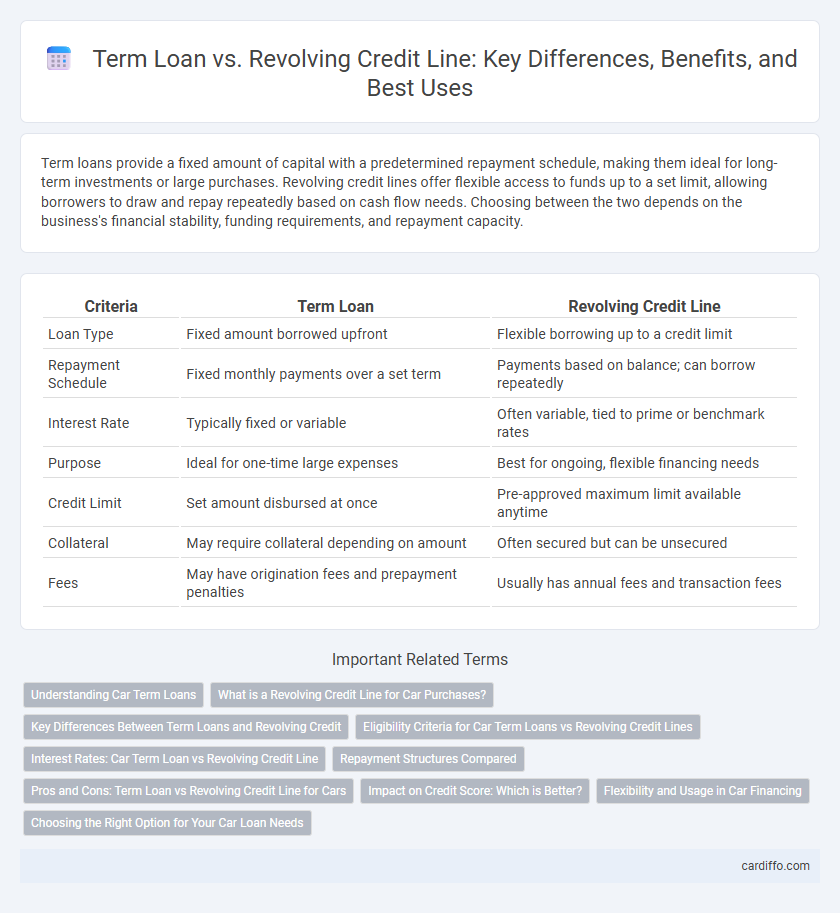

Term loans provide a fixed amount of capital with a predetermined repayment schedule, making them ideal for long-term investments or large purchases. Revolving credit lines offer flexible access to funds up to a set limit, allowing borrowers to draw and repay repeatedly based on cash flow needs. Choosing between the two depends on the business's financial stability, funding requirements, and repayment capacity.

Table of Comparison

| Criteria | Term Loan | Revolving Credit Line |

|---|---|---|

| Loan Type | Fixed amount borrowed upfront | Flexible borrowing up to a credit limit |

| Repayment Schedule | Fixed monthly payments over a set term | Payments based on balance; can borrow repeatedly |

| Interest Rate | Typically fixed or variable | Often variable, tied to prime or benchmark rates |

| Purpose | Ideal for one-time large expenses | Best for ongoing, flexible financing needs |

| Credit Limit | Set amount disbursed at once | Pre-approved maximum limit available anytime |

| Collateral | May require collateral depending on amount | Often secured but can be unsecured |

| Fees | May have origination fees and prepayment penalties | Usually has annual fees and transaction fees |

Understanding Car Term Loans

Car term loans provide fixed amounts of financing with set repayment schedules and interest rates, ideal for purchasing vehicles. Unlike revolving credit lines, which offer ongoing access to funds up to a credit limit, term loans require consistent monthly payments until the loan is fully paid off. Understanding the fixed payment structure and interest rate of car term loans helps borrowers budget effectively and avoid fluctuating debt balances.

What is a Revolving Credit Line for Car Purchases?

