor credit might face higher rates or rejection.

Pros and Cons of Car Loan Rollover

Car loan rollover extends the repayment period by taking out a new loan to pay off the existing one, often leading to lower monthly payments but potentially higher total interest costs over time. Pros include improved cash flow flexibility and avoidance of default risks, while cons involve increased overall debt burden and possible negative impact on credit scores if mismanaged. Borrowers should carefully consider the long-term financial implications and lender terms before opting for a car loan rollover.

Impact on Monthly Payments: Refinance vs Rollover

Refinancing a loan typically lowers monthly payments by securing a new loan with a reduced interest rate or extended term, improving cash flow. Rollover loans often result in higher monthly payments due to accumulated interest and fees, increasing financial strain over time. Understanding these impacts helps borrowers manage loan affordability and long-term financial planning effectively.

Effect on Total Interest Paid: Refinance vs Rollover

Refinancing a loan typically reduces the total interest paid by securing a lower interest rate or shorter loan term, leading to significant savings over the loan's life. In contrast, rolling over a loan often extends the repayment period without altering the interest rate, which can increase the total interest paid due to prolonged accrual. Borrowers should carefully evaluate interest rates, loan terms, and fees to determine whether refinancing or rolling over offers a more cost-effective solution.

Eligibility Criteria for Refinancing and Rollover Loans

Eligibility criteria for refinancing loans typically require a strong credit score, stable income, and sufficient equity in the existing asset, ensuring borrowers can secure better interest rates or loan terms. Rollover loans often have less stringent credit requirements but mandate timely repayment of the original loan, with the new loan primarily extending the repayment period rather than improving loan conditions. Lenders assess debt-to-income ratios and previous repayment history for both refinancing and rollover loans to determine borrower reliability and reduce default risk.

Making the Right Choice: Refinance or Rollover?

Choosing between refinancing and rolling over a loan depends on factors like interest rates, loan terms, and financial goals. Refinancing involves replacing an existing loan with a new one at a potentially lower interest rate, which can reduce monthly payments or overall debt. Rolling over a loan extends the payment period by renewing or extending the existing loan, often used to avoid immediate repayment but may increase total interest paid over time.

Refinance vs Rollover Infographic

cardiffo.com

cardiffo.com