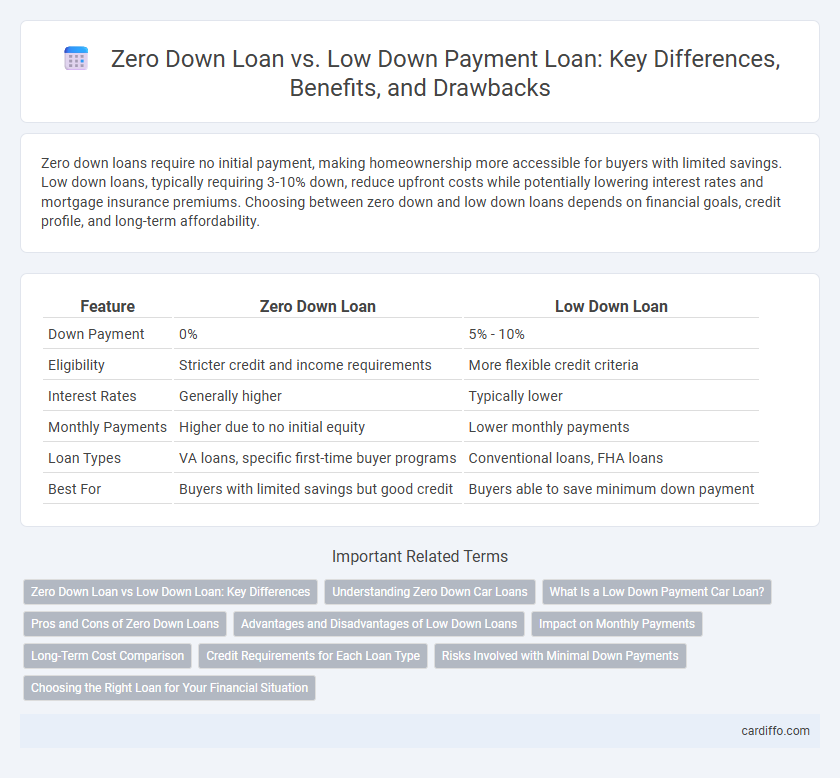

Zero down loans require no initial payment, making homeownership more accessible for buyers with limited savings. Low down loans, typically requiring 3-10% down, reduce upfront costs while potentially lowering interest rates and mortgage insurance premiums. Choosing between zero down and low down loans depends on financial goals, credit profile, and long-term affordability.

Table of Comparison

| Feature | Zero Down Loan | Low Down Loan |

|---|---|---|

| Down Payment | 0% | 5% - 10% |

| Eligibility | Stricter credit and income requirements | More flexible credit criteria |

| Interest Rates | Generally higher | Typically lower |

| Monthly Payments | Higher due to no initial equity | Lower monthly payments |

| Loan Types | VA loans, specific first-time buyer programs | Conventional loans, FHA loans |

| Best For | Buyers with limited savings but good credit | Buyers able to save minimum down payment |

Zero Down Loan vs Low Down Loan: Key Differences

Zero Down Loan requires no initial payment, allowing borrowers to finance 100% of the property cost, often ideal for buyers with limited savings. Low Down Loan mandates a partial upfront payment, typically ranging from 3% to 20%, reducing the loan amount and possibly lowering monthly payments. Key differences include upfront costs, eligibility criteria, and impact on interest rates and private mortgage insurance requirements.

Understanding Zero Down Car Loans

Zero down car loans require no initial payment, making them attractive for buyers with limited savings but often come with higher interest rates or longer terms. Low down loans demand a smaller upfront cost, which helps lower monthly payments and reduces the total interest paid over time. Understanding the trade-offs between zero down and low down loans is crucial for optimizing financial planning and vehicle affordability.

What Is a Low Down Payment Car Loan?

A low down payment car loan requires paying a smaller percentage of the vehicle's purchase price upfront, typically ranging from 5% to 10%, making it easier for buyers to afford a car without a large initial investment. These loans usually come with higher interest rates and potentially longer repayment terms compared to traditional loans with larger down payments, reflecting the increased risk to lenders. Comparing zero down loans, which require no upfront payment, low down payment loans offer a balance by reducing the initial cost while maintaining more favorable loan conditions.

Pros and Cons of Zero Down Loans

Zero down loans allow borrowers to finance 100% of the purchase price, enabling homeownership without initial savings, which is ideal for first-time buyers or those with limited cash. However, these loans typically come with higher interest rates, increased monthly payments, and may require private mortgage insurance (PMI), adding to overall loan costs. Borrowers face greater financial risk due to lack of initial equity, making zero down loans less advantageous in declining housing markets compared to low down payment options.

Advantages and Disadvantages of Low Down Loans

Low down loans require a smaller upfront payment, making homeownership more accessible for buyers with limited savings and preserving cash flow for other expenses. These loans may come with higher interest rates and private mortgage insurance (PMI), increasing the overall cost of borrowing. Borrowers should weigh the benefit of lower initial costs against potentially higher monthly payments and long-term expenses.

Impact on Monthly Payments

Zero down loans eliminate the initial down payment, resulting in higher loan principal and increased monthly payments due to larger borrowed amounts and accrued interest. Low down loans require a smaller upfront payment than traditional loans, slightly reducing monthly payments compared to zero down options but still higher than loans with standard down payments. Borrowers choosing zero or low down loans should anticipate higher monthly financial obligations impacting long-term affordability and budgeting.

Long-Term Cost Comparison

Zero down loans typically involve higher interest rates and private mortgage insurance, resulting in greater long-term costs compared to low down loans. Low down loans require an upfront payment, reducing loan principal and minimizing interest paid over the life of the loan. Borrowers often save money with low down payments due to lower overall loan balances and fewer fees, making them more cost-effective in the long run.

Credit Requirements for Each Loan Type

Zero down loans typically require higher credit scores, often above 700, as lenders assume more risk without an initial payment. Low down loans generally have more flexible credit requirements, allowing scores as low as 620, making them accessible to a broader range of borrowers. Understanding these credit thresholds helps applicants choose the best loan type based on their financial profile.

Risks Involved with Minimal Down Payments

Zero down loans carry higher risk due to lack of borrower equity, increasing vulnerability to default and negative equity during market downturns. Low down loans, while reducing upfront costs, still require some borrower investment which can mitigate risk but may lead to larger loan balances and higher monthly payments. Both options can result in higher interest rates or mortgage insurance requirements, potentially impacting overall loan affordability and financial stability.

Choosing the Right Loan for Your Financial Situation

Zero down loans eliminate the initial cash requirement, making homeownership accessible without upfront savings but often come with higher interest rates and private mortgage insurance (PMI). Low down loans require a small initial payment, typically between 3% and 10%, balancing lower upfront costs with potentially better loan terms and improved approval odds. Evaluating your financial stability, credit score, and long-term affordability helps determine whether a zero down loan or a low down loan aligns best with your budget and homeownership goals.

Zero Down Loan vs Low Down Loan Infographic

cardiffo.com

cardiffo.com