A revolving credit line for car purchases is a flexible financing option that allows borrowers to access funds up to a predetermined limit, repay the balance, and borrow again as needed. Unlike a term loan with fixed monthly payments and a set repayment period, this credit line provides ongoing access to credit, making it ideal for managing multiple car-related expenses over time. Interest is typically charged only on the amount drawn, offering cost-effective borrowing aligned with the buyer's cash flow.

Key Differences Between Term Loans and Revolving Credit

Term loans provide a fixed amount of money with a set repayment schedule and fixed interest rate, making them ideal for long-term investments and capital expenditures. Revolving credit lines offer flexible borrowing up to a credit limit with variable repayments and interest, supporting ongoing cash flow needs and short-term working capital. Key differences include repayment structure, interest rate types, and usage flexibility, where term loans have fixed terms and revolving credit lines allow repeated borrowing within the credit limit.

Eligibility Criteria for Car Term Loans vs Revolving Credit Lines

Eligibility criteria for car term loans typically require a stable income, good credit score, and proof of vehicle ownership or purchase agreement; lenders prioritize borrowers with low debt-to-income ratios and steady employment history. In contrast, revolving credit lines demand strong credit profiles and ongoing income verification but offer more flexible borrowing limits without fixed repayment schedules; this flexibility often suits borrowers with fluctuating cash flow. Both options may require minimum credit scores ranging from 600 to 700, though term loans often have stricter standards due to the longer commitment and collateral involved.

Interest Rates: Car Term Loan vs Revolving Credit Line

Car term loans typically feature fixed interest rates, providing predictable monthly payments over a set period, which simplifies budgeting for vehicle financing. Revolving credit lines often have variable interest rates that can fluctuate based on market conditions, potentially leading to higher costs over time but offering flexibility in borrowing and repayment. Interest rates for car term loans usually start lower than those for revolving credit lines, reflecting the secured nature of the loan against the vehicle collateral.

Repayment Structures Compared

Term loans have fixed repayment schedules with consistent monthly payments over a predetermined period, providing predictable cash flow management. Revolving credit lines offer flexible repayment options, allowing borrowers to repay and re-borrow funds repeatedly up to a credit limit, making it ideal for managing fluctuating cash needs. The structured repayment of term loans contrasts with the variability of revolving credit lines, affecting interest calculations and overall borrowing costs.

Pros and Cons: Term Loan vs Revolving Credit Line for Cars

Term loans for cars provide fixed interest rates and predictable monthly payments, making budgeting easier, but they lack flexibility and require full repayment by a set date. Revolving credit lines offer flexible borrowing limits and allow repeated withdrawals and repayments, ideal for managing cash flow, but often come with variable interest rates and potential overspending risks. Choosing between a term loan and a revolving credit line depends on whether you prioritize fixed costs or borrowing flexibility for your vehicle financing needs.

Impact on Credit Score: Which is Better?

Term loans typically have a fixed repayment schedule that, when consistently met, can positively impact your credit score by demonstrating reliable debt management. Revolving credit lines offer flexible borrowing but can hurt your credit score if utilization rates remain high or payments are late. Maintaining low credit utilization and timely payments on either type of loan is crucial for optimizing credit performance.

Flexibility and Usage in Car Financing

Term loans provide fixed amounts with set repayment schedules, making them ideal for purchasing a car outright with predictable payments. Revolving credit lines offer flexible borrowing limits and the ability to reuse funds, which suits ongoing car maintenance or unexpected expenses. The choice depends on whether borrowers prioritize structured payments for full purchase or adaptable access to funds for variable costs in car financing.

Choosing the Right Option for Your Car Loan Needs

Term loans offer fixed interest rates and set repayment schedules, making them ideal for buyers seeking predictable monthly payments when purchasing a car. Revolving credit lines provide flexible borrowing limits and repayment terms, suited for individuals needing ongoing access to funds and variable payment options. Evaluating your budget stability and financing goals helps determine whether a structured term loan or the adaptable revolving credit line better fits your car loan requirements.

Term Loan vs Revolving Credit Line Infographic

cardiffo.com

cardiffo.com