A balloon payment loan requires a large lump sum payment at the end of the term, making initial monthly payments lower but necessitating careful financial planning for the final payoff. In contrast, a fully amortizing loan spreads both principal and interest evenly over the loan term, ensuring consistent monthly payments that fully extinguish the debt by maturity. Choosing between balloon payment and fully amortizing loans depends on cash flow flexibility and long-term financial goals.

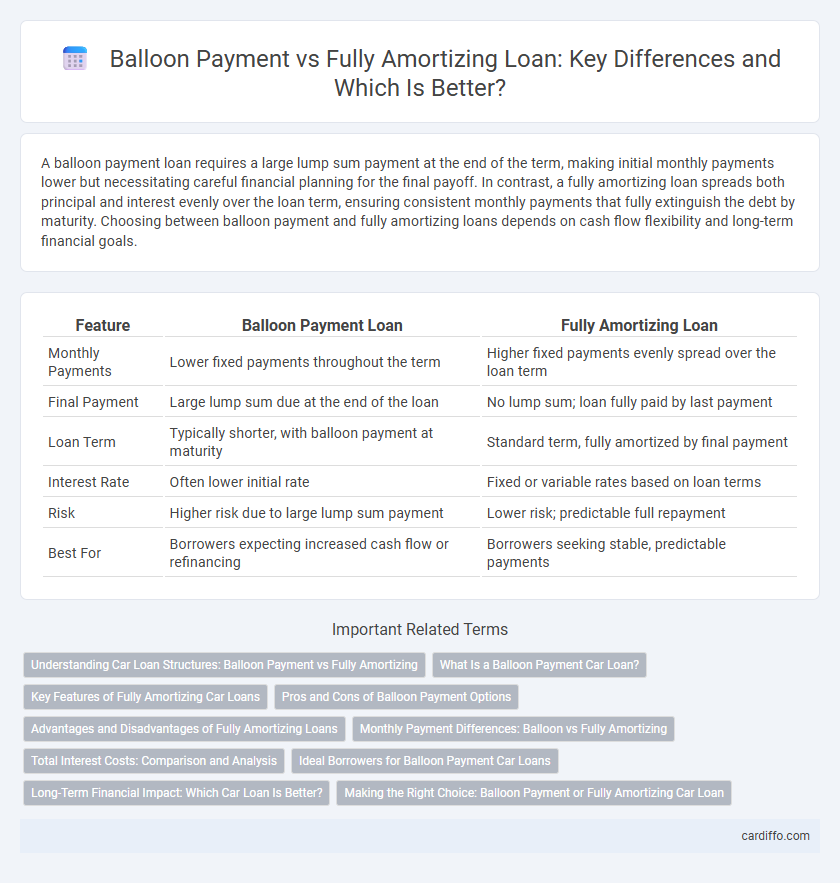

Table of Comparison

| Feature | Balloon Payment Loan | Fully Amortizing Loan |

|---|---|---|

| Monthly Payments | Lower fixed payments throughout the term | Higher fixed payments evenly spread over the loan term |

| Final Payment | Large lump sum due at the end of the loan | No lump sum; loan fully paid by last payment |

| Loan Term | Typically shorter, with balloon payment at maturity | Standard term, fully amortized by final payment |

| Interest Rate | Often lower initial rate | Fixed or variable rates based on loan terms |

| Risk | Higher risk due to large lump sum payment | Lower risk; predictable full repayment |

| Best For | Borrowers expecting increased cash flow or refinancing | Borrowers seeking stable, predictable payments |

Understanding Car Loan Structures: Balloon Payment vs Fully Amortizing

Balloon payment car loans require lower monthly payments with a large lump sum due at the end of the term, making them attractive for short-term ownership or vehicles expected to retain value. Fully amortizing loans spread payments evenly over the loan period, ensuring the entire principal and interest are paid off by the end of the term, resulting in predictable monthly costs and no remaining balance. Choosing between these structures impacts monthly budget management and long-term financial obligations.

What Is a Balloon Payment Car Loan?

A balloon payment car loan features lower monthly payments throughout the loan term but requires a large lump sum payment at the end to fully pay off the balance. Unlike fully amortizing loans where payments cover both principal and interest gradually until the loan is paid off, balloon loans do not fully amortize, leaving a remaining principal balance due at maturity. This structure can offer initial affordability but poses refinancing or payment risk when the balloon payment comes due.

Key Features of Fully Amortizing Car Loans

Fully amortizing car loans feature fixed monthly payments that cover both principal and interest, ensuring the loan is completely paid off by the end of the term. These loans eliminate a large final payment, providing financial predictability and ease of budgeting. Borrowers benefit from steadily building equity with each payment, unlike balloon payment loans where a significant lump sum remains due.

Pros and Cons of Balloon Payment Options

Balloon payment loans offer lower initial monthly payments compared to fully amortizing loans, providing short-term cash flow relief but requiring a large lump sum payment at the end of the term, which can create refinancing or repayment risks. Fully amortizing loans eliminate the need for a large final payment by spreading principal and interest evenly throughout the loan period, promoting predictable budgeting but resulting in higher monthly payments. Borrowers choosing balloon payment options must carefully assess their ability to manage the balloon amount, considering potential changes in interest rates or market conditions that affect refinancing affordability.

Advantages and Disadvantages of Fully Amortizing Loans

Fully amortizing loans provide the advantage of predictable monthly payments that cover both principal and interest, ensuring the loan is completely paid off by the end of the term without a large lump-sum payment. This structure reduces the risk of refinancing or facing financial strain compared to balloon payments, which require a significant final payment and can cause cash flow challenges. However, fully amortizing loans typically have higher monthly payments than balloon loans, potentially limiting affordability for borrowers seeking lower initial costs.

Monthly Payment Differences: Balloon vs Fully Amortizing

Balloon payments typically result in lower monthly payments compared to fully amortizing loans because the principal is not fully paid down over the loan term, deferring a large payment until the end. Fully amortizing loans spread principal and interest evenly across all monthly payments, leading to higher monthly payments but no lump sum due at maturity. Borrowers choosing balloon loans must prepare for the significant final payment or refinancing, while fully amortizing loans offer predictable, consistent monthly costs.

Total Interest Costs: Comparison and Analysis

Balloon payment loans often have lower monthly payments but result in a large lump sum due at the end, leading to potentially higher total interest costs compared to fully amortizing loans, where payments gradually pay down principal and interest. Fully amortizing loans minimize total interest expenses by spreading payments evenly over the loan term, reducing the outstanding principal balance continuously. Borrowers should analyze the total interest paid over the loan's life to determine which option aligns best with their financial situation and goals.

Ideal Borrowers for Balloon Payment Car Loans

Ideal borrowers for balloon payment car loans are those who expect a significant increase in income or plan to sell the vehicle before the balloon payment is due. These loans appeal to individuals seeking lower monthly payments during the term, such as young professionals or temporary residents. Borrowers with stable financial growth prospects benefit from balloon payments, avoiding the higher monthly costs of fully amortizing loans.

Long-Term Financial Impact: Which Car Loan Is Better?

A balloon payment car loan offers lower monthly payments with a lump sum due at the end, potentially easing short-term cash flow but increasing long-term financial risk and interest costs. Fully amortizing loans spread payments evenly over the loan term, ensuring full debt repayment by the end without large residual amounts, resulting in higher monthly payments but predictable long-term budgeting. Choosing the best option depends on individual financial stability, risk tolerance, and long-term cash flow projections.

Making the Right Choice: Balloon Payment or Fully Amortizing Car Loan

Choosing between a balloon payment and a fully amortizing car loan depends on your cash flow and financial goals. Balloon payments offer lower monthly installments with a large lump sum due at the end, ideal for borrowers expecting increased income or a refinancing option. Fully amortizing loans spread payments evenly across the loan term, providing stable, predictable expenses and complete loan payoff without a large final sum.

Balloon payment vs Fully amortizing Infographic

cardiffo.com

cardiffo.com